|

| |

|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ entry views: 1222 today's page views: 497 (17 mobile) all-time page views: 3386538 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1226 page created Fri Jun 20, 2025 11:24:28 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

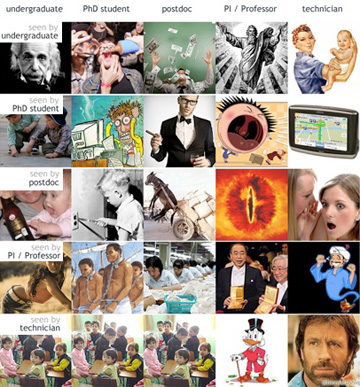

The mr.ham show is on hiatus after Mr. Ham declared that he had lost everything on football punting, and needs some time to get his finances back in order.  "Who would have thought that Fulham wouldn't beat Man City?" Me: "But wasn't it only 400 sunflower seeds?" Mr. Ham: "True, but I have also suffered other huge and completely untraceable losses, so if the Hamerican taxman (since I'm a dual citizen) calls, tell him that I will be collecting backdated unhamployment benefits." Me: "..." Mr. Ham: "And I had to hock all my seizable assets, including my private jet, to an... acquaintance, whose company just so happens to be incorporated in the Seychelles. Good fishing to be had there, by the way. President Hobobuma ain't getting a cent out of this hamster, heh heh! Only the little people pay taxes!" Me: "Wouldn't that just lead to another Greece?" Mr. Ham: "Lala, I can't hear you. Now give me lotsamoney, supposedly to create jobs but which in reality will just be stashed away, or I'll relocate operations to Africa." Marking It Up Several assignments in, I have got to admit that grading answers is a tedious and time-consuming task, if it is to be done properly. After hours of scrutinizing novel (but usually only superficially correct) algorithms, I can well understand why some professors much prefer True/False quizzes. There is, of course, always the Stairway Method of Grading on a Curve, mentioned once before, but worth a revisit. It was also sometime about then that I realised that there may have been a bit more truth in this than I cared to recognize:  Some things don't change (Source: scienceblogs.com) [N.B. Here's another matrix] Even undergrads may have to admit that they may be wrong, though, but I won't be holding my breath. Also contributed to an examination for the first time, and I've got to say that it's another art in itself. Ideally, I would say that an exam should be easy enough that most be able to pass (and adequately covers taught material), but hard enough that few can get it perfect, and with a selection of questions that produces a uniform spread of scores (it helps that undergrads generally don't wail if they aren't able to get full marks, unlike primary school students and their parents). Sins Of A Solar Empire About a month ago, a 13 year-old's innovation of arranging solar panels in a Fibonacci sequence made the news (and my Facebook), and I am slightly ashamed that my first thought was on how it could be improved, instead of giving credit (still low E.Q.). As it turned out, the idea did capture the public imagination but probably wasn't all that it was cracked up to be (still incredible for such a young lad, certainly). The basic counterargument seems so obvious that it is hard to believe that more people didn't pick it up (or perhaps they were just too kind to say so). Essentially, it states that at any particular point on Earth, there is some optimal angle that would generate maximum energy on average (likely dependant on latitude, season and other geographical considerations); then, just arranging all the solar panels at that angle would clearly be the optimal thing to do. This doesn't kill the solar tree structure outright, though - a case might possibly be made for it being more reliable (less variation in energy output), for example, or more aesthetic (even if that may not always be a good thing). It would, however, be irresponsible and wrong to agree with the lad that his theory actually worked as he intended it to. That's harsh, but that's science, and he likely has a better shot than me at overturning Einstein some day. [N.B. Fibonacci trees are already being used in computer science] Actually, a firm called Solyndra has already tried to harness reflected light, but very unfortunately has gone bankrupt after blowing a half-billion dollar loan from the Obama administration, which predictably has provided (probably justified, this time) ammunition for Republicans... Mr. Ham: "Well done!" ...and Republicahams. Yeah, hope and change and all that, but does anybody believe that the Democrats aren't in the pockets of big business (though likely to a smaller extent than the GOP) either? For Good Of All Friendkind The past week has seen another long-lost friend eager to meet up for lunch. After a while, one realises what that usually means. It was faintly entertaining to studiously avoid the subject of work in the chitchat that inevitably followed, until I finally found the charade tiresome, and segued the conversation to the meat. Me: "So, what do you do for a living nowadays?" Him: "Oh, I'm now a financial advisor." Here, I have got to make it clear that I am not against financial advisors contacting their friends and acquaintances at all. In fact, if one of my friends chose this career and didn't call me up (without knowing that I am already covered), I would say that they were not putting full effort into the job. What followed was completely predictable, and I ticked off my mental checklist as the pitch was made.

From what I've seen, whole life insurance basically works like this (see random local example): You pay a a fixed amount of money monthly, and there's a death benefit portion (the "insurance" part) that is paid out upon death (if in an acceptable manner) anytime the policy is active. Furthermore, there is a surrender value that is paid out upon maturity, or if the policy is terminated before that, possibly because the premiums were too high to maintain (though in that event, the returns are particularly lousy) One key point to note is that the insured doesn't get both the death benefit and surrender value - if he dies, he gets the benefit only; if he doesn't and the policy matures (or he terminates it), the surrender value only. Looking at the given example, which I believe is typical of whole life offerings here (expect the special stuff your own agent may be offering, I guess), for premiums totalling about S$54000 (which I figure to be 40 years of S$112 monthly), the death benefit goes up to over S$240000, and the surrender value S$110000. But not so fast - the guaranteed death benefit is only S$100000, and guaranteed surrender value less than S$44000 (recall that total premiums paid, even before inflation is factored in, is S$54000). From observation, I do not hold out too much expectation of being paid what is not guaranteed, and while agents often point to past (often recent) records of bonuses, it should be remembered that the past is not always proof of future performance. Of course, it is not impossible that one may actually get the maximum surrender value of S$110000, but the catch then is that the economy was almost certainly booming during the period of the policy for that to have occured, and one could most likely have improved upon that return. It comes as no surprise that nearly all the independent investment advice I have read is to buy term and invest the rest. Some memorable quotes (as far as I can recall) from Get Rich Slow by Tama McAleese (which I spent many an enjoyable hour poring over in my younger days): "Protect liabilities, not assets" (reasoning being that when you're rich enough, it doesn't make sense to get some forms of insurance) and "If I ask insurance agents why they don't sell term, they will say that they can't make a living just selling term; if you ask them, they will give you a different answer." This appears at least plausible (quote from website targeted towards agents: "I figured out that selling permanent instead of term policies meant better protection for my clients [N.B. hmm] and bigger paychecks for me."); refer also to a recent paper by Wharton and Harvard researchers: "Bad Advice: Explaining the Persistence of Whole Life Insurance", concluding that (*gasp*) agents (in India, at least) recommend a product that provides them high commissions, though it is strictly dominated by alternative products. Presidential candidate Mr. Tan Kin Lian has also weighed in on this issue in the past, castigating the Sunday Times for comparing term and whole life in an improper manner (though the main thrust of that article is actually already in favour of term insurance, and notes that people are under-insured because of whole life) In Republic Singapore, Investments Make You Deviating from insurance for a moment, it seems that the latest arm of the government to screw up is... *rolls dice* the GIC! And the foreign culprit is not Citibank this time, but... *rolls dice* UBS! And the response is (no need to roll dice) - we're in it for the long term, wait ten twenty years ah. This at least shows that our current President has a very good sense of timing. This Is My Whole Life So after the long discussion, I feel it is only proper for me to disclose that I did buy a whole life policy (I think) some time ago. The answer to the second question is that I don't really care. The answer to the third question is that my personal needs are few, with little growth in those needs projected. Of things that would make an impact on those of my circumstances that I care about, the expected differential between whole life and term-plus-investments over half a lifetime is not it. *Takes out pot of tea, and pours a cup for myself, and another for Mr. Ham* *Mr. Ham arrives, armed with towel, for his hot tea bath* Me: "Through long and involved consideration, employing all the powers of dispassioned analysis that I have at my disposal, the most reliable solution I have come up with thus far, as regards my unfulfilled desires, is... ah..." Mr. Ham: "I believe the colloquial vulgarism you are searching for is 'a metric shiatton of money'." Me: "Yes, to my utmost regret and disappointment." Mr. Ham: "And no, I'm not going to lend it to you." Mr. Ham: "Remember, I'm supposed to be flat broke." Me: "Someone once said that the measure of a friend, as opposed to a mere acquaintance, is somebody you would lend a considerable sum of money to, perhaps a month's wages, immediately and no questions asked." *Mr. Ham smiles* Mr. Ham: "But you don't really want to know whether it would work or not, do you?" Me: "Not really, no, I don't." "Let us drink, then." This Can't Go On FAKEBERT: So we both got pwned last week. Mr. Ham: Quite. As you can see, I'm all out. FAKEBERT: Are those hundred-dollar bills I see sticking out of your barrel? Mr. Ham: Hey, hey, hey! It is both secular and religious principle not to seize tools of trade under bankruptcy! FAKEBERT: And... Mr. Ham: My family business is loansharking, you idiot. Mr. Ham (0/400 seeds): A hundred on Tottenham to beat Wigan by more than one goal (at 2.90)! FAKEBERT: Not again? Mr. Ham: Don't worry, I checked - it's tax-deductible. FAKEBERT (424/400 seeds): 100 on United to beat Stoke (at 1.40) Next: Listening Places

|

|||||||

Copyright © 2006-2025 GLYS. All Rights Reserved. |

|||||||