|

| |

|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ entry views: 2113 today's page views: 235 (8 mobile) all-time page views: 3386276 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1226 page created Fri Jun 20, 2025 05:42:26 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

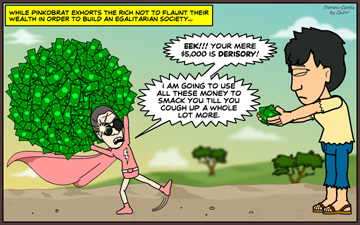

Me: So, that's that for Bitcoins, which are perhaps not something a supposed academic like myself should be going on too much about, but which should be okay for enterprising ghost hamsters. We now move on to the local political... Mr. Ham: A moment. *extracts remote control from cheek pouch, and presses button* The audio bugs have been deactivated. We can speak freely. *ponders* Be back in a second. *leaves room* After a couple of minutes, a familiar, yet ever so subtly different-looking hamster, returned. Herr Ahm: Guten tag, mensch! *more loudly than strictly necessary* If anybody is listening in, I am Herr Ahm, and not Mr. Ham, the completely reputable and totally politically apathetic owner of the investment firm of H.L. Ham! We are two legally distinct entities! I repeat, there is no provably enforceable relationship between me and the extremely accomplished Mr. Ham, although I think he is super smart, very hamsome, and a decent fellow all around! Me: *facepalms* Yes, I think that covers everything. Herr Ahm: *continues loudly* In addition, I am a Gerham national, and not a local citizen, and I know my inalienable rights! If the worst happens, I would be willing to be quietly deported, in order not to cause an embarassing international incident, if you would kindly allow me to exercise my duty-free liquor entitlement before I board the flight out! *mustache falls off* Scheisse! They don't make these like they used to! Ficken humidity, absolutely destroys glue, uh, hair follicles! Me: *drily* I think that we have established beyond all reasonable doubt that Mr. Ham is fully uninvolved in whatever opinions that may be expressed later. But yes, you can get going, Herr Master Political Analyst. What Is Bad PR? Herr Ahm: We're due a quick recap of Blogger vs. Prime Minister - when we left off, the blogger had kowtowed to the PM's demands, which was later extended to several other pieces. Following that, in response to the open-ended demand for damages, he offered S$5000, with costs to be borne separately, which was instantly slapped down as "derisory". The main reason behind the rejection from the PM's end seems to stem less from the sum offered - which would probably barely cover the fees for the most learned Senior Counsel and his team to draft the letters anyway - but the fact that the blogger reaffirmed his commitment to continue blogging about the subject. Had he simply shut down the entire blog wholesale - which the PM's team was probably hoping he got the hint about - I strongly suspect that we would have heard the last of the matter. Trouble is, other than the single ill-conceived post, the blog was mostly a mixture of good and bad arguments on a number of topics, and where would we be if we began censoring people just because some of their points are weak? In any case, this being the Internet, it's not like the content is ever going to disappear, but it's also not like the incumbents have ever shown much indication that they understand that. As already pointed out, it was probably a mistake to officially acknowledge the blog in the first place - which makes one wonder about the process by which The Heart Truths wound up on a government website. Is there some organization, such as the fabled Internet Brigade, that diligently scours the wild frontiers of cyberspace to detect dissent? And who makes the final call to commence the smackdown of unruly netizens? Surely not the Prime Minister himself? Anyway, as explained, it remained a Bad Idea™. With the other side having taken the bait, the offer of S$5000 could be made in the knowledge that it would be a lose-lose for the PM - in the unlikely event that the PM accepted, he would be acknowledging his reputation as only being worth that. However, if he rejected it, as expected, it would inevitably bring into consciousness the - widening? - gulf that exists between "their world" and "our world", where "our" refers to a non-insignificant section of the local populace. Alright, as they say in the armed forces, you're supposed to salute the rank and not the person, but with your guys regularly spouting comments like "let them buy cars" and angling for a "wind of gratitude", it might not be the best of times to pull weight around. But fine, to each his own.  An example of typical online reaction* (Source: Demon-cratic Singapore) *This opinion is not endorsed by bert's blog, H.L. Ham, Mr. Ham, Herr Ahm, or any other character mentioned therein, and is only reproduced under the spirit of fair use, as an educational supplement Since neither side was backing down, battle lines were drawn, and the blogger made the first move by holding a public fundraiser - which has, in just a few days, raised near S$50k of his targeted S$70k from hundreds of supporters, including a number of cheeky S$20.16 donations, through a variety of channels. Now, most of the contributors are probably not under any illusion that he can actually win the case - it's more of a middle finger to the authorities, than anything. Ngerng's success at raising monies further presages another danger for the incumbent side; after they win the court case, let us say that they demand compensation north of S$250000, which is the general guideline for cases pursued in the High Court. Historically, what has happened is that the other party is bankrupted, and thereby politically nullified to an extent. If tradition is upheld, the damages against an individual will be somewhere between S$250000 and S$500000, but perhaps the current PM considers himself more reputable than his dad, or we have to factor in inflation - I don't know. So, what happens if Ngerng manages to raise the half a million - or whatever amount is decided - from the public? In fact, I suspect that at least some part of the initial S$70000 will be available to go towards the final damages, given that his lawyer is probably not in this for the money. If we factor in the possibility that certain organizations may be moved to chip in when the time comes - the SDP comes to mind - it could look really, really bad for the incumbents, even if he doesn't manage to gather the full amount. Just imagine the possible international headlines that could appear: New York Times: "Thousands of citizens rally behind blogger against Prime Minister"; The Guardian: "Donations pour in as protest against threat of bankruptcy"; Le Monde: "Singaporeans ont finalement grandi quelques balles". And the worst thing is, there is now almost nothing the incumbents can do to prevent that from happening, since they can hardly stop private donations. From the published accounts, sums of S$10 or more appear the norm, and of over S$100 not uncommon; if we use S$50 as the average contribution, it would take just 10000 supporters. Given he's probably already gotten a thousand without too much publicity, and that 40% of 3.3 million citizens is over 1.3 million, it is not beyond the realm of credibility that somebody will wind up with egg on his face - and it's not Ngerng. What Is The CPF? Me: *strokes chin* It's a teeny bit far-fetched. But the way you say it... now, it could happen. Herr Ahm: And that's why the PM should never have gotten involved in the first place. With all due respect to the blogger and his cause, there's a very apropros quotation from G.B. Shaw that can be applied here - "I learned long ago never to wrestle with a pig. You get dirty, and besides, the pig likes it." Like, how are they gonna manage it? Get The State's Times to poll fifty people on whether the defamation suit was just? Me: With advisors like this, who needs enemies, eh? Herr Ahm: *puffs on cigar* Let us be honest here. With all due respect to the PM this time, he is not his father - and I don't say that as a bad thing. Everybody has got to have his own style, and if he's aiming for LKY-type "legit hardass", well, I'm sorry, that shit ain't gonna fly, baby. Me: Erm, are you sure you're a certified political analyst? They don't usually talk like that, you know. Herr Ahm: I apologize, I can get carried away. But, this is also partly due to the changing of the times. What impressed the general population forty years ago, is not the same as what will work today. Now, a Middle Eastern or African country banking on mineral wealth can press on - or buy off - the people, but we are too dependant on human capital to strangle its development in any meaningful way. Imagine the outcome if they tried some stunt like China's Great Firewall. It's simply too late for most of that. In a related development, former presidential candidate Tan Jee Say has launched a new Singaporeans First political party, recycling the heart symbol. It's a bit early to determine if it's going to adopt a nationalist bent - but if so, it was coming. Interestingly, a significant minority of its members come from the incumbents, and... Me: Uh, maybe we should get back on topic. Herr Ahm: What? Oh yes, the CPF. Well, it seems as if the Manpower Minister has been roped in as Defender of the Fund, from how he's conceded that the system may not be perfect, but at least it's your money, and anyway the interest rates are better than market alternatives. We are, then, in agreement on the imperfection, and as to whether it is indeed your money - well, there's been some dissent. The flip side of the argument has generally been that less-disciplined ah peks will squander their retirement funds on China mei meis, so by locking it away, it's for their - and the general taxpayer's - own good. We'll come back to this point a bit later, so just keep it in mind. And the big one - directly quoted: "[CPF] rates... are far higher than the equivalent rates provided by similar products out in the market today." True or false? This depends on what is meant by "similar products". If this is taken to be "local fixed deposits", then certainly. However, while they are more or less risk-free, they are also short term. If you look at twenty-year bonds, you tend to see about 3% or more - certainly not "far higher". And, as you have said, it looks even worse when you consider rolling returns from common long-term stock indices. Basically, it comes down to this - there is simply no good reason why the CPF interest rate is pegged, and pegged conservatively at that. Or, put another way - we have constantly been told that we have Most Successful Investment Firms, who have consistently delivered market-beating results; why, then, should we not at least be afforded the option to park our CPF funds with said firms? Their losses are but temporary blips, or so I've been told, and given the ultra-long time horizons involved, I'd gather that a rolling return scheme would be just about risk-free! Heck, Temasek claims at least 13%, compounded annually, over periods of ten years or longer - methinks there is a very simple solution here. Since they have repeatedly insisted that they do not manage CPF funds, we should just promote them to be the official fund manager! I'm not sure if I speak for others, but I don't even require 13% in the future - if they achieve 10%, I'd even be willing to give them 3% as management fees - surely that's more than the industry average compensation - and keep 7% as my CPF interest rate. Can anot? It's a complete win-win!  If you have a more accurate representation, I'd like to hear about it And if cannot, why not? Does the government not have the confidence in Our Historically Most Successful Investment Firm Of All Time to deliver a mere 4% return, on average? If not, why then are they safe enough to handle the reserves, but not safe enough for the citizens? Me: This is, in fact, a pretty good question. The fact that rates have been held fixed at 2.5% might suggest that they're not quite being maximized, especially when our neighbours up north have delivered 4.5% to 6% in the last decade, even though they are legally only obligated to give 2.5% - largely because somebody is actually bothering to manage the funds! Another common justification for the current, rather convoluted setup is that when Our Most Successful Investment Firm earns profits, part of it goes towards the Budget... which then flows into programmes such as the Pioneer Generation Package, which became necessary because the CPF was inadequate to begin with. One can then wonder - why run about in circles? Why not just invest CPF funds such that they beat inflation from the get-go? But we're running short of time. So, Master Political Analyst Herr Ahm, what is the CPF? Herr Ahm: I dunno. Me: Huh? Isn't that what you're here to answer? Herr Ahm: *stubs cigar out* Kid, your blessed government itself doesn't know exactly what happens to the CPF funds after they're plonked into the reserves - and you're expecting a hamster in a three-piece suit to know? You'll have to settle for a quote from one of your Founding Fathers:

I don't think I can put it better than this. Next: To Complete

|

||||||||

Copyright © 2006-2025 GLYS. All Rights Reserved. |

||||||||