|

| |

|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ entry views: 2671 today's page views: 530 (17 mobile) all-time page views: 3386571 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1226 page created Fri Jun 20, 2025 12:26:20 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

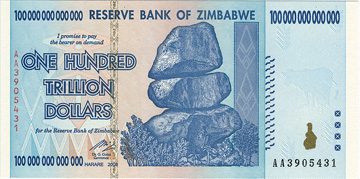

[In real life, it's still to the corner flag when winning] [N.B. Also, why are underhand free throws uncool?] While real-life technology is not quite at the level of cloning yet, it's worth a mention that the long-term goal of the RoboCup robotics competition is to encourage the development of robot players that can beat human World Cup players - which I don't really see happening by 2050, but it would be nice to watch whatever comes out. In this vein, there's been some rah-rah about the Turing Test being passed, but to be frank it was kinda underwhelming. Then again, that's the usual AI hype cycle - lots of excitement, then no-one expects anything much, then Siri's snarking at you and thrashing you flat at Angry/Flappy Bird. In the real deal, Brazil beat Croatia 3-1 to kickstart the World Cup, if with the aid of a rather cringeworthy dive. A Croatian defender's opinion that they might as well just give Brazil the Cup sounded like a slight overreaction... until the next game, where Mexico had two perfectly good goals disallowed. Thankfully, they managed to win despite that, but this should raise some very good questions about refereeing. Holland then took some attention off the bad decisions with their 5-1 crushing of defending champions Spain, with van Persie scoring a superb header. Yes, I'm looking forward to next season with van Gaal at the helm already. It has been exciting off the pitch too, as Blatter's hint that he would stand for a fifth term as president of FIFA - despite giving his word to the contrary - was not taken well by the European contingent. As we have foreshadowed in March, the juicy storyline continues with Blatter now resorting to playing the race card as the Qatar affair unravels. Having witnessed how his mentor (and former president) was disgraced after letting go of the reins, one can well understand why Blatter would want to hang on to the position for some time yet... In unrelated local news, the CPF issue has died down a little, though the blogger's dismissal from his job at Tan Tock Seng Hospital was picked up by some as a new grievance. Personally though, I would say the firing was perhaps not totally unjustified, and he probably would be better suited to be a full-time commentator/infographics designer in any case. And in yet more unrelated news, some co-op funds have gone missing, no doubt because its members didn't trust the management unconditionally. See lah! Our incumbent leaders have for their part stopped digging themselves deeper in, and gone for some overdue "common touch" image management. Not a bad idea, given how immigration concerns have cost a right-wing stalwart his seat in the USA, despite his stance being merely the legitimization of underaged illegal immigrants. This came after a poll suggesting that he would get about 65% barely a fortnight ago, showing how fickle public opinion can be. Not that I approve of the witchhunt mentality, so common after former rulers get thrown out; The State's Times has... Bought Out Mr. Ham: Stop! Stop right there! How dare you impugn the good name of our most respected daily paper! Me: Huh? *grabs hamster* Out with it! Who are you, and what have you done with the real Mr. Ham, you imposter? Mr. Ham: It's me, you idiot! *rummages in cheek pouch* Look, this is the I.O.U. that I signed a year back, which I am now seriously considering not honouring! Me: Oh. But your attitude on the local media... Mr. Ham: What nonsense! Have I ever said a word against them, they who were wise enough to hire two of my hamster clients, Ms. Tiki and Mr. Taka, as official match analysts? We need more employers like them who support local talents!  Satisfied customers of H.L. Ham Job Placements (Source: The Straits Times) Me: You... I... argh, forget it. Mr. Ham: Come, come, let's not talk politics, it's so unprofitable, uh, unproductive. That said, Bitcoin's stumbled a bit too - it got as high as US$683 on June 2, stabilized at around US$650 for a week or so after that, and is now hovering about US$580 after a sudden crash to US$550. The silver lining was, this allowed me to revive Mr. Robo - he was slipping into a coma, if with a big smile on his face, as the price approached S$700. Me: I'd say it's largely a matter of perception. Had the price risen steadily to this point, I gather you'd be happier, since there would have been no recent high to look back at - recall what was warned about 20% swings. Again, not too much has changed, and in fact the outlook for adoption is only getting rosier with eBay and Paypal considering integration, to say nothing about Google and Yahoo Finance adding BTC tickers, and also more... long-established uses. On the minus side, there's been word that 30000 Bitcoins from the original Silk Road heist are to be auctioned, though some have observed that this is actually not a good explanation for the dip in price, given that that more new coins are generated each and every week. More concerning is Ghash.io getting close to claiming a majority of available hashing power, demonstrating that even in a system designed to be decentralised, economies of scale can still come to dominate. Impressively, even a supercomputer's small fry nowadays. Mr. Ham: So why the volatility? Smells Like A Fix Me: An academic study has suggested that speculation exaggerates price movements, and they used wavelet coherence analysis, so you know they can't be wrong. *keeps straight face* Now, with much less stringent reasoning, I gather that it could just be possible that some big holders are messing with the growing number of margin long traders seeking easy earnings on Bitfinex - which seems to have passed BitStamp in volume - but don't quote me on that. Stepping back, it is not a bit ironic that what was created as the "hardest" of assets, with a production predictability that is second to none and a supply that is strictly capped, has nevertheless become the subject of derivative trades, which goes to show that if necessity is the mother, greed is the great-grandmother of innovation. Diverging a bit, this may be a good time to mention Guardians of Prosperity: Why America Needs Big Banks by Bove, which mentions Bitcoin (with small b) on page 43, perhaps a sign that it is entering the wider consciousness. Notably, in describing the British solution to their trade deficit with China in the 19th century, the author mentions that "opium was the universal medicine in China", with nothing at all on its addictiveness and side-effects. Now, I may be a bit of an Anglophile and have my doubts on weed, but this is a very good reminder to evaluate a book's claims objectively. Of secondary note is that the Yanks did much the same for tea about sixty years ago, which one might have thought the British to have been more offended by, but they won the ensuing war, while the Chinese lost, and in the end that's the only thing that really counts, like goals in football.  Twas' a bad century to be a Brit merchant (Sources: ocw.mit.edu & wikipedia.org) Mr. Ham: Yep, 成王敗寇, after all. Chaos and order move ever in cycles, and every dynasty's founding hero was an ungrateful traitor to the last. Me: Anyway, since the newly-independent Americans had proven that they would not be easily beaten down, the Brits were prepared to invest more honestly in them, and cross-continental arbitrage developed. For some reason, silver was consistently relatively cheaper in the UK, and what happened was that traders bought gold in the USA, exchanged it for British pounds, used the pounds to buy rather more silver in the UK than the original amount of gold would have gotten in the USA, and shipped the silver back to the USA to buy more gold with, in the purest expression of capitalism. Mr. Robo: Does that make sense? As in, couldn't the holders of gold and silver on both sides of the Atlantic simply agree on a fixed rate of conversion between the two metals? Me: Good question. We can consider this from several angles. Firstly, such arbitrage as you describe should in theory equalise prices... but let us consider the Bitcoin market. Bitstamp has been trading a few percentage points below Bitfinex lately, despite the underlying asset being virtually costless to move, and it turns out that the trading fees, while very low, on the order of a fraction of a percent, are sufficient to prevent perfect convergence, even if we keep assets on both exchanges to enable instant trades on both ends. Secondly, the rate of conversion is precisely what markets are supposed to discover, and in general participants have no incentive to be honest about what they are willing to pay. Having said that, gold prices are fixed, and as it turns out, have been fixed to benefit the fixers, which if you have been following finance practices in general and commodity dealers in particular, should have surprised absolutely nobody. Thirdly, for actual physical commodities, the actual transfer is dangerous and costly - consider what arrangements and precautions have to be taken to move a ton of gold. The obvious answer is to instead issue banknotes, initially bills of exchange, to represent the underlying asset. However, as cultures over millenia, and certainly Americans circa 1837 discovered, it always happens that whoever is in charge of producing the fiat tokens - emperors, governments, private banks, whatever - eventually gets "clever" and creates more tokens than can be backed by the underlying asset.  Fine, so it got a *teeny* bit out of hand (Source: wikipedia.org) An analogous tendency towards slowly accumulating risk and leverage before a breakdown cleans the slate has been discussed, and indeed the concept applies in many ways. For instance, Bitcoin exchanges have been submitting themselves to solvency audits that purport to prove that they are not running a fractional reserve, i.e. they control every single Bitcoin attributed to their users. We're certainly not limited to direct creation of money, of course. Just a few days back, it was discovered that a large quantity of copper warehoused at Qingdao had been independently pledged as collateral to multiple lenders. As usual, this is not a problem if the firm involved makes good on all its obligations, but if anything goes wrong, what happens is that a crowd of creditors get to meet each other for the first time at the storehouse, and discover together that there's simply not enough collateral for each of them to recover anything close to what they thought was a risk-free loan. Offhand, Our Most Successful Investment Firm happens to have a stake in the implicated company; but to their credit, they may have gotten it right with Alibaba, which is preparing what may be a record-setting IPO in the USA. This, together with Newegg expanding into Singapore, and Uber in Europe, can be recognized to simply be the latest step in the long-ongoing dismantling of the bricks-and-mortar retail scene. While we're on Alibaba, it should be noted that China's reluctance to allow capital outflows has extended to monthly limits on Alipay, and the restrictions on getting yuan onto Bitcoin exchanges can be considered in this light. Given that there remains strong demand for getting assets out, this has been circumvented with methods such as "recharge codes", even as the central government struggles to explain why their officials keep moving their families abroad, despite the impending China Dream socialist utopia that is to flourish. And to wrap up on the Guardians book, the author attacks the Durbin Amendment to the Dodd-Frank Act by noting that while it mandated lower credit card usage fees - a possible sector that Bitcoin can disrupt, remember - to the tune of US$7 billion a year, this didn't help the consumer as retailers simply pocketed the cost savings instead of passing them on. And, he adds, the card companies simpy made it up with other fees. In fact, "don't mess with the banks, because they will simply make the money they're entitled to in some other way" seems to be one of Bove's major arguments. Before I forget, I'd like to share a story on how economics met psychology, which is especially appropriate in World Cup season as it involves Brazil. It is fairly well known that the Brazilian currency is called the real, but the tale of part of the origin of the name is perhaps rather less circulated than it should have been. From the 1950s till the 1980s, Brazil had been stuck with hyperinflation, with each new President attempting to stop the vicious cycle by freezing prices by decree. This, unfortunately, never turned out well. Essentially, this was what happened [N.B. In my humble opinion, this is the most memorable quote of the entire series; and note how he isn't even visibly angry] It isn't that price controls can't work, but the difficulty is in adjusting everybody's expectations at a go - if one has witnessed prices doubling every week for years on end, why should he expect that a word from the top can stop this trend? Additionally, each failed attempt could be expected to make future attempts even harder, as people take it as further evidence that such pronouncements are useless. How this was resolved was, some economists came up with a completely fake currency, amusingly dubbed the Unidade Real de Valor (URV), or Unit of Real Value. What then happened was that prices were quoted both in the uncontrollably-inflating cruzeiro, and the new URV, with the catch that the URV price of goods was kept stable; its conversion rate with the cruzerio then had to be updated multiple times a day. One could wonder at the point of it all, but the magic was that within the space of a few months, citizens had come to accept a stable frame of reference - the URV. Basically, instead of thinking of prices in terms of the cruzeiro, and its associated inflationary tendencies, people began to think in terms of - and transact in - the URV, which had no such history. The fix was then completed by introducing an actual currency at parity to the imaginary URV, and abolishing the old cruzerio. Under Wraps Again Mr. Ham: Yes, uh, very interesting. So, privately, any new thoughts on the direction of Bitcoin prices? Me: On that, I'd not bother too much if it stays above the US$540 level, which if you recall, we were barely dreaming of just half a month or so back. Since you lot got in early, you can stand to take it easy. A number of market watchers are predicting a bubble within the next couple of months based on historical patterns, but I'd wager quite confidently that it will not happen; I frankly don't see any future ten-fold, or even five-fold appreciations within weeks. This could disappoint the get-rich-really-quick crowd, which may not be a bad thing. On the longer term, barring a catastrophic wipeout, I remain fairly optimistic. Mr. Ham: Who would have thought to trust an exchange owner with a cat?! So, uh, let's compare year-end predictions? Me: Doubtless there will be twists and turns along the way, but I'd put it at US$800-1200 on 1 January 2015, and strongly recommend reconsidering the whole business if it doesn't break US$700 by then. You'd also do well to watch how the price reacts to the launch of any exchange traded funds before then, which will open this market to investors who are comfortable with recognized stock markets, but were leery of jumping through hoops to get funds on strange websites. Mr. Ham: What a coincidence, that price range is exactly what H.L. Ham has worked out too! Me: Yes, yes. And to add on, I'd suggest diversifying into the equivalent of selling shovels during a gold rush. I'll leave you to figure out how to do that, but just a hint, it's not purchasing a perpetual cloud hashing contract - though if you're in Minnesota and like to drink beer, this may be worth a shot. And if you're feeling really lucky, you could have a go at calling the entire World Cup bracket - just be aware that you would probably have a better chance winning multiple lotteries in a row, but hey, almost never isn't quite never. Time to mothball this subject again, then. Next: Not A True Post

Trackback by Reality Kings Pictures

Trackback by flappy bird

Trackback by seo in lahore

Trackback by mona lisa of blogging

|

||||||||||||||||

Copyright © 2006-2025 GLYS. All Rights Reserved. |

||||||||||||||||