|

| |

|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ entry views: 1685 today's page views: 494 (20 mobile) all-time page views: 3247714 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1214 page created Sat Apr 19, 2025 14:15:06 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

Concerned that the lights over at the hamsters' had been flickering lately, I paid them a visit, only to find Mr. Robo tied to a beam, which was connected perpendicularly to a column stretching from the ceiling to the floor. Me: I really don't want to ask what's going on. Mr. Ham: Ah, I see you've finally become concerned about our living conditions. Don't mind the heat, it's coming from all the computers I've set to mining. Me: CPU mining? What is this, 2010? *lights go off* Mr. Ham: Darn, there goes the power again. How much electricity can twenty computers draw, anyway? Oh well. *trots over to Mr. Robo* Hey, Mr. Robo, have you heard? Bitcoin's now at US$500! Mr. Robo: Woohoo! We're rich! *starts running in circles* *lights flicker back on* Mr. Ham: Done. That should hold us for a while. Me: ...so, have you considered quitting while you're ahead? H.L. Ham might simply have struck a vein of beginners' luck, you know. Mr. Ham: Human, have some confidence. Me: About that - there happens to have been some research on the psychological profile of top traders, based on the Big Five/NEO-AC model, which the source states as being more validated than the MBTI, as a budding neuroscientist friend of my has previously pointed out. Apparently, the profile of an "ideal" trader would be:

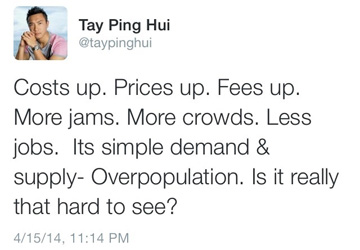

Mr. Ham: No shit, you win if you can put two and two together, have balls, and don't give a f**k. Tell me something new. Me: If you put it that way. Of course, it's not a set-in-stone prediction. Other profiles can do well too, if channeled in the right way. For instance, anger can be good if you can squeeze energy from it. Mr. Ham: But frankly, twelve percent, even if it took just a week, is not worth liquidating our portfolio for. Mr. Robo: Er, isn't five hundred from slightly under four hundred, about twenty-five percent? Mr. Ham: It's half for me, and half for you. We're partners, remember? So, any juicy local news? The State Of The Nation Me: Well, Indonesia's claiming their apology for the warship naming incident never happened, right after the relevant minister paraded it to the local media, another minister's waxing lyrical about the joys of raising six kids in a one-room flat, oblivious to ministers maintaining dignity on a few thousand bucks a month back then, a staunch refusal to provide material support, and the fact that you can't even reliably get such flats even if you wanted to nowadays. In other words, the usual. This self-consolation was then stretched to incredulous lengths when a third minister described the crazy World Cup subscription prices as inevitable due to Singapore being a "price taker"; this could be true, if SingTel doing the equivalent of yelling "take us for any price, we're suckers" by overbidding a fortune on the EPL is considered. Waving about four free matches isn't very convincing when no-one in the region is showing less than 22 matches for free, and charging at most a third of SingTel's asking price for the rest. In summary: two subsidiaries of Our Most Successful Investment Firm bid against each other to jack up prices, and to top it off, they managed to not even earn anything from the cock-up, in essence plucking money from local consumers, to fatten a grateful FIFA/EPL. A worse combination of financial planning, one can scarcely imagine. Oh, it can get worse. Much worse. Mr. Ham: But wait, there's more! Indications are that China's property bubble, after years of frentic and unwarranted construction in far-flung locations, may finally be popping, as participants come to terms with just how much fairy dust there was in the background. And guess who is stuck in the mess? You'd have thought they would have learnt their lesson with Suzhou; I sure hope they're getting some political mileage from these investments, because I don't see much else coming out of them for a long, long while. Me: Just as well as the CPF Board's demanding only 2.5%, eh? That said, it is true that excess funds can be used for investment - but the reality is that if you want a roof over your head, there likely won't be much available for some time, thanks to high and rising flat downpayments. Mr. Ham: Say, I've been poring over this as a hobby for a while, and only wound up with a few questions. First, how are your pigeonholes worth half a million or more? Second, who is going to take over these pigeonholes in the future, given that your government's latest cunning plan is to take in proportionately far more foreigners - about a million of them - than citizens and permanent residents combined, avoiding the issue that banks may not even want to grant loans for properties with sixty years or less on their lease? Third, assuming that the government does act as a buyer of last resort and repurchase large tracts of old HDB estates, as many trusting citizens are expecting, how the heck are they going to come up with the funds required given that past reserves are locked away? Mr. Robo, I remember you had a cute description for that. Mind sharing? Mr. Robo: Uh, using a physics analogy: my best impression of the reserves is that of a black hole, fifty-six man-years wide; nothing has been known to escape it after entering its term horizon, but then again, nobody has been able to directly observe exactly what lies within either; we can speculate that it is indeed supermassive, but whether any useful work can be extracted from the mysterious phenomena, not well understood by even the supposed experts in the field, is another thing altogether. Me: Quite amusing indeed. I would consider the SERS issue as yet another "hidden liability" of the system, same as CPF Life. Both involve an implicit expectation of future compensation - very hefty compensation in the aggregate too, if I may add - but with zero actual legal commitment, allowing for very rosy balance sheets depending on how they are factored in (or not) Personally, my next concern would be on the liquidity of said reserves. From the fact that State buildings and lands were presented in response to a request for an accounting, one can only surmise that local real estate comprises a significant proportion of the whole - and who can forget a former minister claiming that lowering land costs would "raid the reserves"? But if so, one can understand the difficulty in assessing a value. Now, if you have a hundred billion in US dollars, you can at least confidently say that you have US$100 billion, even if there may have been a certain amount of inflation involved. However, if you're talking about Singapore - or indeed any - land, it can get much trickier. To simplify, consider a small city with ten roughly-identical plots of land on its outskirts. Individually, each of them might be worth say $10 million to a developer... if they were sold at yearly intervals, such that supply does not overwhelm demand. The city could then do some simple addition, and happily record $100 million in the debit column on their books. Now, say that the city urgently requires $80 million. One might expect that they could simply flog off eight plots, but they would quickly find that the market doesn't work like that; developers would realise that this would expand supply greatly, and therefore only be willing to buy at a huge mark-down; the instantaneous value of all ten plots might not even be $30 million! In this way, a book value of $100 million could well be completely above-board, but in practice be heavily dependant on context.  Economics at its most basic (Source: Hardwarezone Forums) Mr. Robo: I wonder if anyone has tried to cast actual realisable price in the form of the Uncertainty Principle. Me: That's an idea. Of course, the underlying value could well change too; there's no guarantee that property prices will stay this high, unless you're vested, in which case it will never come down. Right? Mr. Ham: *draws out cigar* Gentlemen, gentlemen. I think I have a very simple explanation of the whole situation. Me: Go on. Mr. Ham: I'll use a parable, since they seem to stick, from my days as a Cult Leader. We can then envisage countries as runners. Your country, then, would be a guy entering his late thirties, and realising that it's getting tougher - his joints are beginning to hurt, his muscles ache and don't recover as quickly as before, his feet are slowing... And you know what? It was completely to be expected. Lost among all the self-proclaimed enlightened leadership abilities of your incumbents, is the tiny fact that Singapore is coming off an extremely fortuitous demographic distribution, which has seen an old age support ratio of between six to thirteen in the past decades. Yes, your government helped by being largely non-corrupt, but it remains that this age distribution allowed them to take for granted many problems that have beset other developed countries for some time. Back to the runner parable, it was the equivalent of an eighteen year-old newcomer boasting about his slick training methods in obtaining results, while dismissing his older counterparts' poorer times as due to a lack of discipline, when a large part of his achievements could simply be attributed to his youth. One could imagine some of the veterans itching to put the young punk down, but instead out of politeness settling for waiting for him to realise it by himself. Mr. Robo: Isn't it... bad to say so? Mr. Ham: *puffs on cigar* It is not a matter of saying or not saying. It is so. If not saying it would cause it to disappear, I would be happy to shut up, but guess what? It don't matter. Me: So, cutting to the chase, do you see a way out of this? *Mr. Ham looks to Mr. Robo* *Mr. Robo looks at the ceiling* Mr. Ham: Let us put our hands together and pray. *lights go out again* Mr. Ham: Isn't that a downer. Mr. Robo, get moving. Mr. Robo: I can't. And I don't care what you do to me, I'm totally beat. Mr. Ham: Hmm, do I recall you shorting Bitcoin for a customer with a shotgun, despite the price rising? Mr. Robo: AAAHHHHHHHHHH! Mr. Ham: ...and let there be light. The Nature Of Chaos They cling to the realm, or the gods, or love. Illusions. Only the ladder is real. The climb is all there is." - Petyr "Littlefinger" Baelish (favourite Game of Thrones character... minus some disquieting deeds) Next: Gone Astray

Trackback by google keyword tool

Trackback by anabolic Cooking review

Trackback by bill gates

Trackback by how to prevent hair loss

Trackback by เกมส์

Trackback by brutal rape

|

||||||||||||||||||||

Copyright © 2006-2025 GLYS. All Rights Reserved. |

||||||||||||||||||||