|

| |

|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ entry views: 855 today's page views: 373 (38 mobile) all-time page views: 3386039 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1226 page created Thu Jun 19, 2025 23:40:16 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

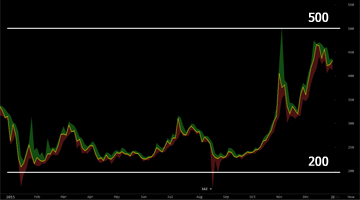

Me: Hi, Mr. Robo. It appears that Mr. Ham is late again. I see that the annual newsletter has been prepped, at least. Mr. Robo: Oh, hello, human. You want to go through it?  If ever there was a time for King in the Mountain fables... (Source: redcafe.net) Me: Maybe later. Just as well that I brought my loose notes for organization, then. Football first - Van Gaal has saved his United job for now with a nil-all at Chelsea, but I stand by my August opinion here: Rooney is done, in the context of "leading the line for an EPL top-four contender", and it's not a temporary dip thing. I've watched United for a long time, and the problem is that this team just doesn't look like scoring. While the young Rooney was definitely among the most explosive talents to grace the English league, he hasn't been that way for years, and with his contract having four more seasons to run, I'd say that the decision on what to do with him is perhaps the most critical one Van Gaal - or his successor - can make, footballing-wise. If Rooney stays, he would be nigh-undroppable due to his tenure and captaincy, and I doubt he'll accept a reduced role with good grace. To me, it looks like he's aiming to reinvent himself as a playmaker, but it's questionable if there aren't better options in that role, already at United even. With Ferguson himself not swinging the axe, which however was understandable then, and then with the never exactly secure Moyes awarding the five-and-a-half year extension, it now falls on the present and future United bosses to make the tough call... which I suspect will be complicated by a lack of willing European suitors that are up for matching his package. I'd love to be proven wrong here, but with the club down to pulling "extra bodies" back, I fear I may not be. Back home, the LionsXII have been booted out of Malaysian competition yet again, after winning the FA Cup, and are now disbanded. The S.League itself continues hanging on, and for all the ink spilled over it, disinterest looks set to continue. It's probably worth observing how the upcoming ASEAN Super League fares before charting the future of the S.League, unless the authorities are willing to commit to a long-term infusion of resources for the players, which given that they have had twenty years to try, appears unlikely to happen. While we're on Malaysia, still no trace of MH370, with the search due to wrap up in June. On the bright side, they did find three 747s stashed away and forgotten in KL. So let's see, what else is there... Erdoğan's the latest head of state to make himself helpful... Germany also testing basic income... a couple of really bad terrorists, fortunately for everyone... America goes heavy on herbs... new Chinese fonts, Moorish music, sword defence techniques, kiddy dodgeball, fan-powered hoverboards, artificial corneas and myopia treatment by vitamins and UV light, and finishing up with an EDMW Civil War turned exodus... that's more or less it for 2015. Ah, wait - remember that new pivot towards "innovation"? Well, our current Minister for Education and former Chief of Defence Force has just joined in on the chorus, achieving impressive innovation-per-sentence ratios, ending with the clearly rhetorical question of "do we feel safe to fail?" Concurrently, the IDA has sounded out on the need for more tech professionals here, which has garnered an insight on how innovation and creativity are inherently bottom-up products. Other commentators were quick to note that what the IDA actually wants is more cheap tech pros, much the same as with the STEM shortage line trotted out by the US of A. To be sure, the hype cycle has returned to Computer Science, with the latest Indicative Grade Profile being AAA/A at the tenth percentile. This should last until the next time Facebook stock tanks, and our bright-eyed undergrads clamour to get into the next Big Money field. Make hay while the sun shines... Next hot sector: robot gofer Meeting Start Mr. Ham: Ah, my star analyst! And the human hanger-on! Me: Since we're all here, how about we begin? Mr. Ham: Righto. *projects slide*  (Source: bitcoinwisdom.com, Bitfinex prices) With reference to last January's projection by H.L. Ham of a US$200-600 range for 2015, our firm has again got it spot-on. Well, the only way we could have done better was to have set the upper limit at US$500 instead, but the floor, as you can see, was quite exact. Yes, Mr. Robo? Mr. Robo: I feel that it is only responsible for stakeholders to be updated on our market assessment methodology, even in view of the laudable results, as Head of Research cum Coffee Boy. In the past year, we - and by we, I mean I - have been refining our range projection engine. For now, it remains separated into Fundamental and Technical modules, the latter of which has an enhanced fractal random-walk simulator, custom-tweaked to be heavy on vol-based MACD; pattern-mining has proven challenging, but certain formations, foremost the Head & Shoulders and Cup & Handle, appear tentatively weakly indicative if identified within three pips... Mr. Ham: *pats Mr. Robo on paw* I'll take over from here. Ahem. Continuing on, H.L. Ham has discovered the Double Dragon Inverted Crane destabilizer, that precedes a ten-stick movement exceedingly reliably - unless, of course, the odd green bars dominate the reversal, in which case we perform box-counting on the posterior composite cloud and watch out for the Perennial Pinecone, when Uranus is in retrograde. Me: ...u wot, m8. Mr. Robo: *whispers* What are you doing?! Mr. Ham: *whispers back* Hey, if you're gonna make stuff up, I figured out that I could do that too. Me: *sighs* Gentlehams, gentlehams. Mr. Ham, I get that you remain less than convinced on the finer nuances of technical analysis, but you probably should let that slide for now. Mr. Ham: Okay. Right. I guess we're done. So, who ordered the buffet? Mr. Robo: Erm, there's the market report newsletter for the upcoming year, written in consultation with the human. Mr. Ham: Ah yes, that. Good. Carry on. Stepping aside from the price for awhile, a major theme for the past year has been "Blockchain not Bitcoin", in the sense that established financial institutions are going ga-ga over "the technology underlying certain cryptocurrencies", and not the currency itself. Not that one can fault them for not wanting to seem too closely involved, given Bitcoin's continuing notoriety; the landscape remains a Wild West at all levels. Even if we leave aside the Goxxing and the many other exchange collapses, Bitcoin has seldom gotten good press in general - its association with the trade of controlled substances and less-than-legal goods continues unabated, a bunch of miner manufacturers went bust after Butterfly Labs' 2014 liquidation, criminals have progressed from demanding Bitcoin for ransomware to actual straight-up kidnapping, and even the recent price doubling has been attributed by some as being a by-product of the MMM Global Ponzi scheme, hatched by the legendary Mavrodi, and a masterpiece in its own right. December then saw the purported emergence of the Creator Himself, with an Aussie gentleman named Craig Steven Wright appearing on the panel at a Las Vegas conference and all but proclaiming himself as The Satoshi. While his ultra-buffed LinkedIn page was breathtaking, some details just didn't click, chief among them being that all it would take for Satoshi to prove his identity is to sign something with his private key. The saga has stalled thus far with Wright's house raided by the Feds, and online pundits coming up with possible motives. A bit late, but the sentiment's appreciated Mr. Ham: Wait, the hackers targeted Greek banks for a ransom? Isn't the idea to hit up those who, like, have money? Me: Ouch. Well, I suppose I should lay out the structure of the H.L. Ham State of the Bitcoin newsletter here:

General Developments Despite the not-exactly-positive headlines that Bitcoin has gotten the past year, it is of some consolation that it has at least made the news with some regularity. Singapore does actually seem one of the unequivocally-friendlier jurisdictions for the technology, with our then-Minister for the Environment and Smart Nation etc. giving it the thumbs-up, before no less than the Prime Minister himself mentioned it positively at the UOB 80th Anniversary Dinner last November. While we're on the not-bad news, transaction volume is on the up-and-up, as is venture capital funding, while apps such as the Bomberman clone Battlecoin integrate Bitcoin into their systems. New Tom Clancy-branded novel Commander in Chief has incorporated it into its plot, and for an art project, an A.I. was handed funds in Bitcoin and ordered to randomly buy items from the deep web. Unsurprisingly, it got arrested. The drive towards improving miners hadn't slowed either despite the moribund price for much of 2015, with BitFury rolling out immersion cooling for their ASIC clusters, and more hashrate in reserve than one can shake a data centre at. As raised in last year's AGM, the blockchain concept has taken root in the academic community too. At my institution alone, June's seminar by Buterin was followed by another by Roger Wattenhofer in December, and homegrown research on incentives, doubtless among other contributions. Offhand, in the context of computer science, I'd say that blockchain tech touches the fields of databases, networks and cryptography in particular, while going beyond traditional boundaries:

Regulatory Developments and Major Markets The long-awaited New York BitLicense finally came into effect in August 2015, but proved so onerous that Bitcoin firms, including leading Euro exchange Kraken, decided to bail to other states rather than play their game. Some have muttered that it was designed to prevent upstarts from challenging the incumbent big fish, which was lent some plausibility in that the first recepient was backed by Goldman Sachs, even as various banks load up on blockchain-related patents. Although actual market information is hard to extricate, partly due to the semi-anonymous nature of Bitcoin, it appears a fair bet that China remains the major driver of demand and prices. The "Big Two" of OKCoin and Huobi routinely exceed a million BTC in volume each day - note that the 15 millionth Bitcoin had just been mined days ago - which makes these figures ludicrous, until you remember that they have zero-fee trading. This has allowed inflated volumes to the extent that although BTCChina is a distant third, they still tend to beat the sum total of all major Western exchanges, which tend to be in the low tens of thousands. Of these, Bitfinex is the only one that offers margin trading, and at a relatively staid 3.3x leverage at that; Bitstamp remain the standard vanilla reference, who have managed to bounce back from a US$5 million loss in January, while BTC-e and its associated trollbox remain the slightly-shady outfit that doesn't ask questions and is happy to take anybody's money, though a lack of hard currency means that USD prices there are often somewhat below the rest. Despite that, they may ironically be the most stable of the lot. And then there are the pseudo-bucket shops that offer 100x leverage or even more, and which shall not be advertised. For the more professionally-backed exchanges, itBit - previously based in Singapore, and now armed with a trust charter in New York - and the Winklevoss twins' much-ballyhooed Gemini are the standouts. However, particularly in the case of Gemini, they have been plagued by a lack of trade volume and liquidity, which tends to reinforce each other. Gemini hasn't made many fans by reversing trades either, and with their COIN ETF now stuck in SEC limbo for two years as the ETF vehicle is itself coming under scrutiny, they may be staring at an unhappy repeat of their Facebook experience. Then again, the Bitcoin Investment Trust ETF-like product has been trading at a premium to the underlying asset, which does suggest that there is a class of investors who are wary of dealing with the nitty-gritty of Bitcoin, and yet want exposure. Such exchanges are hardly the only way to obtain Bitcoin nowadays, with Coinbase, Circle and Xapo among others positioning themselves as middlemen with wallet and vault services, as explained back in April 2014. A major distinction between these services and dedicated exchanges is that they maintain daily buy limits, in contrast to exchanges that encourage as much action as possible, which is probably due to them accepting more consumer-friendly but also reversible payment methods such as credit cards. Finally, there are the in-person purchases. Although the excitement over ATMs has died down, LocalBitcoins volume has been on a steady uptrend, which may indicate real grassroots interest, hopefully. The Fight for the Soul of the Coin With Bitcoin prices recovering, the outlandish expectations are making a return, with Marc Andreessen maintaining that it can reinvent finance, and one U.K.-based investment bank believing that it can "become the sixth largest global reserve currency within fifteen years". H.L. Ham remains more measured in its outlook, in comparison, with Bitcoin currently engaged in a battle for its very identity; this may sound overblown, but rest assured that it is no hyperbole. Recall the original, irresistable promise of Bitcoin: a decentralized, secure, fast, cheap and unlimited store of value and peer-to-peer transaction system. From this alone, it is not hard to see why it has been thought of as a killer innovation, given that historical approaches to the implementation of "money" have been far inferior, with the puzzle of an "ideal money" having engaged John Nash himself:

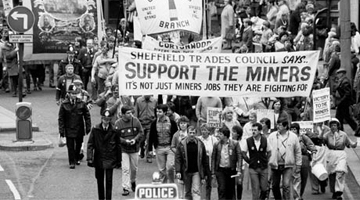

The Auld Enemy, Castle Yellen, a.k.a the Federal Reserve (Source: theartof12.blogspot.sg) Of course, achieving all five desirable qualities is far from trivial - or it would have been done previously - and as it turns out, there are tradeoffs between these qualities, as splendidly described by Litecoin's Charlie Lee. In summary, for Bitcoin, security is currently subsidized by the block mining reward, awarded to the miner that earns the right to write the latest transactions to the blockchain (with probability proportional to its share of the current committed hashpower). However, this inbuilt subsidy is preset to diminish over time, upon which miners have to be incentivized by other means, or else leave the system and thus reduce the security of the whole. On this, Bitcoin was designed around the assumption that in the future, a combination of two things would continue to pay for the security that miners provide: Firstly, the value of Bitcoins would increase; since a halving of block mining rewards is scheduled roughly every four years, a doubling of Bitcoin price in the same timeframe would "buy" about the same value of security. Secondly, Bitcoin users would start to chip in more for transactions. Currently, most transactions are accepted for free, with a nominal amount (typically 0.0001 BTC, or a nickel at current prices) specified for priority inclusion. Higher fees could then also "buy" security. Now, on the priority inclusion part - as the persistent Wikipedia fundraisers suggest, counting on voluntary funding for societally-beneficial services is tricky at best. However, Bitcoin does have a built-in mechanism for "encouraging" payment of transaction fees: it was never truly unlimited, being based after all in a physical universe. For now, about a thousand transactions can be registered per block, and with a block being generated about every ten minutes, this yields "a few" transactions per second for the Bitcoin network as a whole. The reason that Bitcoin appeared unlimited, and its usage free, was that demand for transactions had historically been much lower than its capacity - however, as the number of users increases, the number of desired transactions can obviously exceed capacity. If so, and if capacity remains fixed, the outcome will be a fee market - each transaction "bids" to be registered on the blockchain by offering a fee, and miners select the set of transactions that will give the highest fees to include in each new block. Of course, if that happens, microtransactions involving tiny fractions of a Bitcoin may never be economical, and such use-cases unsupported.  Ye shalt not crucify mankind upon a hash of double SHA-256! (Original source: sites.google.com) The question on how to resolve this dilemma has split the Bitcoin community into two ideological factions, the small-blockers and the large-blockers. Roughly speaking, small-blockers intend to keep block capacities relatively small (what a surprise), and view the fee market as a necessary evil. Their main concerns are the implications of large blocks - being a decentralised network, all transactions and thus blocks have to propagate to all nodes, so one problem off the bat is that Internet bandwidth is limited - and costly - in some areas. Since storage is not free either, this increase in costs may encourage centralisation by disincentivizing independent nodes, destroying one of Bitcoin's major distinguishing selling points. In opposition, large-blockers are for raising block capacities. Their argument centers around the risk of node and miner centralisation in practice being low, and the expectation that improvements in communications and storage technology will handily support their proposed increases in block size. Put simply, they downplay the tradeoffs to decentralization and security that larger blocks will cause, or at least place their importance lower than the cheap and unlimited properties. Of course, there are many secondary arguments, such as small blocks indirectly hurting security anyway if it discourages adoption (i.e. miners may get a larger slice, but of a smaller pie), and that changes to the standard Bitcoin protocol must be taken only in extreme situations (i.e. keep the status quo, or users may start to fear arbitrary changes that could destroy the value of Bitcoin), but the fundamental struggle is as laid out above. In actuality, almost none of the key players are officially set on keeping the current 1 MB limit forever; however, the core developers have been on the side of "wait and see", holding off on a number of reasonable-sounding Bitcoin Improvement Proposals (BIP), which has been taken by some to be as good as being on the small-blockers' team. In response, former Bitcoin Core chief developer Gavin Andresen, once anointed by Satoshi but who had relinquished his position in April 2014, attempted a coup of sorts by releasing a competing Bitcoin XT implementation, that included the BIP 101 measure of a new initial 8 MB limit, which will then double every two years.  Brothers-in-ASICs, we gather for a better, less-centralised tomorrow! (Source: gleniswillmott.eu) Given Andresen's longstanding status in the community, it was not unexpected that his proposal managed to gain a certain traction, with a number of major exchanges and wallet providers pledging themselves to Bitcoin XT in late August 2015. Recall, since Bitcoin has always been an open-source implementation, adopting a different-but-backwards-compatible version has always just involved miners and nodes switching to the new software, also termed a "hard fork". This is something many are not keen on, since with new blocks on the competing forks possibly not compatible with each other - which is actually the point of forking in the first place - the fork that "loses out" by failing to attract the majority of hashpower will in effect die out... and take all of its transactions since the fork began with it. While no true hard fork - save obviously necessary bug fixes - has ever passed, the prevailing theory is that miners will quickly switch to whatever the winning side is to preserve their mining profits, since hashpower cannot be shared between forks. As it turned out, however, miners did not appreciate being led into XT, and with nearly no expections, decided to stay with Bitcoin Core while backing BIP100, an alternative proposal that would allow miners to vote for blocksize capacity changes. While XT did cater for a painless transition by only kicking BIP101 in after 75% of blocks signal acceptance, it has come nowhere near that without miner support, with well over 99% of blocks created by loyalist miners currently. This, combined with a censoring of Bitcoin XT from the most prominent online forums - ostensibly as it is not "real" Bitcoin - has not gone down well with some large-blockers, who responded with a campaign against ownership centralisation of said forums. Unfortunately for the revolutionaries, if there is one law in cryptoland, it is "hashpower talks, empty talk sulks". While miners and exchanges are interdependent to a large extent, when it comes down to it, only one of them comprises the actual Bitcoin network, and it isn't the exchanges. Guerilla spam attacks continue every so often, but do not look like changing the stand of miners anytime soon.  Long live the pickaxe-wielding proletariat! Down with the exploitative merchant class! (Original source: imagekind.com) Of course, a prolonged standoff benefits nobody in the long run, as an IEEE Spectrum editorial explains, and invested parties have been inching towards a consensus, most visibly at the ongoing series of Scaling Bitcoin conferences. A compromise appears to be forming around the new segregated witness (segwit) innovation, which segregates cryptographic signatures (the "witnesses") into a mirrored Merkle Tree (the basic data structure of Bitcoin). Not only does this handle transaction malleability, it further conveniently increases the effective block size, for the same capacity limit, since it removes signature data from coming under the limit. However, while segwit has the advantage of being pushed out as a "soft fork" that does not require users (other than miners) to upgrade their Bitcoin clients, it is also clear that it is at most a temporary solution to the block size debate. Ultimately, more than technical tricks, however appropriate, the issue is one of vision, of what Bitcoin will be: a digital-gold store-of-value foolproof monetary base that relies on secondary protocols for various uses, or a one-size-fit-all pure P2P universal network, that handles any and all transactions? With the amount of cash potentially involved, accusations of conflicts of interest have inevitably been thrown around. For example, Litecoin potentially benefits from receiving the overflow of transactions with smaller Bitcoin blocks, while exchanges presumably care more about mass adoption at this point, and thus prefer larger blocks to facilitate that. Now, given that we have long identified Bitcoin as being foremost a cryptocommodity store of value, and described off-chain transactions, it is not hard to guess where H.L. Ham's sympathies lie. It should be emphasized that our objection to Bitcoin being a flat universal network, as in the Bitcoin Unlimited proposal which would remove capacity limits entirely, is founded more on practicality than anything; although future tech improvements have been presupposed in arguments for big huge blocks, the O(N2) nature of pure decentralisation seems to imply a strongly exponential growth in transactions if Bitcoin really catches on, which when multiplied by a concurrent explosion in nodes, might not be matched by bandwidth and storage space increases anyway.  YA DON'T LIKE *BIG BLOCKS*? SAY THAT AGAIN? (Source: vine.co) Put another way: why should you really care exactly when somebody in Manhattan bought a cup of coffee, or when a guy in Ethiopia topped up his mobile phone? What is actually important, IMHO, is that the sum total of value on the Bitcoin network remains consistent. Pushing every single fifty-cent transaction on the main network, to be guaranteed by maybe millions of bucks in hashpower, seems to me overkill; what appears the "correct" approach, given that security is hardly free, is to allocate a suitable amount of security depending on the value of the transaction - i.e. a hub-and-spoke model. Overflow into Litecoin and other alts, and letting the free market figure it out through floating exchange rates, is probably the simplest - if most troublesome for users - option. While there have been various suggestions, such as fractional-difficulty "weak blocks" that allow for finer granularity of security compared to the all-or-nothing of current "strong" blocks, much of the interest and effort has gone into designing secondary overlays atop Bitcoin, the most promising of which is probably the Lightning Network (LN). While the specifics are many, the basic idea behind LN is that everyday petty transactions can be settled on secondary micropayment channels, without touching the main Bitcoin blockchain. One key realisation is that, unlike centralised exchanges, LN sidechain channels are themselves decentralised - anyone can still open a channel with anyone else, whether or not the other party's true identity is known, just as with Bitcoin itself. Definitely, there is no guarantee that LN will turn out to be the most popular scalability solution, but our opinion remains that hierarchical networks are the future. Mr. Robo: Does our CEO have anything to add? Mr. Ham: Huh? Well, I have always thought that it's not the size, it's what you do with it that matters. Me: *smacks Mr. Ham* The Economics Behind It All Me: Ahem. Moving on. Having surveyed, in turn, the underlying technology and broad direction of Bitcoin, it is about time to shift focus from the computer science angle, to an economics outlook. Doubtless to the great dismay of at least some classically-trained commentators, the reports of Bitcoin's death have been greatly exaggerated. It is hard to continue without referencing the eminent Brazilian computer scientist Jorge Stolfi, already mentioned here, who has been an active skeptic of Bitcoin, though as far as I can see, a conscientious and reasonable one, a rare sight indeed in the oft-echo chambers that are crypto watering holes. Given that he has, as far as can be discerned, been happy to contribute under his real identity, and has expended significant and likely underappreciated efforts - such as the sum-of-bubbles model - I find it only right to devote a few paragraphs to his undoubtedly well-meaning expositions. From his objections, it appears that his primary concern is that Bitcoin is a scam that will ruin the common folk - which given that trade volume is surging in Brazil, is quite understandable. Of course, some arguments such as cryptos not returning dividends, not being scarce, and having no anchoring intrinsic worth, have been addressed here in previous meditations on value. It happens to be a separate analogy that I found especially interesting. In this example, a circle of participants is described, where each guy starts with a fifty dollar bill, which they pass around. Then, more and more people join, some of whom contribute two or more bills to the circle, in the hope of obtaining greater returns. The story ends with the circle-creator leaving with two bills, with the unsaid implication that at least some of those remaining in the circle have to lose out. The interesting part is not the Bitcoin-as-pyramid-scheme-Ponzi accusation, which has been trodden well enough, but the similarity of this setup to another famous analogy: that of "velocity of money" in economics. In this case, the "new money" introduced to the circle corresponds neatly to money creation by banks... and well, you see how it goes. Admittedly, this is less a defence of Bitcoin, than a query as to whether "respectable" fiat money is any better in truth. Again on the academic side, Courtois for one has argued in 2014 that cryptocurrencies tend to self-destruct as and when miners opportunistically jump between different cryptos and flood their hashrate, which would make holding cryptos dangerous; in practice, among his case studies, Dogecoin and Unobtanium have turned to merged mining, while given that Bitcoin commands by far the most hashpower, this flaw would seem inapplicable outside of the usual 51% attack threat. Indeed, in a recent interview with Nature, Courtois now refers to Bitcoin as the "Microsoft of cryptocurrency", and asserts that its first-mover position is eminently defensible. Mr. Robo: Further, there have also been direct responses to miner hopping, such as time-based trust keys. Me: Yep. To be sure, Bitcoin may not be good as a general-purpose currency, with Japanese and Russian economists, among others, still attempting to wrestle the concept into mainstream economic paradigms. But, in my opinion, this is wholly distinct from whether there is space for cryptocommodities in the global financial landscape. And on the "blockchain not bitcoin" fad, the main question remains on the types of applications for which private trusted blockchains would be useful, and plain old trusted databases, not. As Derman recognized, the point of Bitcoin is that the trade is the settlement. Or, if financial institutions can't trust each other not to sabotage or manipulate plain old databases already, what exactly does a blockchain bring to the table? Then again, given how dysfunctional the industry can be, I'd wager that some smarties are already scheming as to how to exploit the technology... I suppose I'll leave off with another brief thought experiment, like last year. Recall that we justified value then, as from real resources exchanged for the cryptocommodity token. This time, we consider the distribution of total real resource value, to that vested in this asset class. A recurring fantasy of crypto supporters is that they buy or mine the crypto, and after some time, magic happens, and they become the new wealthy elite. Of course, one has to suppose that this is not automatically true, or at least, not all that redistributive. Imagine the dream scenario where Bitcoin actually moons, to say US$10000 per coin, in ten years. A fairly-early adopter who bought at say US$100, might be chuffed at making 100x. However, does the new buyer at US$10000 actually lose out? Not really, if one considers that he can simply turn around and cash out for that amount, if that is the established market price. Not only that, one has to suspect that if everyone actually hodls forever, the upside potential of Bitcoin will be limited. One could formulate this relationship, very roughly, as turnover versus utility. With high turnover, each user on average obtains Bitcoins "at market", and also passes it on "at market" - potential for capital appreciation, or the difference between the two prices, is relatively low. However, the utility as a medium of exchange and representation of value rises... Wrapping Up Mr. Ham: Eh, you're rambling again. Mr. Robo: We're nearly done. There's this last bit on modelling market hypotheses as dynamic Bayesian networks... Mr. Ham: *impatiently waving paw* Nah, skip that. I came for the honey, ham. You got the number for me? Mr. Robo: Okay, then. For 2016, H.L. Ham's year-on daily median range is US$350-800, similar to that of 2014. While we expect the much-awaited upcoming halving to have an impact, bubble potential should be limited due to the increasing maturity of market participants. Ending 2016 in the six hundreds, i.e. a 40% gain, should be construed as a promising success for the ecosystem. Mr. Ham: Tally-ho! Much obliged! *grabs hat and leaves* Me: *watching rapidly-departing hamster* Well, you've got to wonder sometimes if all that effort was worth it. Mr. Robo: Yeah, I mean, we took pains to consider everything that we knew about, in coming up with the projections - the tech, the economics, the regulatory developments, the greater market sentiment, the psychology of market participants, their numbers, the depths of their pockets, the competitors, the miners, the mining equipment manufacturers, geopolitics and a shit load more... and Mr. Ham just takes it and runs with it? Me: *shrugs* I suppose the synthesis of data is its own reward. Such... partial-information games have always been strangely alluring. They lie tantalizingly between deterministic systems, which while possibly challenging logically, can be so drearily mechanical, and the uncharted oceans of blind idiot chance, where there is nothing to grasp onto. Mr. Robo: *twiddling whiskers* I dunno, never quite thought of it that way myself. Me: Hey, a guy needs something to live for. Look at kids, they got dreams: "I wanna be the fastest sprinter in the world", "I wanna be the best footballer in the world", "I wanna be the fireman with the loudest bell in the world"... nothing to be ashamed of, really. And some of them even keep them.  (Source: Fist of the Blue Sky #41) [N.B. This is one series in which you feel really, really bad for the bad guys] Mine was lost to me, so I have another now, and I care not who laughs - I want to be the most accurate man in the world. Mr. Robo: Meh, sounds slightly posuer-y... hey, ok, it's cool, don't do that "flattens hamster" thing, please. Me: You're a quick learner, Robo. Always liked that about you. And strictly speaking, I suppose it's "most accurate guesser in the world". Has its downsides too, though, if one desires to be mostly-honest. But, eh, we've more analysis lined up, Mister Robo. Never a dull day at the firm of H.L. Ham... Next: One Way Only

|

|||||||

Copyright © 2006-2025 GLYS. All Rights Reserved. |

|||||||