|

| |

|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ entry views: 254 today's page views: 499 (20 mobile) all-time page views: 3247719 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1214 page created Sat Apr 19, 2025 14:20:27 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

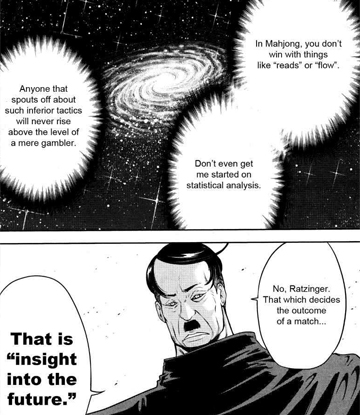

Me: A bit of a downer here, Muhammad Ali has passed on. Guy made beating people up an art form, and I say that with all sincerity; never know when it might come in handy, as our Amos Yee might have appreciated at Jurong Point recently. Float, sting, shuffle, enter history [TRUMP's take, TRUMP and Ali] Returning to other pursuits. Mr. Robo, come across any interesting stuff lately? Mr. Robo: Certainly, human. But first, condolences on Ali. Watching pop culture icons disappear must remind one of the fragility of life. Oh well. Anyway, some miscellaneous research that caught my eye, these weeks: the counter-intuitiveness of quantum mechanics has begun to necessitate computer algorithms to select experiments; science may unavoidably be going down the rabbit hole of meta-complexity, that is if we are butting up against the limits of the class of theories that can be properly analysed by individual humans, or hamsters. Oh, and there's this take by Wolfram, on how computational irreducibility sufficiently captures the concept of free will - in other words, as long as there do not exist computational methods that accurately model our minds, we can claim to retain free will. Of course, it was previously hypothesized here that there may not even actually be physical determinism... Me: Er, ok. Mr. Robo: Then there's a FindFace app from Russia, that supposedly can identify strangers in crowds with 70% accuracy, if the target has a social media presence; could be terrifying to some, I understand. An artificial hive mind - okay, there's some hype there - has hosted an AMA on Reddit, China's testing straddling buses, touch found not to inform vision some time back... Mr. Ham: *walks in, waving cigar* Pshaw, real hams don't waste their time on all this theory-technical crap! Real hamsters are hamsters of action! Like Muhammad Ali! Learnt a lot from him myself, like how you gotta punch the other guy in his guts, to get him to quit protecting his head. Real hamsters don't bother themselves with peasant concepts like "practice", they simply bask in their due exultation of being the beloved of the gods - again, just like Ali.  Jumpman, meet Punchman (Original source: theguardian.com) Mr. Robo: Actually, he was more born of Clay, achieved greatness... Mr. Ham: *shakes head sadly* This tendency towards circumlocution is why you haven't amounted to anything, my dear Mr. Robo. Ya just gotta trust in your instincts sometimes, find something you're good at, and just whack! *accidentally punches Mr. Robo full in the face* Oops, sorry. I mean, I gotta admit you got some brains, but you're squandering it on math and logic. Like, you could've shorted Nokia. Or Theranos. Mr. Robo: *wails* Bah dose! It's bwoken! Me: Actually I don't think Theranos was openly traded, but it's definitely a worthy case study. It's difficult to separate the company's story from that of its founder, Elizabeth Holmes, who dropped out from Stanford at nineteen to revolutionize the blood testing industry. In fact, she arguably got her break interning in a Singapore lab when SARS - and the local biotech bubble - was all the rage. Of course, we know how that ended. Anyway, the latest update on Theranos is that its test devices - modestly dubbed "Edison" - might not even work, despite the glittering cast that had signed onto its board of directors, including no less than Henry Kissinger. Notably, next to no details had been published in proper journals over the last decade - which could have been understood as defending their I.P.. But, if the proof was left to the pudding, the withdrawal of all Edison blood tests for the past two years certainly did not bode well. As it is, Theranos' valuation has just plunged from US$9 billion to less than a billion, leaving Holmes dry. Mr. Robo: *shakes tiny paw* Ees example of importance of disciplined scientific methodology! By the way, have you heard, European research is going open access... Me: Interestingly, Tim Draper was one of the earliest seed investors in Theranos, and guess what he last made a big splash about... yep, it's Bitcoin. On that, while Draper's US$10000 per Bitcoin target in three years, set back in 2014, was always on the wildly optimistic side, he might at least be closer to breaking even on the nearly thirty thousand Bitcoins he bought at auction back then. Mr. Ham: Which is why I'm here - gentleman and gentleham, I call an extraordinary general meeting of the firm of H.L. Ham!  [Full-scale chart] Mr. Robo: Uh, it's my presentation, right? Following on our latest First of January AGM that proposed a US$350 to US$800 value for Bitcoin for the year of 2016, the actual price has indeed stayed within this range up till today. A low of US$352.50 - or almost within a dollar of our minimum bound - was reached on Jan 16 on the reference Bitfinex chart, and a high of US$593.89 achieved yesterday, before a local pullback to about US$575 as of now. The intervening months were characterised by a steady runup to about US$450 by May, before the hundred-over dollar jump towards the end of May. All within the researched expectations of the analytical division of the firm of H.L. Ham. Me: Not bad, especially given the US$350-700 post-crash range of 2014, and US$200-600 range of 2015, as previously proposed by H.L. Ham, have been pretty spot-on, without even mentioning the swing trade mid-2014. Assuming a hodling from the US$400 level at start 2015, this would seem to represent an approximately 50% return in one and a half years, or roughly 30% annualized. Mr. Ham: *puffs on cigar* I apologize, it's kinda piddly, but you can't always have years like 2014 with multibagger returns, my human. In any case, since there were investment schemes denominated in Bitcoin, the true return is slightly higher than that - in fact, it was just about sufficient for my three and thirty performance level bonus to be unlocked. *winks* Oh, and the depreciation of the Singapore dollar against the US dollar since then played into our favour too. Me: ...it's always satisfying to watch as reality confirms one's market research so exactly, eh, Mr. Robo? Mr. Robo: Eh, you don't know the work that went into it, and all the false starts in the model building and validation progress. In the meantime, I have been investigating kernelized regression ensembles on decision forests of sparsely-decomposed features, which has given me some ideas on higher-frequency trade tactics. Couldn't resist testing out the deep learning fad, but nothing concrete on that end, I'm afraid. Next up, I've heard fine things about smart matching pursuit for signal representation, it's not immediately obvious how it would be applicable to forecasting, but... Mr. Ham: *kicks chair out from under Mr. Robo* Quiet! Quit giving away trade secrets! And in any case, if you haven't realised, I had the final say on all actual investment decisions as CEO - your advice remained just that, merely a suggestion.  The Mr. Ham school of market forecasting (and mahjong) (Source: The Legend of Koizumi #24) Mr. Robo: I... you... he... Me: Many ways to skin a cat, I suppose. Mr. Ham: Now, now, we're not that vulgar a species. Us hamsters are adorable, peaceable creatur... *stomps Mr. Robo* Stop moaning will ya, I'm talking here! Me: ...well, there should be plenty of volatility in store, what with The Halvening scheduled to happen in little more than a month. China led some of the recent pumps, but I'd gather much of it is simply the fundamentals catching up. This would, I expect, include the slow realisation that the strongest blockchain is where it's at, after major financial and state actors have dicked about without gaining much traction. Just last week, Russia has revealed plans to issue its own Putincoin and ban all other cryptos, which suggests that they're wising to Bitcoin's potential to suck in value. China's mulling it too, while local banks are attempting to fill their innovation quota. Still, it's advisable to keep a thumb on adversarial arguments, for instance by perusing anti-Core forums. Mr. Robo: *struggling up* There was something of a missed opportunity, though, when we failed to put more than play money into Ethereum, explained here last year; our initial prognosis was that its investment prospects were iffy, given perpetual inflation of the underlying token, hard-to-quantify complexity of contract execution, and explicit warnings that it was not intended to be a store of value by design. However, the impending DAO launch, and heavy Coinbase support, has allowed up to 40x gains for the earliest crowdsale adopters. Mr. Ham: Meh, can't get them all. From what we knew back then, I'd say it was the responsible call. It could be noted that Bitcoin's status as top crytpo remains unchallenged, given its US$9 billion market cap to Ethereum's US$1 billion, which Ethereum mostly appears to have taken from other altcoins such as Litecoin. In general, it's folly trying to chase altcoin booms, and given H.L. Ham's scale, we'd likely crash most of them if we tried to get in and out of substantial positions. Me: As it happens, Buterin was back here a couple of days ago. Exciting days ahead, hamsters. [Translation] Next: Chop Until Jin Song

|

|||||||

Copyright © 2006-2025 GLYS. All Rights Reserved. |

|||||||