|

| |

|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ entry views: 405 today's page views: 274 (10 mobile) all-time page views: 3386315 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1226 page created Fri Jun 20, 2025 06:35:41 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

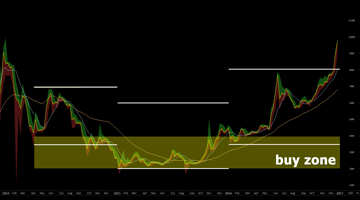

Sorry, couldn't help it. Happy new year to all! Me: Well, time to join the hamsters in taking stock of the previous year, and figuring the new one out; but before that, some quick thoughts on the state of economics. Economics Re-examined - World Bank chief economist Paul Romer (paper) I have to concede, I had never been particularly convinced by macroeconomic arguments and models, back when I was taking the modules. Oh, they weren't wrong per se, but the nagging feeling was that they weren't of much practical use, in that the formulations were always "accurate as defined". Reality doesn't fit? Oh, that's just exogenous, the math is correct! Unorthodox (but, on hindsight, likely accurate) arguments tended to just get marks docked, so it was a lot easier to just go with the flow. Maybe I'm just bad at math. Then again, these failures do get an airing every so often; Taleb gets trashed on economics forums when he points out the failures (misapplications?) of theory, but a telling observation is that there aren't direct refutations, instead mostly dismissals of the form "he hasn't published in top econs journals, ignore him" (no-one mention the disaster that was Long-Term Capital Management, that crashed and burned utilizing that very assumption of convergence with two Nobel laureates at the helm, here). Occasionally, one gets a Romer (who's probably set for life and doesn't need to stay in the good graces of a tenure committee) or a Ha-Joon Chang arguing for more politics and history and slightly less math (like the old days), but that's about it. And we come to the interesting bit: when you've gotten as far as dynamic stochastic general equilibrium and are discovering more parameters than one can explain, much less fit, it's not too much of a stretch to suppose that at least some practitioners might prefer stuff that works, rather than stuff that can be proven to work (and then not quite work). Now where do we find such techniques, I wonder..? [N.B. One thing about economists, is that they seem to be deferred to, even in areas that they have no particular record of expertise in. The opinion columns of newspapers, for one, appear heavily overpopulated with them (though they aren't necessarily agreed with by the population at large, and one can understand why the public might suspect that their interests are not necessarily aligned - re: protectionism for professions uncontested, that for lesser trades derided)] The Fourth H.L. Ham AGM Mr. Ham: ...yeah, you're just bad at math, human. *leafs through papers* Ooh, Xi has just okayed 6.5% GDP growth for China, now what does that correspond to, according to our expert Dr. Chang? *consults notes* Oh. Oh, crap. Me: Oh, shut your trap. Where's the hamster who actually did all of the real work? Mr. Robo: Is that me? Uh, apologies, got caught up in all the trade volume these past weeks, haven't managed to draft the annual newsletter yet. Me: No problem, Mr. Robo. Just don't crash the market accidentally, yeah? Mr. Ham: If you two are done - I, CEO of the firm of H.L. Ham, am pleased to report yet another stellar year!  H.L. Ham charts the preceding three years [Enlarged version] In keeping with our reputation for sensible projections - see US$350-700 for 2014 from April onwards - and a prescient call of US$1000 "if you're willing to wait a few years", together with a suggested buy zone of US$200-400 after the December 2013 bubble - then US$200-600 for 2015, and US$350-800 for 2016; all of which, as you can see, came very close to the truth. Me: About that US$800 maximum for 2016, we wound up about ten days off. The expected resistance level held exactly as expected during the June halving top, but we were looking for the breakthrough in early 2017. Instead, after mounting pressure below that level through most of December, the formation blew its top spectacularly, to hit some US$980 in a week, spoiling the accuracy of our prediction. Frustrating, but there's always room for improvement... and I can't complain too much, given the practical effects. Mr. Robo: I dunno, maybe we should return the extra money? Mr. Ham: Excuse me. *Mr. Ham waddles across room* *Mr. Ham picks up a large mallet* *Mr. Ham waddles back* *Mr. Ham conks Mr. Robo across the head with the mallet* Mr. Ham: Please, do continue. Me: ...okay. We should probably follow up from last January's AGM. To be honest, there haven't been too many surprises. Much the same old for-and-against arguments for Bitcoin have been flung around, with the obvious realisations with regards to private blockchains arising (see Goldman Sach's withdrawal from the R3 consortium) - basically, if there are a limited number of known participants with reputation at stake, there is simply very little reason to resort to blockchains. There are any number of legacy database systems that would fit the bill for that particular use-case, which they should well know. No, the fundamental argument for Bitcoin remains devastatingly simple: it is a fungible, infinitely divisible (for all intents and purposes), digitally transactable, freely storable commodity (not currency, not quite yet) with predetermined scarcity... which, some have gone as far as to propose, is an "economic singularity". Hacking away all the distractions, the basic value proposition remains: given these properties, the leading cryptocommodity is a self-reinforcing magnet for value - returns attract investment, which increases its utility, which produces more returns, etc: insane alpha, in financial terms.  Yes, yes, come to papa. (Source: bbc.com) Oh, it's not 100% guaranteed, of course, but what is? The main difference with "can't-lose blue chips", as far as I can see, is that there's no one to blame when that tanks (think General Motors in the 1970s). Yes, there have been some technical deadlocks, with the Blockstream-Bitcoin Unlimited feud still no closer to being resolved, and segwit being contested (but, with some justifications). Then again, there are few indications that Bitcoin's current scale limitations can't be solved. Lightning Network implementations (with some caveats, again) are inching towards being deployment-ready, while numerous other improvements - from privacy fixes to hardware scaling (hmm) - are constantly being proposed. This is all before considering the impact of any ETFs, of which there are at least two now in the works - the Winklevii's long-suffering COIN (now on BATS instead of Nasdaq), and a SolidX offering (XBTC on the NYSE, insured). This has attracted its usual share of detractors, with the ever-active Stolfi giving his accustomed pitch in response to SEC requests for comments - Ponzi, Madoff, "no real service". As before, while he should be appreciated for his sorta-reasoned opposition (and the very real danger of scams), it might be instructive to view this from another direction: what is the value of a commodity system that can be propagated near-instantaneously, and stored near-costlessly? And this is in a climate where, say, a service that allows distribution - not even storage for more than a day, mind - of duckface selfie videos is valued at... US$25 billion. Bitcoin's current market cap of US$16 billion sure seems ridiculous, placed in this light. But one supposes that it is not easy to change one's opinion (pretty common, granted), and some counter-arguments have been... strange. For example, "[some metals are reasonable investments] that are likely to retain most of their value, because their price is due to the high energy costs of producing them, and energy is not likely to become cheaper so soon" (now just wait a minute, Bitcoin mining, energy, hmm...). And, uh, it's bad because "it doesn't last forever" (defeating entropy is a pretty high bar, in my humble opinion...) That said, there is indeed no coming back from a Zhou Tong-ing Again, this is hardly to say that Bitcoin is a sure-win thing. It is, certainly, true that merchant and consumer adoption has been minute, and that existing fiat app wallets (e.g. Alipay, WeChat) do the job for these cases. It is, also, not impossible that a technologically superior cryptocommodity could usurp its place (but, aside from many types of improvements being directly absorbable, it can be argued that any such "hostile" takeover might reduce cryptos' long-term potential, because if it happened once, could it not happen again?) The bottom line remains, however, that as it stands, the upsides dominate the downsides - in other words, there are many more ways in which crypto/Bitcoin wins, than loses. Even assuming minimal additional uptake, one gathers that there are likely enough believers and users for it to plod through hard times (see: mid-2014 to end-2015), because, well, a mostly-anonymous way to hold and transfer value, outside the control (and grubby hands) of devaluation-happy authorities? Ha, like there can be any demand for such a thing (there is) No, the most credible threats to Bitcoin etc are political - and network blocks will probably only have partial success, it will take very heavy-handed enforcement to stem its spread. But, thing here is, unilateral country-specific bans, even in the major Bitcoin giants of China and the USA, are unlikely to kill the concept off; Bitcoin trade and its concomitant benefits will simply continue amongst those that are "in", leaving people from the "outs" watching on the sidelines. Further, one supposes a distinct lack of will in more-democratic states such as the latter, where there can be expected to be outspoken support for the right to privately truck in whatever values one so desires (see: Amos Yee). And indeed, GOD-EMPEROR TRUMP's circle is packed with blockchain tech enthusiasts, including, of course, Peter Thiel. In short: no, I don't see this particular genie getting back into the bottle. No one will drive us from the paradise which Satoshi created for us! The pertinent question then is, what is Bitcoin's future path, assuming this? It is true that governments would prefer control over their (and, in the case of economic superpowers, others') currencies. And here you have an upstart that offers borderless and possibly soon nigh-untraceable transactions that's relentlessly siphoning away state power over the perception of value, but which would be a huge headache to stamp out, if that's even possible. Eh, wait, the whole thing's currently worth a paltry ten-plus billion, i.e. 1% of the Iraq War, or a single not-particularly-large hedge fund? If one thinks of it this way, the time-tested path of least resistance presents itself: as the Romans bought off the barbarians, just buy into Bitcoin! It's not hard to imagine this proposition going through the heads of Wall Street rainmakers, if I know anything at all about finance: we've a bunch of dry powder sitting around unused, and dwindling opportunities in a market that's looking kinda overvalued. Then there's this new digital cryptocommodity thing, that there will only ever be 21 million units of, the quants downstairs looked it over and swear it looks legit. Heck, why not throw a few bucks their way? Note that if this is what is actually happening, one would expect there to be zero official declaration from the big boys - if they are indeed accumulating, one would expect it to be done gradually and silently, as not to drive the price up; of course, it may also be that they are really not interested. This is just a reminder that official stances, like New Year messages, actually convey next to no useful information. And, it's not like opinion on Mankind prospers under the GOD-EMPEROR, praise be upon him! [N.B. Our incumbents may be getting into the mood too, finally] *Mr. Ham's snores fill the room* Me: Wake up, you fat little hamster! Grr, I wonder sometimes, why do I even bother explaining things to you. Mr. Ham: *rubs bleary eyes* Eh, thanks? You could have just started with the year-on price predictions, and saved time. Our buddy Lingham says US$3000 by the end of 2017, by the way. Me: Well, Mr. Robo's refined models suggest a more conservative US$900-1800, though we're honestly less certain about it than previous years - it's uncharted territory coming up, with the past week or so all within the top twenty days for Bitcoin prices, all-time. Perhaps we'll be proven inaccurate for once, but that's what we've come up with. We'll see. Mk Hit A Scorpion We don't post footy much nowadays, but when we do, rest assured it's worth it. One needs the right platform to showcase one's talents... [mixtape.moe copy] Next: Who Could Have Guessed?

|

|||||||

Copyright © 2006-2025 GLYS. All Rights Reserved. |

|||||||