|

| |

|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ entry views: 223 today's page views: 33 (4 mobile) all-time page views: 3081074 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1183 page created Fri Apr 19, 2024 01:25:38 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

Me: It's slightly delayed, but finally, the fifth annual general meeting of the firm of H.L. Ham... hey, what's on the wall here? Mr. Ham: *entering with coffee in paw* Ah, human, I see you've just discovered our updated organizational chart; pretty damned fine year for the firm, you got to admit; revenue up, profits up, headcount up... come, come, we'll start with the presentation of the Employee of the Year award. Me: The voting's done, I expect. *shaking ballot box* And why am I disenfranchised, may I ask? Mr. Ham: You're not a full-time member, and more importantly, I had the feeling you might be biased against me. Me: Well, you're probably right on that. So, going over the rules again, one ham one vote, one duck one vote, no-one can vote for himself. That was quick. And the first vote, by Mr. Ham, goes to... *opening envelope* Mister Ducky! Mr. Ham: Well, communication has really improved since he got hired. In the past, whenever I set a direction for the company, Mr. Robo would talk about things like "not practical" or "unrealistic" or "impossible by the basic laws of physics". What poppycock! I can't fulfil my grand visions for the company, with such a negative attitude from my subordinates! Now, look at Mr. Ducky; he doesn't say no, he just looks me straight in the eye, with that ever-present confident smile of his. That's what I expect from a middle manager! Me: Point taken, I guess. And the next vote, from... *reads name on envelope* Mr. Robo, is for... Mr. Ducky too! Mr. Robo: Really, he's the best overseer I've ever had; unlike Mr. Ham, he won't peek over your shoulder and try to teach you how to program when he doesn't know nuts about it himself, or ring you up at two in the morning and insist you come back to the office to balance the books, because he forgot the inspection date. No, Mr. Ducky just sits there with that kind, supportive expression on his face, and lets me get on with my job! Er, no offense intended, Mr. Ham. Me: *turning ballot box over* And it seems that Mr. Ducky has abstained, not that it matters. Mr. Robo: How diplomatic! I always knew he was considerate and mindful of others' feelings! Mr. Ham: What self-effacing dedication! The quiet and unshakable sort! Top leadership material! Me: So it's settled, the rubber duck is H.L. Ham's employee of 2017. That went better than I feared. Mr. Ham: On to the review of the past year. *flicks projector on*  (Source: coindesk.com) We were off by an order of magnitude from our US$1800 projection, but in our defence, we did state that it was less set in stone than our previous spot-on calls; a big pop was almost inevitable from our models, the big question was when, and we were holding out for closer to 2020. On the bright side, we simply hedl our reserves due to that, even as other gurus cashed out for understandable if probably misguided reasons. Recall the big events of the year - the Winklevii's ETF was rejected in March, tanking the price temporarily, before segwit was finally forced through by threat of UASF in the middle of the year. This brought about the BCash and other Bitforks, and of course, the price just kept steadily steaming along in the middle of all that, with regular pullbacks. Before that, a recap on our previous AGMs:

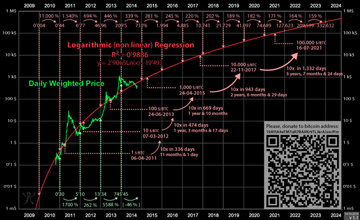

Me: Sometimes I think, we should have charged a lot for our newsletters, you know. Publish our research for free on a blog, and next to nobody takes an interest, even if they would have been looking at 100x returns in less than three years had they followed it; maybe people will value it more, if we typeset it nicely and print it on high-grade glossy paper, and stick a, I don't know, US$10000 tag on it or something. Mr. Ham: I'll get Mr. Ducky onto that. So, our research assistant assistant, what's the outlook? Mr. Robo: Erm, it's a bit long, so I've broken it into bite-sized sections. We'll also reveal our price targets at the midway point before the luncheon, as Mr. Ham requested. *shuffles notes* We'll start with the tech, then, before the econs and finance part after the break. It's not news that there has been much acrimony over the direction of Bitcoin, although that has been solidly settled in the Bitcoin Core dev team's favour, despite rogue miners and Bitcoin Judas trying to wrest control. It is perhaps testament to the Bitcoin brand's strength, that BCash somehow remains the coin with the fourth-highest market cap, a cool US$50 billion, despite being a complete rip-off that left out the latest Core improvements, because their dev team couldn't figure out how to integrate it. Inside Attacks - Bitforks  The Pirate Bay knows what's up (Source: r/bitcoin) [N.B. And oh yes, it is BCash, whatever they try to say] While Bitcoin's cryptographic security has thus far been bulletproof, there looms an ever-present threat to its integrity: internal splits. One of the worst-case scenarios would be roughly evenly-matched hostile fork camps, that further actively perform double-spending attacks on enemy Bitcoin fork chains. Thankfully, despite the BCash faction's grandstanding and shilling, the BCash chain has settled into a clearly-subsidiary and generally-declining position, leaving no doubt as to what chain the venerable Bitcoin name refers to. Though the Segwit drama and power struggle had us concerned for a bit, all's well that ends well, and its conclusion supports one welcome realisation: miners are not in practice as influential as we feared. Indeed, despite the vast majority of hashpower supposedly signing onto the ultimately-misconceived New York Segwit2X agreement, the devs called their bluff by doing almost nothing, and miners and other signatories ended up gradually dropping out, despite their cheap signalling beforehand, likely encouraged by Bitmain's near-monopoly on ASIC supply. Fortunately, that last may be coming to an end with GMO and others entering the manufacturing business, and the failure of B2X - which to be honest, could have been an agreeable compromise had the Core devs acquiesced - should give added confidence that future attempts to hijack Bitcoin are probably not going to succeed. Interestingly, many BCash supporters appear against Segwit (and thus, S2X) in any case, for what I personally think are short-sighted reasons, as so often explained since 2014. Moreover, the proliferation of random Bitforks should also help to subtly inform the public, that not all that has "Bitcoin" in its name (unlike BCash) is, well, Bitcoin. Back to the miners, all evidence over the past year has been that they are ultimately self-interested, as assumed by Bitcoin's design. Once price signals confirmed, upon BCash's release, that users preferred the original Bitcoin by far, miners flocked to it (and Segwit), pledges be damned. Resistance was limited to mostly snide mempool spamming, with next to no actual attacks, even on the much-weaker BCash chain. Then again, this makes complete sense - miners are in it for the long haul, after all, and have plenty of fixed equipment and location costs. From Bitmain's perspective, yes, they may prefer BCash since it retains their proprietary ASICBOOST advantage, but is that worth risking it all going up in flames, especially with Bitcoin exploding in value over the past year?  Hey, it's a *healthy* bait-and-switch! (Source: steemit.com) Me: Disclosure here: H.L. Ham has swopped the bulk of its BCash for Bitcoin on ViaBTC and later Bitfinex, whom we have to commend for their sensible reading of the situation. We foresee no reason to doubt our decision. Altcoins, Scaling & Security Just to make it clear, H.L. Ham remains fully behind Bitcoin Core's scaling roadmap, which remains on track with Segwit leading into Lightning Network, and on-chain scaling also in the picture - but only once Segwit etc have been properly evaluated, as it should well be. And then, there's Mimblewimble and other proposals, that are certainly more sustainable than simply raising the block size limit every time they become full... A mention of altcoins here cannot be avoided, given how some of them have achieved on-paper gains that dwarf even Bitcoin; while we're at this, it may be timely to address the "cashing out" issue, which not a few of my acquaintances seem to doubt can be done. Although there have been scattered account closures, converting Bitcoin into the fiat of your choice hasn't been a problem - Coinbase, for all their other faults, would probably do for smaller amounts, and even if you're talking low millions, breaking it up into several orders should do the trick on most major exchanges. Anything more than that, and there will be over-the-counter trade specialists from those exchanges eager to assist, for a small commission. The other interpretation of not being able to cash out, is not being able to cash out at a fixed price. Personally, this assertion appears very strange, since traders of other commodities such as oil, soy beans, etc are definitely not guaranteed a certain price, especially for large lots, either. If the point to be made is that crypto is volatile, then certainly that is true, in which case the statement could stand to be more precise. With the understanding that H.L. Ham's view may be biased in light of our major holdings being in BTC and ETH, we find it difficult to recommend longer-term investments in alts in general. It is true that an altcoin can more plausibly increase in price by say, five-fold in 2018 (with associated GPU mining craze), while we think it unlikely for Bitcoin. However, in the same vein, we think it unlikely that Bitcoin's price will fall to one-fifth its current value, which is harder to vouch for for most alts. In a sector that is already high-risk, high-return, we deem the current altcoin mania too much of a pure gamble.  New innovation: Proof Of Marketing [Winning quote: Bitcoin was developed as a decentralized digital currency, meaning that, until now it has had no single administrator. Kitcoin overcomes this deficiency by establishing an administrator.] (Source: r/bitcoin) Going back to the cashing-out issue, it should be noted that this is exacerbated with altcoins, especially those not in the current Top 50 and therefore having a cap of less than a billion bucks. Of course, if you're punting a few hundred dollars about and it grows to tens of thousands, good on ya; trouble is, when you start talking about hundreds of thousands or millions, the slippage when trying to get out would be enormous; in these cases, there really aren't that many reasonable options in crypto to place the capital. The take-home point being, one seriously needs to know what to expect with one's investment decisions. Our other main knock on many alts, is that their value proposition is extremely unclear. Some, like Ripple and various Ethereum-based ICOs, hawk institutional support, which while better than nothing, should be carefully analysed on a case-by-case basis - it is not unlikely that they fail the basic sniff test: given the setup, would a simple database server do as well? And then we enter oBikeCoin and DentaCoin territory, and we've got to say, well... Mr. Ham: Hey, don't knock my SPANK hoard! Me: *ignoring Mr. Ham* To summarize, while many altcoins tout superiority in some way over Bitcoin and competitors, there are really very few free lunches in crypto; yes, maybe you can demo thousands of transactions per second with low fees (quite common, frankly), but does it really hold up under serious attack? An admirable attitude that the Core devs hold, I feel, is that of no second chances. If they open the door to premature node centralisation by raising the block size too much, there's no way back. If they introduce a zero-day vulnerability by rushing Segwit or Schnorr or whatever, ditto. I'd say they understand well what they've been entrusted with, and aren't about to risk it for temporary - and probably non-critical - competitiveness. Mr. Ham: I'm hungry. Me: Gah, fine, on to the price projection.  (Source: r/bitcoin, also enlarged at bitcointalk.org) A New Valuation Era Mr. Ham: What's this? A chart for ants? Me: You can just click to the bigger version. The important thing is that we have moved away from our previous models from 2014-2017, which emphasized micro effects on Bitcoin's price... which, from how it missed last year, was getting outdated. It's no secret, I believe, that H.L. Ham peruses external data in our own research - not all of which makes any sense, obviously. As such, when we come across a model that closely approximates what we had in mind, it is only proper to acknowledge the idea. Here, we see US$100k reached sometime in 2021, which we feel reasonable if maybe slightly optimistic - but hardly unrealistic, given that it's just a five-fold increase on what has already been reached, over three years. A more conservative outlook would be US$40k stable - coincidentally the Winklevii's small bull outlook, and Novogratz's end-2018 call - before the next halving, and then stable six figures around the halving after that, or closer to 2024. Given this, a annual projection is not really relevant for the firm's purposes given our long-term horizon, somewhere between say US$12k-30k would be very comfortable, for the coming year. And we note that this should mitigate energy concerns somewhat, since this implies that mining energy demand should not increase overmuch from today, broadly assuming that it remains in proportion to profits. [To be continued...] Next: A Game Of Cryptos

|

|||||||

Copyright © 2006-2024 GLYS. All Rights Reserved. |

|||||||