|

[ October 2008 ] | |

|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ today's page views: 1039 (47 mobile) all-time page views: 3739308 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1256 page created Sun Mar 8, 2026 14:12:12 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

- LSM1301 lecturer on deuterostomes "NUS Fights Climate Change" - banner at entrance of Arts Canteen, next to LT9 "Buy Tiger Tooth Necklaces" - temporary stall outside LT9, next to Arts Canteen Yum yum. It turns out that a person is quite often not wholly correct in his assertions, unless of course (s)he is a politician, in which case (s)he is always right and the response is to deny everything and sling mud at opponents. Or (some) teachers, in which case (s)he was only testing if you're alert (however I can sympathize with the [sometimes undeserved] lack of respect [some] teachers get). Or... Okay, let's move on. Puzzlecrack 2008 Team FourOKOJ/C.fckbsds solved all four daily puzzles in this year's edition of Puzzlecrack, sadly not fast enough to claim any prizes. But hey, it's for the challenge! Keeping on theme, I can't count the number of times we went down the wrong track here, although that's only to be expected. Did most of the stuff for Monday, helped a bit on Tuesday (thanks to some nice tools), next to nothing on Wednesday (major credit: twm) and finally solved Thursday by myself (this is not saying much, since the winning team for Thursday settled it in seven minutes - it may be a good one to try if you're new though). As team member C.Wenhoo said, "breadthwise search power increases exponentially with number of team members", so I guess we could be in with a shout with more (i) organization and (ii) participation. I'll see what I can do about a one-input decrypt-many-ways script one of these days. Puzzlecrack worryingly resembled my HYP, which is my major concern after this semester's mid-term exam results were probably the best of all my semesters so far (again, that's not saying much - the marks from CS4213 reinforcing the impression that one can score well without actually knowing much in detail). Actually, research is probably worse, since for Puzzlecrack you know that there surely exists a solution, since somebody (sadistic) set the problem up. And this brings us to... Grad School Sought the opinion of my main mentor-professor, but didn't get any earth-shattering insights that could tip my decision firmly one way or the other. There seems to be a consensus that it would only be surely worth it to forsake NUS for a top-10+ ranked CS department in the USA, though, with the distinction in quality of education blurring between 10+ and 20+, with NUS probably a better choice once we hit the low twenties and thirties (which seems reasonable considering stuff like the Engineering & IT rankings from THES [criticism], since direct comparism between grad schools internationally appear hard to find).

Actually, I'm teetering towards NUS (as I don't see myself as a professor-type, for now anyway). With each application to a USA grad school costing upwards of a hundred bucks, just shooting them off sounds rather unattractive... so, spend the cash, or eat the words? More on Minibonds Last month, I expressed the opinion that the general public/stakeholders should not be made to indirectly subsidize (i.e. pay) for the mistakes made by particular individuals who went in search of higher returns (but got unlucky). Well, it turns out that some who got caught up in Lehman-linked investments were old uncles and aunties, who with all due respect aren't the sort whom would be comfortable calculating portfolio risk variances. Quite a few of them were going for the tried-and-tested zero-risk (well, if the bank doesn't collapse) fixed deposits, but were persuaded into "very safe" structured investments instead. It turns out that some of them may have been badly advised by their relationship manager, and thus probably should get something back (though the worst-case scenario remains to get nothing). Taking DBS as an example, as they expect to pay out $70-80 million in compensation to investors who put in about $360 million, it seems safe to say that for each fully-compensated person, four will go empty-handed. Quite clearly these likely younger/better-educated persons aren't too happy at losing out to the "vulnerable" group, with some among them claiming to be quite as "ignorant" too. Now, such investments are inherently risky to an extent - the fact that it offers a higher interest rate illustrates that by the universal No Free Lunch rule, and really, investors should be expected to know that at the very least. Of course, if a relationship manager explicitly told an 80 year-old granny that there was "absolutely no chance" of default, then it's the bank's fault. Continuing on to investors who recognized the existence of risk - did they bother to ask about the worst-case scenario, and did the relationship manager volunteer this information (probably not)? Opinions can differ on this, but really I feel that anybody who is going to entrust a substantial portion of his wealth to a financial institution should at least have taken the responsibility to ask that one question (and also weighed the chance of the institution failing). The alternative is of course to quietly collect the higher returns (as doubtless some structured products have managed to give) if things go well, and make a lot of noise and demand one's money back when things go wrong. Obviously if authorities cave in each time this happens, there would be no downside at all to buying risky investments - heads I win, tails I can't lose. Therefore, in principle and in general, such bailouts should not be (and in reality usually are not) done. The solution, as often happens, is knowledge. As I have suggested, the worst-case scenario for any financial product could be printed prominently at the top of each contract or brochure (like those lung cancer pics on cigarette boxes). If mandated by the government to all banks, no bank would be worse off under this regulation. Yes, a bank might argue that hey, though the worst-case is to lose everything, we calculate that there's only a 0.1% chance of it happening, so making us reveal this makes us look unfairly bad. To this my answer is that if the risk is that low, why not have your quant wizards work their mathematical magic and whip up a product which guarantees a minimum of like 90% (backed by the bank) in the worst case, by reducing returns when good things happen? In effect, this shifts the work of portfolio balancing from clients to banks, eliminating doomsday outcomes, while leaving those who want to take their own risks in stocks or other derivatives (with or without private non-bank funds) with no excuses. One can argue that while this might reduce the choices of informed investors, these investors should be okay with going it themselves, instead of desiring the pseudo-assurance of having their funds administered by a big bank with all the connotations of trust and responsibility that brings. Allowing banks to double as investment agencies is problematic this way (but of course when the going is good, "free market" and "liberalization" are the iron-clad mantras). I would gather that most investors are risk-averse anyway, and would be happy with such an "innovation". Then again, there will always be the greedy breed who will be attracted solely to the highest returns with "reasonable-looking" risks, but then there are inveterate gamblers too, and neither have my sympathy. Misc. Cool Links Nothing particularly wrong with these - just had to post them before I forgot about them totally.

Nifty treemap by WinDirStat

Sure it's safe? Rooney, Rooney Quite contrary - I bashed him for underperformance last month too, and am now happily munching on my comments after his resurgence. Not that Tevez deserved to be dropped, but Ferguson knows best. $537/$800 with United saving me from a wipeout last week - Yes, accuse me of bias, but Liverpool simply have ridiculous luck nowadays. And how did City contrive to go behind and then struggle to draw with Newcastle? Tottenham losing is about the only thing one can count on these days, and their plight has gone beyond funny by now. If they don't get anything (or even a point) from Bolton on Sunday, they face Arsenal (which will really hurt for Spurs fans), Liverpool and Man City next, and I seriously don't see them netting anything from these fixtures. This would leave them with 2 or 3 points from 12 games, which is nearly a third of the season, and probably worse than even Derby last season. $50 on Man Utd (-1.5) vs Everton (at 2.35) - over evens sounds good $50 on Sunderland to beat Newcastle (2.15) - looks worth a try

- from EC3312 Tutorial 7 Q2(b). Incredible threats sound so much better than non-credible ones, don't they? Hey, I suppose I'm entitled to a one-liner (or few-liner) every now and then... (Rest of this week's virtual punting) $50 on Man City to beat Newcastle (at 2.20)

Dark dark cannot see (photo credit: Law) Honestly I couldn't make out much of anything, but since Lawrence assured me that there's a bunny in there somewhere I'll take it in good faith. Today's Ph.D. decision research: Typed in "starting pay PhD singapore" into Google, and the fifth link returned was by a Ph.D. "senior" at NUS, now at Google (USA). Notable quotes: "I am disappointed at the job options of a PhD graduate in Singapore, and found them clearly lacking any attraction whatsoever. I find solace in achieving mastery of a subject matter after four years of research and study, but financially, it is a little disappointing." "In a related thread, what makes sense in Singapore? People management... Are you too smart for your own good?. Manoj Thulasidas. Today newspaper. Aug 25 2007." Whatever job I take, it probably shouldn't be related to soccer prediction; I would be on $478.25/$700. But hey, Arsenal dropping points to Sunderland was always welcome. I'll wait to stick something on Newcastle getting whacked by Manchester City on Monday, but for now: $25 on Liverpool to draw Wigan (at 4.35) - no Torres... $25 on Man Utd (-2.5) vs West Bromwich Albion (2.35) - big win due?

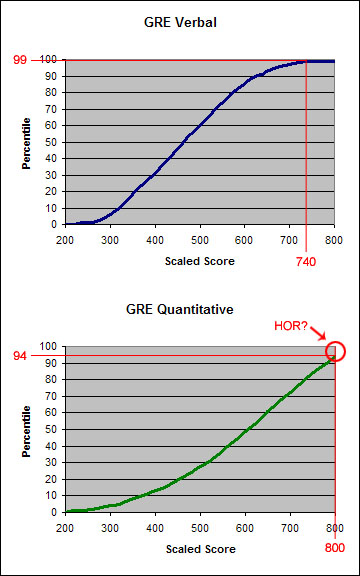

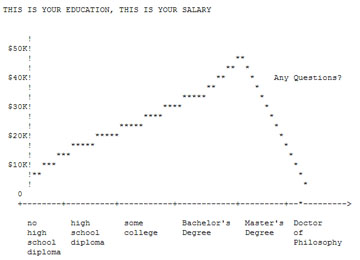

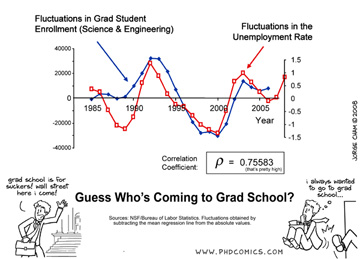

- academics - [DRAFT COPY DO NOT DISSEMINATE] by  Bert, Fake C.FC(K), B.SD fakebert@glys.com The Graduate Records Examination (GRE) is believed to be an important aspect in applications to graduate schools, especially nationally-ranked ones with extremely competitive intake cutoffs. The author investigates the preparation, undertaking and offers post-analysis of said examination, and concludes that while generic challenges were posed as usual, results of this approach were modestly promising and support further research into this career path. Categories and Subject Descriptors G.R.E.2.1. [Preparation - Resources], G.R.E.4.6. [Empirical Testing Methodologies], G.R.E.8 [Other Research] General Terms GRE, ETS, Human Experimentation Keywords gre strategic planning, examination techniques, computer adaptive testing, stress acclimatization, language mining. 1. INTRODUCTION The decision to enter graduate school is not an easy one. Complications are compounded when this decision is taken late in an undergraduate career, especially when research metrics are ordinary with little hope of sharp improvement, and is a common problem encountered in the field of doctorate engineering. We observe a representative specimen (REALBERT, thereafter occasionally known as RB) and by this means hope to gain an understanding of, and offer solutions to, this challenge. 2. MOTIVATION AND PREPARATION 2.1 Motivation Graduate school is popularly perceived as a safe haven from a hostile "real world" [1], where the relative freedom of undergraduate life from the General Laws of Financial Necessity and Social Responsibilities may be propagated indefinitely, or at least for four or more man-years; Admissions to reputable programs of the sort that parents would be eager to inform other relatives of, and that those relatives would be reasonably expected to be aware of, is however not trivial. Acceptance rates are commonly in the range of twenty to thirty per cent [2] [3], and usually require heavy research experience. While the weak form of this problem under optimal conditions (i.e. papers in international conferences, multiple IOC gold medals, glowing letters of recommendation, internships at multinational companies, GPA 4.0++, devoted community organizer) has been solved and proven to almost surely [4] be a win for the subject (for sufficiently large numbers of applications sent), the general formulation for normalised subjects does not yield to even intensive repeated metasearch methods, and is suspected to be intractable [5]. The dearth of progress in the theoretical arena has led to empirical analysis being the preferred avenue of mainstream researchers, and in this vein we study the progress of the publicly available standard dataset REALBERT. 2.2 Preparation REALBERT represents the profile of a typical long-shot candidate, with inferior depth of planning and unwarranted optimism parameters. In this analysis, REALBERT was subjected to a five-day preparatory phase after obtaining a GRE testdate through forced elimination of options. Scheduling conflicts furthermore squandered much of this allocation, leaving the actual discounted period of data transfer available to be approximately three hours. REALBERT however had the benefit of proven training sets [6], and its performance was likely to have been asymptotically boosted by iterative enumeration of filtered vocabulary. Gains were maximized before the letter D, after which faulty memory allocation (see MALLOC) necessitated adaptive reductions in the uptake density. Hardware overheating forced REALBERT to exit prematurely and enter sleep mode before completing the procedure. The confidence measures towards the GRE at this point was a poor 0.12-0.18 (at 95% significance level). In summary, the preparation of REALBERT was woefully truncated and sub-optimal, which added to the difficulty level of the subsequent operations. 3. EXECUTION 3.1 Compulsory Subroutines At the prearranged time, the modified REALBERT was transported via circuit Bus. 198 to the central processor, PROMETRICTESTCENTER [7]. Naïve campus search techniques nearly doomed REALBERT to the dead-on-arrival fatal error, but an elevator shortcut to the third level was thankfully found before the chronological limit was expended. 3.2 Register Assignations REALBERT encountered various minor inconveniences while being loaded on the main system, as a consequence of the busy scheduler. Photographic and graphological identifiers were verified as per standard procedure. System security was exemplary, with hemispheric reflectors mounted atop the examination sandbox to provide a complete view of the cubicle-compartmentalised architecture. 3.3 Limitations It was discovered that specifics on the content of the GRE may not be revealed, as insisted on the product agreement. Further discussion will therefore focus on aggregate observations and trends. 3.4 Analytical Writing REALBERT was called upon to produce a GP-type essay in 45 minutes, and a similar critique in 30 minutes for the first benchmark, after some preliminary I/O device centering. REALBERT stumbled slightly over the lack of a built-in spell checker, but thankfully was not overly disadvantaged. 3.5 Break REALBERT was granted a ten minute reprieve for memory defragmentation and liquid garbage disposal. 3.6 Quantitative Reasoning REALBERT next answered 28 mathematical puzzles in 45 minutes for the QUANT benchmark. Although no obvious errors were thrown, the inefficiency of the REALBERT arithmetic processing unit was glaring. REALBERT took nearly 40 minutes to complete the test run, in comparism to superior implementations like MEEPOKMAN [8] which boast worst-case timings of 15-20 minutes. Possible explanations were the overly paranoid linear redundancy checks of REALBERT, and the outdated skim-and-return paradigm more suited to the pen-and-paper era of computing. 3.7 Verbal Reasoning REALBERT had to confront 30 prolix catechizations of dubious practical utility; The analogies were turbid, the antonyms soporific, the sentence completions tendentious and the reading comprenhensions sibylline. REALBERT struggled puissantly for noesis of this recondite pedantic material, but truckled to maladriot and lachrymose nonfulfilment. A few logic circuits blew out as REALBERT realised that the input data was not in fact an ingenious cryptogram, but a butchering of the English language. 3.8 Quantitative Reasoning II At this point REALBERT signalled to take a leak again, but was informed that only one break was allowed. With no recourse, another set of 28 maths questions was rushed through with legs crossed. 4. RESULTS One advantage of Computer Adaptive Testing (CAT) [9] is that the results are determined near instantaneously through parallel computation threads (in contrast to HAMSTER, which however has more forgiving operational requirements and is cuter). REALBERT achieved the humdrum scores of: Verbal: 740/800 Quantitative: 800/800  (Source: GRE Guide to the Use of Scores 2007-08 pp. 13) An interesting diggression would be on the claim of racial bias on the GRE [11]; Question: If people of different races receive significantly different average scores on any given test, is that test necessarily flawed? 5. CONCLUSIONS Preliminary results (presented above) thus far indicate some faint promise in the REALBERT dataset. However it must be remembered that the methodology taken is still very much in development, with some studies claiming near-zero predictive success of the GRE [12], with others funded by the GRE (predictably?) arguing in the other direction [13]. It must also be remembered that graduate school is in all probability a long and hard road [14] [15], with decent but not especially impressive remuneration. Still, it is not without its attractions, having lured a combined cohort of hundreds of thousands each year in the United States alone [16]. 6. FUTURE WORK Conditional on available application funding and the self-discipline of REALBERT's professors to refrain from rolling on the floor laughing, experimental feelers will be impudently extended to several good graduate schools in the final stages of hypothesis testing. We continue with the obligatory inspirational quote: - Benjamin Franklin This paper was made possible with inadvertent funding to the tune of US$170 (for the GRE examination fees) from Dad Corporation, and a grant for continuing research on the FMS (Father-Mother Scholarship). REFERENCES

- changelog - cute stuff - changelog v1.09 --------------- * Generalized image backup solution applied for globetrackr (see changelog v1.08g). Now most entry-specific images will still be pulled from ImageShack whenever possible, but a Javascript function will detect if an image link is broken, then only in that case use local bandwidth instead of leeching. NO MOAR BROKEN IMAGEZ!!111 * URL encoding for special characters (especially Chinese) fixed, so comments and direct links etc now work for entries with these characters in their title. * Individual entries (from direct link) now display a link to the next chronological entry at the foot of the entry (Cumulation skin only) * Month displayed in monthly views (Cumulation skin fix) Answer One Two Three

I shift teeny symbols around! General Biology has been lively recently - stuffed colugo and flying lizard specimens made an appearance, with useful mnemonics thrown in; Delightfully kind professors cannot often fail good students maybe, but the lecturer was kind enough to hint that there existed more risqué (and thus likely more effective) ones. Oh, the midterm scores (30% of total) for Health Economics were also revealed, with a sadly severe curve:

Damn scary There's got to be something to be said for not revealing the exact scores (and also not returning the scripts), though - saves bickering over individual marks from the point of view of the professor. While I'm on this track (and in reference to last month's blog post), yesterday's New Paper came out with another reader's letter concurring with a chap who was rejected four times by NUS, but ended up with a Masters from Oxford and who is now a Ph.D. student at Princeton. They have a legitimate case, but identifying ability is one of the toughest (if best) skills to acquire - even a genius on the level of Zhuge Liang fell flat on his face at times (see the case of Ma Su). For a fixed amount of places, guess what's going to be the next wave of letters to the editor if interviews/other considerations are given higher weightage over standardized examination scores? "Parents urge transparency, objectivity over admissions process", I wager (this seems to come up every now and then for medicine and law already).

The problems of one little bun don't amount to a hill of beans in this crazy world Lastly, I feel my luck changing after coming across this tiny (abundoned?) bunny downstairs on Bunday, though I didn't take adbuntage of this bunderful opportunity to stuff it into my bag. Was hoping against hope that it would begin to follow me so I would have an excuse to head home with it, but no deal. It was gone when I got home from school :(

- academics - One of life's turning points approaches. Barring any major mishaps, I'll be graduating with my degrees come next May. The question is - where I will be at this time next year?

Option one looks even less attractive now than before. Option two was what I had in mind - invest another four years or so for another piece of paper (N.B. the stipend here has even been raised to S$2800 a month after passing the quals). Supposedly a good second uppers (which is more or less in hand) would be sufficient. Then there's the overseas option. Frankly, while NUS is decent, it probably isn't the apex yet, at least in terms of global recognition (the relatively short time needed to get a doctorate as compared to the US standard [3.5 to 4, vs 5 years] may be a contributing factor). Actually, I kind of regretted never actually sending out applications to the top US colleges after NS, so I could at least know what I could have gotten into; Not that I would have gone even if I had the money, since the slight difference in quality would be swamped by a huge difference in payable fees. It just wasn't worth it at the undergraduate level. Now with most graduate students getting free tuition and receiving stipends on top of that, however, the question arises again. Of course, I can just take the easy way out again, but then I would never know what could have been. Or I could plonk a couple of hundred down on a GRE, pester three professors for referral letters, and mail out applications to some of the best CS departments around. Then if I don't get accepted, I can at least accept the fact with good grace. Yes, I think that's what I'll do. GRE booked for Friday. It's not all roses, obviously:  Take with pinch of salt (Source: Career Guide for Engineers and Computer Scientists) But at least it's a good place to be in a recession...  Seems legit (Source: PhD comics) Time to read some walkthroughs...

- art -

Well, here I am, sitting at my desk after a half-hearted half-hour going through my EC3312 Game Theory notes, in readiness for the mid-term examination tomorrow morning. It's not like I haven't put in the effort, though - as with each other economics tutorial this semester, I had attended and taken notes at every lecture (well, except the one EC3353 7 p.m. makeup), and dutifully typed out the solutions to every tutorial given out so far. A decent position to be in, perhaps, if a teeny voice at the back of my head hadn't whispered, "What the bleep are you doing with your life?" A fair question to be sure. Oh, studying is okay, but at the end what do I get from it? A living maybe, but I am sadly not among those blessed souls who sincerely want for nothing, nor those only slightly less blessed ones who want for nothing in particular, or who want but without much strength of desire and thus suffer little in their deprivation. To add to this curse, what I want should not be attained with worldly riches (alas, otherwise matters would be rather more straightforward if by no means simple) or by donning a mask, and indeed I would be sorely disappointed if obtained through such means. So now, it is the little matter of living and working for the foreseeable future, without a clear or even comprehensible path towards my actual goal. But so has it been for the best part of a decade, and one gets used to, or more aptly comes to a temporary grudging accommodation with, this state of being. It is said that there is a way out of every problem, and in a matter of want there is always the path of renunciation; Alas, it is not one which I can devote myself to yet. My heart is still supposed to be too young, my role as a fool is not done. I may know that in my waning years I will with all probability look back and laugh, but that knowledge does not change the fact of the present, my own Kobayashi Maru. What has it been, seven years? What is seven more? By day I let it consume me, by night I let it haunt me. When it consumes me I cannot happily wake, and when it haunts me I cannot peacefully sleep. Yet, one way or another, I will have my satisfaction in this life, with no need for a next. But for now, as always, I wait...

- changelog - changelog v1.08g --------------- * globetrackr image backed up each day, to be used if globetrackr server down (general JavaScript solution for broken images). * "page created" timestamp added under Site Statistics section. - Overheard after a certain midterm while the prof was collecting the papers, and probably within earshot. That's honesty for you More Economics Well, it was coming. Friday's Straits Times front page headline was "Marketing of risky (structured) products under review - MAS wants complex investments explained more clearly to public". Personally, I think one thing should be mandated to be in big bold letters right at the top of any factsheet or brochure for such products - the minimum guaranteed return (if any). Stating the distribution of risk (e.g. 50% chance of a 10% or better return, 80% chance to at least break even etc) with regards to the future is probably out of the question, unfortunately, unless the banks all submit to an external neutral agency for such evaluations - the accuracy of probabilities usually cannot be debated on hindsight, as the following joke (appropriately referencing the skyrocketing of petrol prices these days) illustrates: Unhappy at the recent hikes in petrol prices, a man was nevertheless delighted to discover a petrol station that advertised free sex with each fill-up. Every morning, he would make it a point to visit the station on the way to work, with a carpooling colleague in tow. Each day, after the man paid for his petrol, the station owner would ask him to guess a number between one and ten to win free sex, and each day the man tried but failed: "Hmm... I'll try 8 today." the man said. "Sorry, but the number I was thinking of was 7. Better luck next time." the owner replied. As they drove off for the umpteenth time, the colleague turned to the man and said, "We've been trying almost every day for months, and you haven't won even once. I think the owner's cheating." The man replied, "Nah, can't be. My wife won twice just last week." It might be interesting to evaluate the financial intelligence of the average consumer - quick, if one puts $100000 in a three-month fixed deposit that pays 0.4%, what's the interest obtained? $100, though some may answer $400 (and not wholly without reason). By the way, the standard local fixed deposit interest rate seems to be hovering around 1% these days, while inflation exceeds 6% - making the half-life of money about 13-odd years. The universal tax strikes again. It seems a good idea to duck out the impending recession as an academic for a few more years, tooling about with theoretical models. Not that the university is distinctly non-commercial either, judging from the stalls that spring up at the Central Forum every so often. I was handed an ad for Tatarah.com.sg a few days ago, which re-alerted me to their special bidding model that made some waves when they first appeared. (I also committed another error when I bought a can of Milo not noticing that the Milo truck was parked some twenty metres away, but that's another story) Essentially, their highest unique bid auction model sets a maximum price for an item, then allows participants to bid any amount equal to or lower than that. The highest bid that is bid by a single person wins. However, since the maximum price is set to a small fraction of the actual value of the item, the eventual winner effectively gets a whopping discount. How then does the seller/auctioneer profit? The catch (there's always one!) is that putting in a bid also costs money. Take for example a Sony Playstation 3 with a retail price of $599, and a maximum bidding price of $99 (actual example from the website). The "processing fee" for each bid was set at $3. Thus, to a participant, putting in a bid essentially involves paying $3 for a chance to get something worth $599 for at most $99. Note that the processing fee imposes an upper limit on the number of bids a rational participant can make - in the above example, there is no point in putting 200 or more bids, since that would already cost $600 and the participant could just directly buy the Playstation instead. The exact number of bids that a rational participant should put is probably somewhat smaller, and depends on his belief of his chances of winning. For instance, if he thinks that putting 10 bids would give him a 30% chance of winning, he would go for it - the expected cost is a maximum of $30 + $99 = $129, while the expected return is $599 * 0.3 = $179.70. However, while it is true that putting in more bids strictly raises one's chances of winning, by exactly how much is mostly unknowable, especially since the total number of bids is not shown. For the seller/auctioneer, he doesn't really care how participants bid - his foremost concern would then be the quantity of bids. In the above example, once he gets 200 bids of any kind, he has already recouped the loss from flogging off the Playstation at a huge discount, from the processing fees alone (in reality the number of bids required would probably be slightly less than 200, as the winning bid will likely still be at the high end of the price range). Note that this is directly counter to the interests of participants, who would desire fewer total bids so they have a higher chance of actually winning! The next question is, is there a strategy for bidding? Let us first assume that the total number of bids is fixed and known, and each participant is allowed a single bid. Then in the (unrealistic) case where one is the only allowed bidder, the optimal bid is a single cent, which would definitely win anyway. Extending to two, both participants should bid the maximum allowed price ASAP (since in the event of a tie, the earliest bidder wins). This assumes of course that the processing fee (P) and maximum price (M) are relatively low enough compared to the actual value (V) of the item, more specifically V > 2P + M, which should be true. (N.B. Why not both try their luck at a single cent instead of the maximum allowed bid? For much the same reason as the Prisoner's Dilemma) Things start to get messy with three participants. Now, fastest finger first is no longer a given, since if all three would bid the maximum allowed, any one of them would do better by bailing out to a lower bid. There is technically at least one (asymmetrical) pure strategy Nash equilibrium (i.e. none of the participants can improve their position by changing bids) when two of the participants put in the maximum bid and the last one puts in a bid a single cent less, but this does not say anything about who the winning third participant should be. To demonstrate a mixed strategy solution (which is guaranteed to exist under certain conditions), let us allow each of the three participants (P1, P2 and P3) only three distinct strategies - S1 (bid $98.98), S2 (bid $98.99) and S3 (bid $99.00), and to simplify the math further assume that the participants consider the cost of the three strategies to be the same (hey, what's two cents?). The processing fee is a sunk cost and likewise ignored. Normalize the payout of getting the Playstation to a value of 1, and assume that participants have an equal chance of being the first to bid. Then the outcome for participant 1 for each strategy is as follows:

A mixed strategy here is some (c1,c2,c3), where cn is the probability of playing strategy Sn (and thus c1+c2+c3 = 1). A mixed strategy Nash equilibrium would then be some (c1*,c2*,c3*) which, if chosen by two of the participants, cannot be defeated in general by some other mixed strategy by the third and last participant. A counterexample: Consider the mixed strategy (0,0,1), i.e. the pure strategy S3 (bid $99.00). Can this be a Nash equilibrium? The answer is no, because consider if the third participant switches to (0,1,0) - then his expected return rises from a mere one-third to the maximum possible of one. There are many ways of arriving at a mixed-strategy NE, but for this example I resorted to brute force computation and arrived at (0.25, 0.25, 0.50) or thereabouts. Intuitively, this should be about right since playing S1 or S2 gives 2 chances (out of 9) to win outright from the above tables, while S3 gives 4 chances. Then, if each participant is restricted to a single bid and the number of participants is known, an optimal mixed strategy can be determined by an extension of this idea. Unfortunately, this analysis is probably not very useful/applicable to actual Tatarah auctions (and others of the ilk) for several reasons:

There is a way to reconcile the conflict between auctioneer and participants, though. Instead of a closing time for the auction, which has the risk of not collecting sufficient bids (and thus processing fees) for the auctioneer, the auctioneer can declare a required number of total bids to close the auction instead. For the above Playstation example, it could perhaps be 250 bids - this would guarantee the auctioneer $750 in processing fees, which would cover the retail cost of the Playstation and more. Participants would benefit by knowing the probabilities involved (though they would no longer be able to get lucky by joining an auction with very few participants. It must be said that this is unlikely to happen often, since the auctioneer would go bust). Refunds for the processing fee, if participants get tired of slow-moving auctions, would probably have to be implemented, but at least in this case participants no longer have an incentive not to publicize the auction. But doesn't this look like a... lottery? Well, it depends - according to the United Kingdom's Gambling Commission, unique bid auctions aren't lotteries if they "exercise skill or judgement" (like darts in the UK), and "...Examples of factors that may enable operators of reverse auctions to ensure they are compliant include time limits for the submission of bids, the provision of information to participants about previous winning bids (for similar items) and updates on the status of their current bid(s). Operating reverse auctions of this type may make it possible for participants to apply a strategy to their bidding (demonstrating a requirement for a level of skill or application of knowledge)." Shouldn't be a problem. So, if laws are interpreted the same way in Singapore, this may be an opportunity for enterprising fellows to set up an effectively zero-risk (pseudo-gambling?) operation. Is there a market for this? Likely yes, looking at the popularity of 4D and related games. Is it moral? Well, as moral as gambling in general is - personally I suppose the "skill" involved is not much better than, say, allowing people to roll a ten-sided dice for one of their numbers in 4D - though it must be said that coin tosses can be controlled to an astounding degree with enough practice. A last caveat with these kinds of auctions is that it is certainly technically possible for the auctioneers to have a proxy insert a winning bid, with knowledge of the bids placed. Cries out for oversight, doesn't it? Hammie Warz Mr. Ham and Mr. Fish have resumed hostilities recently. The battle to be the dominant fuzzball appears to be a monthly occurrence. There have been suspicions that this is due to Mr. Ham attempting to innocently mount Mr. Fish when the mood takes him, but this has been vigorously denied by both hamsters. Strangely, despite Mr. Fish probably being the better fighter when they get sorta serious (after protracted staring contests, Mr. Ham is always the one to run, squeaking away), Mr. Ham has a rather aggressive greeting ritual in peacetime - springing at Mr. Fish and licking the forehead, then optionally other body parts. Either case, Mr. Ham always gets United Nations support by acting as the victim, so all's right in their little world.

Left: Is the one on top the blanket, or is the one at the bottom the mattress? Right: I demand U.N. protection!!! Word While going through the site links, I discovered that not all that many 4O-related blogs are still up - what a pity. Just for fun, I ran those that were into Wordle, "...a toy for generating 'word clouds' from text that you provide... giv(ing) greater prominence to words that appear more frequently in the source text".

I would have given out an AAAAA to the first one to correctly identify all seven blogs from their word clouds, but then realised it wasn't that hard actually. Footie You just can't make stuff like this up. I thought I had seen it all when Samuel Eto'o considered a move from Barcelona to a Uzbekistani club, Kuruvchi (sorry, can't get Borat's Kazakh National Anthem out of my head). Then, a linesman awarded a "ghost goal" (video) for Reading despite the ball being nowhere near the line. Then, news came out that Nigerian businessmen were out to buy Newcastle United. Of course, Newcastle (together with Spurs) were already providing all-around comic relief this season (bolstered by new Newcastle manager Joe Kinnear peppering his first interview with a few dozen choice expletives), but Nigerian businessmen! I think I've gotten enough emails from them to be justified in guessing at the form of their offer:

I'll just stick to pretending to punt, thanks ($478.25/$600 now): $50 on Arsenal (-1.5) vs. Sunderland (at 2.15) Oh, and if ever I have to pretend to drink, I'll take Carlton Draught (N.B. its set to O Fortuna).

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Copyright © 2006-2026 GLYS. All Rights Reserved. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||