|

| |

|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ entry views: 1096 today's page views: 1238 (28 mobile) all-time page views: 3733282 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1256 page created Fri Mar 6, 2026 19:30:01 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

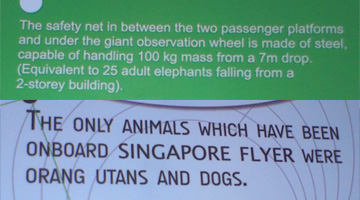

It has been a fairly busy week, kicked off by a family outing to the Singapore Flyer (first visit, minded the heights less than expected, appreciated the interactive displays triggered by QR code-like icons) and the billion-dollar Gardens By The Bay (Cloud Forest literally cooler than expected), with a stopover at Marina Bay Sands for a view overlooking the casino (which was less crowded than expected, but then it was midday)  Mr. Robo doubts the first, Mr. Ham will set the second right Friday was smk's wedding day, with a bunch of the 4O guys as his best men, two of whom flew back from America specially for the occ-asion (and whom duly took up half the groom's speech, among the best I have heard, largely as it took barely a minute), held appropriately at the Ocean Ballroom (surely a mere coincidence). No tables were flipped. Was seated at the unofficial Table of Sad Bachelors (two exceptions) with our former maths teacher, who now has her very own smartphone app, as well as our very own National Man of Mystery, who once again managed to keep his occupation a complete secret. If he has entered the espionage business, I have no doubt that he is terrific at it. This was followed by lunch (with regrettable but frankly par-for-the-course undercommunication) with the returnees from America on Sunday, and another KTV session where my inability to sing remained mostly unexposed. Give Us Our Daily "News" Interspersed between a never-ending deluge of warnings, rumblings and totally missing the point on imported labour, the State's Times has somehow managed to find space to feature a taxi-driver earning S$7000 a month, hot on the heels of dishwashers earning S$3000 (barely-veiled message: if you can't make it, you're lazy/stupid, none of our business) The lesson of bleedin' obvious overstatements not being taken kindly by the prickly masses appears to have been swiftly forgotten by the feel-good-at-all-costs official media, who may have forgotten how many residents are, or personally know, hardworking cabbies, most of whom despite driving long hours take home barely half of the seven thousand claimed. The by-now-commonplace virtual outrage led to the high-flying cabbie being outed for defaulting on a S$4000 loan, casting justified doubt on the veracity of his claims. Shortly after, the cabbie complained of misrepresentation, with the S$7000 figure revealed to be an absolute maximum (and let's face it, perhaps still a slight exaggeration, which is by itself nothing much - sit in on an average reunion dinner) Stung by having the journalistic integrity of its hard-won 135th-in-the-world reputation impugned, National Mouthpiece Number One went into damage control mode, with the reporter (who happened apparently to not be a local, to additional online fury) essentially washing her hands off the affair, offering as part defence the lame observation that another driver who claimed S$6000 a month was not flamed. Technically, it is true that S$7000 is achievable - with inhuman hours, and everything falling into place. Assuming that a driver never has to cruise for customers, and either travels at near top speed (since the meter fare goes by distance) or is at a complete stop to maximize revenue, he can earn S$68 an hour by making eight 10km relays at 80km/h, which by the way is probably completely unrealistic. A bigger question mark may lie over the nice-sounding closing hope that "what the two cabbies revealed appeared to be a starting point to find out how other cabbies could earn more than the current $2000 average" (figure supplied by an MP - note decision to publicise outlier instead of average, yet again) Cruelly, I suspect that the demand for taxi rides is largely inelastic, and even if our cabbies all became smarter and more hardworking than our latest Lei Feng, it probably does not mean that the average salary will hit (or even approach) S$7000 (or even S$5000). There are only so many customers to go around, after all. At least a Ph.D. is not mandatory yet. Late Again Well, the renew-immediately trick hasn't worked out too well, and I ended up hanging onto my books for too long again. In no order: Leverage, Popes & Bankers, Scammed and Debunkery. I have to say that I have read about tulips and bubbles in this category one too many times. Popes covers usury (its condemnation in particular) from a religious perspective (not that this ever eliminated the practice) in great detail, but the most noteworthy section was on the compulsory (forced) government bonds (prestiti) historically collected by Italian city-states such as Venice and Genoa. Inspiration for the CPF? It was Leverage that I spent the most time on, however, drawn by some of its simple but convincing arguments (the ones which I agreed with). It is hard to quibble with, for example, a division between productive and non-productive income equality, where inequality can be tolerated if the person makes a tangible good (e.g. Ford's automobiles), less so with investment for interest, and even less for speculation. [N.B. Many financial transactions are simply zero-sum, and in the aggregate can provide no benefit - pit a hundred Einsteins against each other as traders, and no matter how insightful their models, how involved their calculations, they cannot come out with more than they began with. Or: finance should play at best a tertiary role in the economy] It goes on to a startling observation on interest - one is often told of its power after compounding, with say $1000 invested at 5% a year becoming over $120000 in a century, a fine reward for the virtue of saving. What is far less often mentioned is the flip side of the equation - that the debtors who together borrowed the $1000 will have to somehow come up with the $120000 to repay their creditor - O(n)s are, in practice, not created equal. [N.B. I had toyed with writing a short story about generations of a family benefitting from such interest; of course, in real life, decent returns are difficult to guarantee once wealth reaches a certain level, and of course fortunes can be completely destroyed in an instant during wars and the like. Might still make an okay tale though] This simple mathematics (mentioned here in another form in the local housing context), the author says, is the cause of inevitable business cycles. He also states that the US GDP growth is basically a Ponzi scheme based on debt accumulation, and that experts are often intentionally clueless (quoting Bernake's assertion in 2007, before the big crash, that prices were ultimately supported by increases in income and employment - gee, that turned out well) [N.B. The SDP has been busy coming up with a Non Open-Market (NOM) flat scheme, whereby flats are sold only at construction plus administrative cost (without factoring in land), but can then only be sold back to the HDB at cost price less depreciation. Completely unsurprisingly, the policy launch was met with indifference by the incumbents (but this tends to go both ways)] As they say, NOM NOM NOM More points:

One more thing I realised is how inexact economics actually is - there is nothing magical about many of the definitions often taken as gospel. Take the consumer price index: this single bland statistic rests on many assumptions, ranging from what consumers actually buy, to how they should be weighted, and it is perhaps no coincidence that such figures can be tweaked (even in a completely proper manner) to taste... Also got lost in Archer's As the Crow Flies, which raised Mr. Ham's ire for having the Trenthams as the antagonists. A CITOW AI? Conversation at the table turned at one point to the possibility of writing an artificial intelligence (AI) for the Chaos in the Old World (CITOW) board game, which might explain to an extent the sad part to an extent. As I do have a (very) little experience in this area, and find it hard to convey information precisely purely through conversation, I shall unilaterally continue the discussion here. As frequent readers may recall, there are only two major types of decisions that players have to make - where to place units/cards, and to whom to assign damage. While it was proposed to develop an AI without regard to card status, such an AI would at times be extremely ineffective, to say the least (e.g. piling Warriors onto a region with Field of Ecstasy) This might be a good opportunity for a very brief overview of (board)game AIs. To begin with, consider Tic-Tac-Toe. As most kids should quickly realise, it ends in a draw if both players know what they are doing. For example, given the below scenario, being able to think ahead just two turns ("what would he do if I did this, and what could I do then?") would eliminate many options:  Long-winded exposition by novice Although there are only nine squares (and thus a maximum of nine possible turns to play and think ahead), the number of choices can get quite big, though optimal play can be condensed into relatively few rules. On to chess, each player controls up to sixteen pieces, most of which can make several possible moves. The basic idea of "thinking ahead" is actually the same as for Tic-Tac-Toe, but the complication is the far larger number of possible moves available (about 30), compared to nine (actually even fewer considering rotations, and decreasing) for Tic-Tac-Toe. To think even two moves ahead would mean considering about a thousand scenarios, and to think through the entire game (usually dozens of moves) would be nigh unimaginable. Of course, some people are (far) better chess players than others, which suggests that although fully solving chess may not be possible, adopting good heuristics is very possible. What generally happens with human grandmasters is that they can, looking at a position, identify with high probability the most promising (and concerning) options, and analyse these options deeply, further ignoring (most) bad or unlikely developments along the way by experience and intuition. Computers, on the other hand, often largely dispense with the creativity and simply crunch the numbers, actually examining millions upon millions of possibilities, although they do get help at the beginning and end, though opening books and endgame tables containing precomputed information. While computers can run into trouble if unable to search deeply enough (such as in Go), they never tire, never get discouraged, and never blunder (within searched positions) - which has been enough for them to consistently defeat human champions. So how does all this carry over to CITOW? For a start, one can consider a baseline AI that chooses among all valid moves completely randomly, which is easy enough to arrange. The next level up would probably be a "scripted" AI that adheres rigidly to a fixed goal - for example, playing Slaanesh, it could pile Cultists on regions with Noble tokens, come what may, perhaps playing defensive cards (if able) once any opposition Warrior appears. Moving on, one could of course go the traditional way and simulate future moves to judge their goodness. This may however be less fully applicable in CITOW than chess, as there is more than one opponent and thus it is not a zero-sum game, with inter-player politics coming into play, with some element of luck involved (combat dice rolls), and hidden information (Chaos cards) on top of that. Well, it is not that an invincible AI is possible anyway (defined as one that always wins - proof left to reader). One for next time, maybe. Hole In Two  Like a hamster Smartphone doesn't admit a lanyard? Not a problem with a suitable case and a power drill. Ham Boot Camp I got invited back to the second day of Mr. Ham's Asshole Seminar, as he needed an external observer to lend credibility, and I had little better to do anyway. I arrived at the disused warehouse early, and entered into some chit-chat. Mr. Ham: Herr Ahm's a specialist on Singaporean, not American, politics, but I have it that he has Obama to take it. He's thinking 290 electoral college votes, plus or minus ten, but don't quote him on that. Personally, he thinks the Chinese transition far more captivating; stakes higher, more cloak-and-dagger, right up his alley - though he is now of the opinion that grabbing a ball might be the best method of all. And... ah, they're here! *A very straight-backed Mr. Robo enters, trailed by five other hamsters* [To be continued...] Next: Hard Ham Truths

|

|||||||

Copyright © 2006-2026 GLYS. All Rights Reserved. |

|||||||