|

| |

|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ entry views: 2182 today's page views: 1239 (28 mobile) all-time page views: 3733283 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1256 page created Fri Mar 6, 2026 19:30:27 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

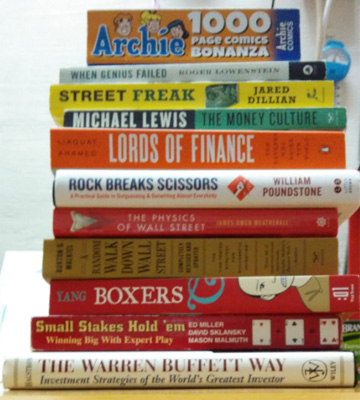

Pre-preliminaries Week in review: A labmate obtained Samsung 840 Pro solid state drives for everyone from COMEX, which speeded bootups tremendously, as advertised. Visual Studio and other "heavy" applications were likewise more responsive, which puts me in the dilemma of whether to spring for this nice-but-not-essential upgrade (the 256GBs are going for S$180-255 now). On the negative side, they do have a reputation for failing without warning (if it happens) - though given ten-year warranties, we'd probably have moved on by then... Besides, the way it's been going, hard drive failures may not be disastrous, given that copies of one's data tend to be retained by large corporations and/or the government nowadays, as many fine ladies have found out to their dismay. Local awareness of The Fappening (hey, it says so on Wikipedia) was obligingly raised by our always-dependable homegrown gender equality organization, though CNN still took the cake by identifying 4chan as "maybe a sysadmin". The FBI are belatedly on the case, but of course there's no way these cats are getting back in the bag (also, that's not how one fights 4chan)  Projected general reaction to AWARE's missive (Source: funnyjunk.com) Taking it further, on the off-chance that the US authorities don't already have your data, never fear! Apparently, they're just gonna take it, whereever it may be. In this light, it is little wonder why China's developing their own services (and now, OS), though it's mostly swings and roundabouts. To be honest, I thought encrypted peer-to-peer storage (i.e. paid one-way BitTorrent, as far as I can make out) was a bad idea (since the middleman doesn't actually control the hard drives, it seems as though there will either have to be massive redundancy, or a fair chance of the other end simply disappearing), but there could well be some demand if these intrusions keep up. With all this going on, it appears that computer science's cool again... which however might have been more reassuring, had it not come from The State's Times. Now, I wouldn't say that the outlook's bad, but in reality, pure techies haven't been getting that much love here; dodgy financial engineering, however... And hor, now no nid degree anyway! Gahment sey one leh! Wah liew eh, this one deserves its own post - perhaps next week. Recreationally, I had the sudden urge to try out the apparently-unwise-but-hey-it-works Mjollnir-stacking build on Sniper; conclusion following two losses and then a win is that it's actually fairly feasible, provided that your team has some means to prevent you from being mobbed (hence the losses) - with two Mjollnirs and some knickknacks, the near-perma ministun (and chain lightning) proved more than sufficient in almost all solo duels, even at next to no health. Preliminaries We may be referring to some of the following (yes, this is gonna be long - feel free to bail anytime):  Those who bow, should bow openly. I'll be covering my thoughts from the conference (before I forget them all), together with the above purchases (plus Capital and Flash Boys), in as coherent a flow as I can manage; certainly, it could all be garbage, so humour me here. "The Art" - Atalanta in Calydon, A.C. Swinburne As the storm raged unabated against the shuddering rock of their cave, the tribe huddled miserably against each other. Meat was running low, and if the weather kept up, they would soon starve. Yet, by unspoken consensus, they had surrendered their last bird to him. In later ages, such as he would go by many names, not all wholly compatible, yet sharing a common and unbroken tradition. Seer, shaman, medicine-man. Astrologer, diviner, sage. Technical analyst, big data scientist. Anxiously, they watched as the silent man gutted the quivering creature, and deliberately let its lifeblood leak onto his low, flat stone, already stained a uniform ochre from previous consultations. His dark eyes stared intently at the entrails, now in a steaming pile upon his primitive altar. Long minutes passed. The children fidgeted uncomfortably, and not from the chill. Then, without warning, he sat up straight. As his audience gaped, open-mouthed, he raised his hand to them. Three fingers. Spoken language had not yet been invented, but they understood. Three sundowns. Three sundowns, and the rains would cease. They would be able to hunt and live again. In the end, it was four, but it was good enough. And the hunters wondered, as well as they could in a time when such words had not yet come - they could tell if prey were here by their tracks, could even guess where they would go, by dead reckoning. It... made sense. Branches broken to north, buffalo north. But how the heck could anybody tell that the weather would change soon, by studying the spill of small intestines?! Every so often, it is advisable to take stock of where one stands in relation to his forebears, if only to maintain some perspective. Here, we concentrate on one of the defining human urges - the mastery of causality: "if so, then this". Certainly, in many instances, causality is well understood and quantified, and considered "solved"; here, I do not speak merely of complex modern theories, but also of more mundane knowledge; an ancient ruler, for instance, would exhibit little amazement at majestic structures - it is just placing big blocks on top of each other, after all. Backbreaking work, but hardly special. Whether his army would emerge victorious, however... While respectable scientists today uniformly malign more... esoteric studies, it should be remembered that by and large, they were born of the same root - the understanding of casuality, and thereby reality. Distinguishing the twain is often not as simple as one might expect by looking in the rearview mirror. Was Newton's alchemy obviously wrong, or merely underdeveloped (N.B. the philosopher's stone does exist... if one considers it to be "nuclear bombardment")? Why isn't quantum theory mere quackery, like the rest of them? The answer is, of course, repeatability, with the significance then coming from the generalizability (here, we skip the riddle of induction, or whether we can, in fact, ever learn anything*). But here, of course, arises a problem - in many domains, we simply cannot repeat a scenario, while holding other major variables constant. You could drop cannonballs and swing pendulums as many times as you wish, but the end of a drought, the development of a society, refugee flows in Syria? [*As all predictions imply some assumptions, fundamentally that the past does in some way impact the future (though unpredictability can be useful too, as in two-factor authentication code generation - you don't want someone who peeks at a short sequence of your tokens to be able to reverse-engineer the seed, and deterministically generate new tokens in the future; recall, this ties into randomness being incompressible, and also almost all reals being random)] A very rough-and-ready summary of currently popular topics in machine learning, as gleaned from the trip, would be that they are geared towards handling larger and larger quantities, of lesser and lesser well-structured data (though I'm not certain whether this properly constitutes a trend). Examples:

And of course, there were the many papers I had to admit I could only get the most superficial grasp of, no thanks to weak math-fu. Not that getting stuck's new, though. Risk and Uncertainty - The Eighteenth Brumaire of Louis Napoleon, Karl Marx "Nope, but it rhymes." - Mark Twain Sure, one could just assert that such speculations are not science (physics) - but if so, one would have to admit that fields like biology and medicine are not quite science (Gefland: "There is only one thing which is more unreasonable than the unreasonable effectiveness of mathematics in physics, and this is the unreasonable ineffectiveness of mathematics in biology"). Call it engineering, call it gambling - or, just perhaps, call it an opportunity for new science. True, it is hard to imagine how some subjects could ever be tamed... but then, flying machines were unthinkable not that long ago either. And who would have thought determining paternity with over 99.9% accuracy was possible, mere centuries ago? One might consider progress in knowledge as a journey from uncertainty towards risk (and, sometimes, near-certainty). Under uncertainty, one is mostly lost; there is no model one is confident of. Under risk, we may not know for sure, but we at least have an inkling of what is probable. In other words, it is magic versus sufficiently-advanced technology; gullible simpletons versus river-reversing/wind-changing/eclipse-prophesying manipulators; casual punters versus roulette ball trackers (blessed by the Shannon himself, as recounted in The Physics of Wall Street; interestingly, many of those featured dragged their doctorates out, not that this makes it advisable) The takeaway at this point, then, is that to assert a problem as "unsolvable" is... risky. Now, we can prove some formulations "computationally hard" - for example, checking whether a team can win a knockout tournament, even with pre-known outcomes for each matchup (the presentation had some disagreement over whether the Netherlands could beat Germany in the given example; well, now we know Argentina can, but holy overreaction!) - but history is littered with examples where such difficulties were eventually sidestepped creatively. [N.B. A quick example here: consider the problem of coming up with the next number sequences of the form {6449, 6451, 6469, 6473, ?}. Someone who has figured out that they are contiguous primes can provide the answer with 100% accuracy, while one who has not might only be able to guess that it's slightly larger and odd. Of course, the prime-number concept is fairly compact. Still, I am pretty certain that we are far from exhausting such frameworks; As an example, consider this old Google interview problem: {SSS,SCC,C,SC,SSSS,?}. The solution is, in theory, accessible to kindergarteners.] Being able to see the future without constraint, then, has been a prized ability for as long as we have been. The Greeks trusted in their oracles (even if they did give some rather cheapskate double-headed predictions), while most religions seem to have respected its allure sufficiently to ban their followers from dabbling (i.e. claim a monopoly). One could however suspect that at least some of the foretellings were merely educated guesses (with a dash of trade secrets, occasionally sprinkled with a seasoning of aggressive sales tactics; Rock Breaks Scissors is a collection of such "tricks", and it's telling that their take on the stock market is essentially using the P/E ratio)  It's just "counting", after all [N.B. Beware the compulsory price for future sight, though] (Source: dm5.com) As a sidenote here, advisors employed for their precognition (or, at least, common sense) were often clergy or fools (or both), across various cultures. Even disregarding the prevailing religio-political complex, this had sound basis. First off, other than monks and the "mad", everybody else at court was either subject or servant - their opinions must then be coloured by flattery or fear (of course, holy men were technically still subjects, but they were at least shared with another master) Secondly, such people had qualities that should render their advice intrisically more valuable; more than their learning, clergy were expected to possess a certain degree of detachment, while fools were recognized to, at least sometimes, offer flashes of insight not available to the conventionally sane. In both cases, this translated into a sublime objectivity - the power to observe, and describe, matters as they truly are, unaffected by external pressures and expectations (which just so happens to be the bedrock of science) Further on this, in his chapter on behavioural finance in A Random Walk Down Wall Street, Malkiel recounts a psychology experiment in which subjects were told to press a button to move a randomly-moving ball upwards, but who in fact had totally no influence on the movement; only the clinically depressed correctly judged that there was an illusion of control. Other than being mad, it seems, being sad works too. Malkiel also emphasized that people tend to be overconfident about their knowledge, and (strongly) underestimate the uncertainties and risks involved, all of which is antithetical to making good calls; yes, it's a nice fuzzy feeling to believe in oneself, so "I don't know" can often be the hardest words to say (actually, there's heavy overlap with Kahneman's own tome going on, which is pretty common - the Long-Term Capital Management saga is covered from various angles by several of the above books, for example. When Genius Failed describes Buffett's involvement, and let's just say that if his public image is that of a folksy grandpa, there's a shark under that facade) And, to complete this trinity, it could be mentioned that being bad is probably by far the most lucrative of the three, at least in the short run. Lewis in The Money Culture details the (very profitable) underbelly of the business, from bilking the little man to bilking S&L executives controlling millions, with the obligatory mention of Milken and detour to RJR Nabisco (see, overlap) - oh, and plonking US$16000 on whether one of their number could finish a 1.6km run in 7:30 in their spare time. This is also a reminder that in real life, information can be extremely asymmetrical. Let's say that a guy manages to build an impressively consistent record of taking large positions in stock counters, days before they rise by a lot. Question: has he managed to conjure some wonderful new indicator from publicly-available data, or is he simply working from tip-offs from the old boys' club? Answer: this is a very good question! Can't Be Done, Sorry Shifting our focus over to the books, I shall attempt to distill what I have picked up. However, before we hand the mike over to Buffett, it should be recognized that in the context of personal finance, their advice comes in rather late down the list. Cribbing the relevant reddit FAQ (also in Malkiel):

Admittedly, all this is not very exciting, but as with physical fitness plans, this falls into the "everybody knows it, few actually practice it" category of knowledge. But yeah, fine, all the boring stuff is done, you've hidden a few rolls of hundreds into a biscuit tin, gotten insured up to your ears, shovelled enough into your pension plan that the guy down at the office tells you that he can't take any more... and there's still something left over! Time to become the next Buffett! But wait, that's Malkiel running down the street, waving a copy of his book - he's hollering something... you can't beat the market! See, I cover both fundamental and technical analysis, divided as they are by how much of the market they believe is logical and psychological respectively... and both don't work! No managed funds have outperformed the market in the long term, so you should trust in an index fund (like mine)! Here, it is important to be clear about what Malkiel is actually saying. Obviously, it is not literally true that no-one can beat the market - Buffett aside, there are surely many lesser-known investors who had close to their entire disposable net worth in, say, Apple stock since 2001. What is being said is, under standard statistical computations (as used in modern portfolio theory) on publicly-known historical information, investors cannot obtain higher returns without taking on higher risk. To illustrate this, we might imagine a casino with many games, each with its own risk and reward. On the safer side, we have say penny slots, which return a sure 1% profit per hour played (this is a nice casino). For the adventurous, there are the high-stakes baccarat rooms, where one has a 50% chance of losing it all in an hour... but also a 50% chance of doubling one's chips. Now, in this casino, it's not even that hard to beat the average - just throw it all down on baccarat, and one will either be broke, or a genius (indeed, in repeated games with both a skill and luck component, it is a basic tactic for the less-skilled player to go all-in if possible, thereby maximizing the influence of luck). The point is that you won't know which category you fall in beforehand, and that in the aggregate, baccarat players (with zero expected return) are actually worse off than the penny slot plodders (who, recall, make 1% with certainty) Let us now follow a punter who opens a dusty door obscured by a potted plant, to discover a long-forgotten room of slot machines... returning a constant 10% an hour. Jackpot! Would this not constitute higher returns without higher risk (positive alpha)? Well, not in actual financial markets, since the flood of newcomers would soon drive the price up such that risk and return are again in equilibrium, so efficient markets theory goes. The most you can count on reliably is to insulate yourself suitably by controlling the beta of your portfolio - which in the beta equals one case, simply means an indexed fund. Additionally, not only are individual stocks unpredictable, even the schedule of their gains is too - Malkiel cites Seybun's findings that 95% of the significant gains in the stock market came in about 1% of the trading days, i.e. prices are characterized by wholly unpredictable spikes, which means that moving in and out bears the risk of being out at the wrong time. More ambitious readers might, understandably, want to just chuck the book out of the window at this stage. What's the point of all these negative findings?! What I want to learn, dang it, is how to have bought AAPL in 2001! So he marches over to Buffett, who is smiling genially while casually throttling a Nobel winner in Economics. Buy undervalued companies and hold forever, the Sage of Omaha sayeth. But, just as the seeker rejoiced, the Sage continued. Unfortunately, everybody and his grandma knows that by now, and I've been behind the market for the last decade, but then my reputation was made long before that. As for you, good luck! ... In fact, as some like Taleb have argued, the relatively small number of major investments by Buffett (who famously advised to make just twenty buys in a lifetime) makes it hard to be sure whether he was not, in fact, mostly fortunate, like our 100% AAPL (or more recently, Tesla) investors. Detractors could argue that, by following his supposed reasoning of "Coke is a big brand" and "everybody drinks soda", one could as easily have bought into dogs like General Motors. Supporters could point out that the details matter a lot to him, and that knowing when not to do anything, is actually harder to do than when to. Anyhow, the conclusion: if one doesn't want to spend time on following finance, and is also wise enough to accept that he doesn't know much about it, congratulations! He can just dump it all into an index fund, walk away and spend his life doing whatever he likes, and be pretty confident of coming back and finding that he did better than most, with no effort. If one does want to meddle in the markets, however, then he should be aware that it's actually a lot like competitive poker - only the very best (where best is some mix of skilled and lucky) are rewarded handsomely; there's no consolation prize for "I put in 1000 hours of reading and simulation, where's my returns?", no trophy for "fairly decent", as Dillian puts so starkly in his introduction in Street Freak: "Capitalism requires a dedication to the pursuit of reality. A rock is a rock is a rock... Profits are profits. Losses are losses. And there is no evading losses... the smartest man on Wall Street, after months and months of research on a single trade, has no control over the outcome. In the short term, his position can move against him and force him to liquidate the world's best idea, only to make him watch as it appreciates 200 percent over the next six months." Because there's always somebody out there who put in 2000 hours, 3000 hours; so, if one doesn't actually have loaded dice - or at least think he does - good luck! Ancestral Memories An office on the fifth floor of some dilapidated building. A group of men sat, with arms folded, waiting for the bespectacled, T-shirt clad fellow before them to finish sipping his cappuccino. It was drizzling, and the raindrops pattered impatiently on the windowpanes. At least one of the men found their progress across the glass more interesting than the impasse. The fellow turned to face them. Apparently, he was done with the coffee. In a series of fluid motions, he ran his fingers over the keyboard, humming all the while. Abruptly, he stopped, and wagged a couple of fingers at the assembly. "Sell Apple, buy IBM, period three months, range ten percent." he pronounced. The men looked at each other. On the surface of it, this was a ridiculous trade. Apple was hot stuff, had the slickest marketing department this side of Jupiter, and fanatical fanboys who would jump off iCliff if the ghost of Jobs told them to. IBM was... okay. Wasn't bad, long-lived enough, but so yesterday. Where your granddad put his money. Steady corporate contracts, reliable enterprise hardware, zero consumer cachet, zero wow. It made no sense. Then the leader of the pack stood up and offered his hand. "Thank you. Much appreciated." The lanky cappuccino-sipper shook it almost dismissively, his eyes already locked on his computer screen. The transaction was complete. There was no more to be said. Oh, they had tried before. Why, they asked. The answer was always the same. That's what the models say. The fellow tried explaining the models once. Once was more than enough. At the next quarterly meeting, they presented their results. The short Apple, long IBM rebalancing had outperformed all the other divisions. The team leader could sense it in the board of directors' eyes, as he detailed their strategy. They were thinking, what the f**k?!, but were too well-mannered to say so out loud. Gamble or not, it did pay off, after all. He was relieved, because he didn't really understand what was going on either. Still, the bonus would be nice. The guys deserved a night out, after all the long hours. But, very worryingly, he simply could not shake the disturbing image of a mess of small intestines out of his mind. Next: Mai Tak Chek Lah

Trackback by Klondike Cheats

Trackback by เสริมจมูก

Trackback by moncler ダウンジャケã...

Trackback by porn videos

Trackback by bali hotel

Trackback by China Mahjong

Trackback by gratis spile

|

||||||||||||||||||||||

Copyright © 2006-2026 GLYS. All Rights Reserved. |

||||||||||||||||||||||