|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ today's page views: 198 (21 mobile) all-time page views: 3740445 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1256 page created Tue Mar 10, 2026 06:01:13 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

Well, that didn't take too long, following from the first one in January - and it probably won't be the last:  Frankly, one can't really fault LKY even if he did really take some cues from the CIA in the early years (Source: dailymail.co.uk) For those who have been on holiday, the reigning God of War, the GOD-EMPEROR TRUMP, took out Iranian Supreme Leader Ayatollah Ali Khamenei on the 28th of February in conjunction with Israeli forces, kicking off yet another Iran War. Global reaction was more mixed than might have been expected, and despite some European nations such as France and Belgium stating that it did not follow international law, others like Germany have withheld criticism*, with fellow Anglos Canada and Britain supporting the action despite recent beef with America - and Saudi Arabia supposedly onboard too. From this, GEOTUS's statement that he does not need "international law" appears largely true, reflecting his essential honesty in reflecting actual reality, in contrast to past U.S. Presidents. The latest strikes have been critiqued by news outlets as "imperialism", but let us be candid - what can you call an entity with over 700 military bases spread all over the world, but an Empire? And when the casus belli is divine will, what else can one name its leader, but a GOD-EMPEROR? In any case, the And if I were a betting man, I would wager that GEOTUS is not quite done yet; such is the price of international order. [*Singapore is, as usual, pragmatically "deeply concerned".] [**Notably denied by Iranian intelligence sources, which may be another example of Team Blue propaganda.]

Considering as the "Pandemic Game" has been repeatedly referenced on this blog regarding the COVID-19 pandemic (recognized by the WHO as having lasted just over three years, from March 2020 to May 2023), it may be time to finally compile and summarize my understanding as to what had actually happened, and what should have, but did not, happen. There are several reasons why I am writing this, at this particular time in February 2026, or some three years after the worst of the pandemic had been over. Firstly, I had intended to address the issue as a whole since at least 2022, but would be sidetracked by the continued emergence of new revelations and evidence. While one cannot discount future disclosures, the major narrative(s) on the pandemic have largely stabilized, which should allow an attempt at analyzing all these individual parts as components of a unified theory. Secondly, it had been next to impossible to discuss or question certain aspects of the pandemic while the event was in progress, publicly at least. Eminent clinicians had fallen foul of the establishment and (quite likely misguided) online lynch mob for voicing some entirely reasonable doubts, with reputations and careers destroyed (temporarily, in the best case). That said, it should be emphasized that some of the greatest (and most atrocious) misgivings have relatively little to do with any specific medical expertise, as shall be explained. Thirdly, this telling has been weighing on my mind for ages, and in putting keypress to Notepad, I hope to finally rid myself of this burden. Again, the standard disclaimer that all of the following on the topic is my personal interpretation, with no relation to any other entity or organization, applies. Further, the primary objective of the analysis is not intended to attack or lay blame on any individual or group, but to try and figure out what had actually transpired - and perhaps inform an improved response to future pandemics and crises. Prelude: Jubensha (剧本杀) - Ravi Velloor, Is Singapore prepared for a 'rent-a-human' world?; in The Straits Times, February 19, 2026  Liar Game would make a good jubensha, come to think of it (Source: mangafire.to) This remark on the precedence of questions over answers came at a quite opportune time for this post, borrowing as it does from Einstein's (and doubtless many other prominent scientists') philosophy on problem-solving. This assertion is also supported in jubensha, the live action role-playing genre so popular in China*, of which I had just participated in my first session. While they vary widely in setting and difficulty, a mix of logic and lateral thinking is typically required to solve the underlying mystery. However, there remain some significant distinctions between the (artificial) scenarios presented in jubensha games (and whodunnit novels) and real life. To begin with, the author (and gamemaster, or GM) has full control over all information presented to participants in jubensha. Given this, the solution can (and usually) depends on the (very) careful reading of minute details in the provided clues and rules. Next, what is not presented is often as critical as what is - for many cases, the solution can become trivial, or at any rate much easier, were an additional otherwise unremarkable fact to be revealed. Moreover, the information density can be expected to be high, in that there are only so many red herrings and dead ends that can be included, while remaining within the scope of the genre. Then, once the creative brainstorming part is dispensed with, what remains tends to be similar to a logic grid (word) puzzle** integrating event timings and alibis. In contrast, real life has no GM - or no single GM, at least. Especially with the advent of the Internet, the amount of available information and "facts" is essentially infinite, and has to be winnowed and filtered by the participants (i.e. all of humanity). That said, there is at least no compulsory viewpoint to be imposed on everybody, which implies reduced influence of perspective control (which can frankly become extremely contrived in jubensha) and pure logical deduction. This does unfortunately make discovering (some sort of) Truth feel like a fool's errand - how is it even possible to make sense of a firehose of oft-conflicting information, in our post-truth society? One approach is to simply disengage and disregard all news (i.e. give up), which however also relinquishes any potential of making a difference and righting wrongs. Another is to pick and stick to one's trusted information sources (i.e. GMs), which has led to much partisan division. A third, and apparently superior if more complex method would be to weigh and consider multiple sources - which is easier said than done, all the more when many issues are gatekept behind specialist credentials (e.g. can one speak about the practical impact of supposed inflation, if not an economist?) Which brings us back to the original point, on the importance of (the correct) questions - while the authoritative answer might never be known, the incongruence*** of relevant parties' behaviour can at least suggest very strongly that some shenanigans was involved. Such questioning will play a large role in the following analysis of the Pandemic Game, and hopefully inform as to some possible answers. [*Possibly better known as detective/deduction games (typically with less plot and structure) elsewhere, of which Mafia/Werewolf is probably the top example.] [**Some resemblance to linear algebra may be noted, where the jubensha ideal is to have a single canonical solution.] [***Analogous to proof by contradiction.] Degrees Of Wrongness A second major point on investigating the pandemic and various other topics, is that one can almost never be proven right or correct beyond absolute doubt, in the real world at least. In keeping with the jubensha theme, consider one of the oldest tropes - the murder victim in a locked room. In a game, it may be taken as an axiom that the only key to the room was in the victim's pocket, and the lock was unpickable. In real life, it is usually impossible to be certain that there is no duplicate key, and many locks are but momentary inconveniences for a semi-skilled guy with the appropriate tools. On this note, I have occasionally been reminded that I may not be correct, when advancing various hypotheses - which is fair enough. However, it is also the case that some hypotheses can be thought as almost certainly (and glaringly) incorrect****, while acknowledging that their opposite or converse is not then automatically correct. The example of what the Earth is, by Asimov in his The Relativity of Wrong, would be a classic illustration of the concept:

We will be drawing on these concepts pretty often in the dissection of the Pandemic Game to come. [****Which may be why certain philosophical traditions prefer to describe things by negation, since it is easier to assert what they are not, than what exactly they are.] [*****Were Asimov not a famous author, this slander of English Literature experts might be thought quite mean-spirited.] [To be continued...]

Wonder how much of this was A.I.Composed? [N.B. Forget Grok, Bytedance's Seedance 2.0 is pretty incredible for video generation already - and without pesky censorship concerns*!] (Source: straitstimes.com) [*Probably unless it involves the CCP.] The lack of subtlety in U.S.-China interactions - especially on the part of the former - had been noted last December, but America is really rubbing it in with a (series of) blatant CIA recruitment videos aimed at Chinese citizens, particularly military officers. Per the last post, they're not even offering bribe money now! Overall, the production values are decent enough, but I have to confess that the messaging seemed rather vague on the first watch-through - for example, the wording on the laptop form was "连络中央情报局" (i.e. intended to mean the CIA), but "中央" alone would far more often refer (in China) to the CCP's Central Committee (i.e. "中央委员会"), and be understood as a metonymy for China's national-level government as a whole. Indeed, before the logo reveal at the end, the entire video wouldn't have been out of place as a call for Red Guard-type anti-counterrevolutionary fervour (possibly relevant from Xi's recent purges of the Central Military Commission [N.B. also 中央], leaving just himself and one other member... for now), which could have led to momentary confusion as to whether this was some sort of modern self-criticism campaign (that Xi's father was once on the receiving end of, as it happens), and led to much bewilderment at select party branches. One supposes being the reigning God of War does confer some privileges, including a quite overt approach to "espionage" (think James Bond just showing up at the beginning of the movie with an IWI Negev light machine gun in each hand, and a bandolier of high explosive grenades); GOD-EMPEROR TRUMP has certainly lent truth to many of this blog's previous analyses, including assertions last month that he "doesn't need international law" (well, probably true) and that he has offered the "easy way or the hard way" (with respect to Greenland), exactly reflecting our December explanation.  果然是雄狮堂主,懂王川普! (Source: instagram.com) Certainly the most colourful of these fulfilled predictions was GEOTUS depicting himself as a Lion King in a, uh, rather tasteless video also featuring other political personages past and present, which has been defended as a honest mistake by a staffer. That said, while the vast majority of the initial outrage was about the portrayal of the Obamas, it can be quickly confirmed that the entire clip was massively offensive, so it could be less discriminatory than it appears at first glance. At the higher geopolitical level, this only bolsters the description of great power politics as a "jungle world" by our late, great founding Foreign Minister S. Rajaratnam, as also brought up in a late January commentary in The Straits Times by the former LKYSPP Dean, who applied a crocodile analogy instead. The article would also discuss Carney's salient warning at Davos on how "the old order is not coming back", and that "if you are not at the table, you are on the menu" - on which more soon. Today's focus will be closer to home, with the latest update in Singapore's on-and-off cyber defence adventures being yet another alleged attack from the UNC3886 hacker group, this time on all four of our major telcos. The local Operation Cyber Guardian supposedly spent eleven months evicting the snoops with there being "no evidence to-date that sensitive or personal data such as customer records were accessed or exfiltrated" - which could be reassuring, or just a sign that the attackers were pretty skilled actually. The Chinese embassy promptly called out The Straits Times by name to express their strong dissatisfaction with the "groundless smears", though it was soon pointed out that that no explicit denial was made, apparently out of future plausible deniability considerations. Then again, some appreciation might be had for their Ministry of State Security not openly recruiting Singaporeans as informants on YouTube, mass-produced generic A.I. slop videos notwithstanding...  Makes a change from the usual property agent leaflets By the way, this Falungong brochure was found nicely folded within an envelope in my letterbox, which had me recall when The Epoch Times was distributed on university campus perhaps some fifteen or twenty years past. Seeing as it's basically open season for propaganda locally, the more the merrier, I say!

An update's long overdue, so here's a quick recounting of my birthday visit to the new permanent exhibition of the Albatross File at the National Library, after the splash it made in the local media on "reshaping school history lessons". Long story short, the lost-and-found dossier by founding Finance Minister Goh Keng Swee revealed that Singapore's separation from Malaysia in 1965 was a preplanned "bloodless coup" agreed with the (non-Singapore) Malaysian leaders, supposedly "...right under the noses of the British, the Australians and New Zealanders who were defending Malaysia with their blood and treasure", as the always-eloquent LKY put it - while adding that he did not want to do it, as consistent with the former narrative. As students of the English language might have suspected, Goh intended "Albatross" as an allusion to the maritime avian choker of the same name, which did quite aptly describe Singapore's then-situation. The more-pertinent question here would be why the government took so long to make a big hoo-hah over the documents, seeing as they had been rediscovered in a dusty storeroom some forty-four years ago back in 1982, which was definitely sufficient for high school textbooks to have been corrected* for two generations at least. Well, this timing might - if I may be so bold - be attributed to recent geopolitical developments, seeing as the primary message of the files was that the Singapore authorities (i.e. the PAP) were cunning and sovereign masters of their own fates (as opposed to being passively expelled by the Tunku), a condition that may be becoming increasingly hard to maintain in the forthcoming Age of Empires II (refer Maduro, and now quite probably Cuba, Iran and Canada etc., with that last perhaps to confront their own separation vote for Alberta[oss?]) [*On this, it may be of interest to examine the evolution of Wikipedia on the matter too; Singapore's wiki page had asserted that "the Malaysian Parliament voted 126 to 0 to expel Singapore from Malaysia; the Singaporean delegates were not present and could not vote" as recently as December 2014, with the "secret negotiations" updated for the current version, though "expulsion from the federation" remains in the second paragraph of the Introduction.] Able Was I?

I suppose it may not be a bad idea to try and project Strength and "independence", given how a U.S. Presidential advisor has just reconfirmed that "...the real world... [that] is governed by strength, that is governed by force, that is governed by power... [and] these are the iron laws of the world since the beginning of time". That said, it is unlikely that dedicating an interactive display on the tenth floor of a library building would be sufficient to address doubts on this topic, and it might be entirely relevant that the exhibition provided next to no background context on the (anti-)Communist Malayan Emergency from 1948 to 1960, fought against the mostly-Chinese and China-inspired anticolonial Malayan National Liberation Army (MNLA)... which could have been awkward given the PAP's own socialist left-wing roots, and more importantly their greatly increased socialization with the CCP in recent years, after re-establishing formal relations in 1990. Another takeaway from this is that history is often mutable - who is to say that a janitor won't discover the Bluebird Files in the bottom of a locked filing cabinet at the disused PA headquarters with a sign on the door saying "Nassim Jade Transaction Records", fifty years hence? On this, there has been continued lionization of LKY for supposedly turning down a bribe from the CIA in 1960, though this was apparently at least in part because he thought at the time that "if the Americans and not the British had been in charge in Singapore and Malaya before independence I would have been in jail, probably tortured and died a Commie". The irony here is, of course, that scarce three years later, LKY would consign many of his former party comrades to jail and torture for supposedly being Communist (which some never admitted to), supporting the old saw that the LKY of 1970 would have imprisoned the LKY of 1960. Which brings us to the key observation: LKY could afford to snub the CIA because, well, he was definitely not a Communist**, and was in fact already actively purging the leftist and suspected-Commie wing of the party. It would have been far more impressive had LKY delivered his "You do not buy and sell this Government" line to the CIA*** while proclaiming his support for Team Red, which might well have led to a promising politician disappearing in darkest Africa, given the ferocity of the Cold War contest then. Frankly, why would the CIA move against somebody who was doing their job for them, far better than they could? [**Though he did make his kids learn Russian just in case.] [***On this, the Boston Globe alleged that LKY's whistle-blowing was actually due to the U.S. being unable or unwilling to procure his favoured doctor for his wife, possibly reflecting the reputation of the American medical establishment even then; their claim that LKY had "privately held sympathy" for U.S. policy in Southeast Asia would be justified to an extent, by LKY's staunch support for the U.S. in the Vietnam War.] Of Spheres And Lines Take nothing from LKY, though - he amply manifested his (geo)political brilliance**** in bringing together two former antagonists (i.e. America and China), by explicitly supporting the ongoing Sino-Soviet split, without which the (Sino-)Soviet Union might well be still around (but hey, they have got a second chance on that)... with Singapore admittedly being the beneficiary. The challenge for the current national leadership would be adapting to a world where these two powers are not aligned, and let's just say that 7 Strategies For Continued Economic Success may possibly become largely irrelevant, if actual long-term division and bloc formation happens. Then again, it's not like Singapore didn't thrive the last time empires and "spheres of influence" were in vogue, with said spheres just declared officially back in season by The Diplomat, no doubt influenced by the Donroe Doctrine asserting U.S. preeminence in the Western Hemisphere (over China's objections) by the Emperor of the West, TRUMP the First. Recall, de reden waarom we geen Nederlands spreken***** is because the British and Dutch empires carved the region up back in 1824, with Singapore falling just north of the dividing line. One can only imagine what might have been had Raffles (or his fellow Brits) been a more convincing negotiator (like GEOTUS) - could he have gotten Batam, Bintan and the other Riau Islands thrown into the deal... or maybe pulled Johor in?  Just imagine how much ERP can be collected! (Source: r/imaginarymaps) [****With his enduring influence in China leading to him getting mentioned in another (far-hotter) set of secret files, by a former British First Secretary of State and recent Ambassador to the U.S.; this may yet bring down another left-leaning administration, in the U.K. this time.] [*****Then again, Dutch never quite took root in Indonesia either, so this might be contested; still, had the hypothetical Dutch colonial government included it in exams, I gather we wouldn't be half bad at it eventually!]

Since I'm hitting the big 42, here's coverage of a recent short trip to Indonesia - and some related thoughts: Back To Bali It has been almost two years since I was last there for a conference, and it was good to see that the monkeys had reformed their thieving ways - or maybe it was just that they had been adequately bribed at the resort. The highlight of this holiday was dinner at Merlin's, which featured a custom Tarot-inspired spread to decide the dishes. For the record:

This appears an extension of the basic Past, Present, Future spread, if also with a reworked deck to facilitate good vibes, because it would be hard to spin cards like Death, The Devil and The Hanged Man into a lighthearted and palatable entrée; since we're on the subject of food, the latest update to the local (short-lived) budget meal initiative has had the national broadsheet conclude from their interviews that "diners were generally unconcerned" - which may imply that S$3.50 may no longer be sufficient for a slap-up meal - which recalls one of the most-famous parliamentary exchanges on food subsidies from some twenty years ago, that asserted about S$3 for a basic meal even back then. On to traffic, it only struck me on this trip that there were essentially no traffic lights on the island, which had the drivers somehow navigate their way through swarms of motorcycles and scooters at intersections - while also squeezing the cars past oncoming vehicles along what definitely felt like single-lane roads (which recalls the recurring query on how the heck a bus can fit within a lane, given that it contains double seats on either side of an aisle). All this appears possible due to lower average speeds, a more conservative driving style (countering the stereotype of maniac traffic in certain less-developed countries), greater awareness by all road users, and some courtesy habits (e.g. honking when approaching bends)  Vote for Dog at Lodge, or Cat on Bench! [N.B. This may recall the story of wise Yudhisthira from the Mahabharata, who would not leave his (pariah) dog behind for all of Heaven.] Great Scott The trip would also coincide with the passing of influential cartoonist and humourist Scott Adams at 68 from prostate cancer, despite the best efforts of GEOTUS and RFK Jr. to procure the Pluvicto drug that he wanted*. The former would duly eulogize Adams as a Great Influencer, and as covered here back in May 2016 on 7 Reasons Why TRUMP Will Be The Next POTUS (indeed), Adams was perhaps the only high-profile analyst that correctly identified TRUMP's persuasion genius leading into that historic election, making this a case of Game recognizes Game. Before that, Adams was best known as the brains behind Dilbert (an early prototype of yours truly, maybe) and the author of an eclectic selection of self-help tracts, including God's Debris (as reviewed here in 2007) On that last, Adams had reportedly independently rediscovered Pascal's wager towards the end, resulting in a (close to) deathbed conversion, the appropriateness and effectiveness of which would be hotly debated. Although this might not have the savoir faire of Voltaire, Adams remains a quite-uniquely clear-headed investigator of reality, which has had him convincingly debate Sam Harris on the merits of TRUMP, amongst other feats of cutting through media sophistry and social engineering. As with many honest prophets, Scottadamus would wind up abandoned by the general public, with his trying out of Ivermectin as part of a last-ditch treatment predictably dissed as using "worm pills" - but that's a subject for next time. One believes Adams' last act - somewhat reminiscent of his namesake, the First of Man - was one final effort at persuasion, or at any rate, of driving inquiry particularly amongst believers. A typical analysis of his case goes as follows: suppose his deathbed conversion was indeed legitimate; if so, what would be the reward for the lifetime adherent of an Abrahamic religion, over and above that for last-minute opportunists?  There are levels to this too (Source: facebook.com) As Adams often demonstrates in his comics and writings (and as comprehensively recounted in Astral Codex Ten, whose author happens to share the same first name and initial), this question might be better approached through a switch of framing and perspective. In this case, the pertinent question would be: have non-believers actually done anything, to be deserving of eternal damnation? Further questions naturally follow: How would one know what specific flavour of God is correct, then - since this seems to often come down to "the one that is most politically and culturally dominant amongst the social circle of my family and/or geographic region"? And what does it say about humanity, that such a belief is so widely accepted? One has to confess that the entire idea of transactional admission to Heaven or Hell remains problematic - consider, for example, the old trope of an old lady waiting to cross the road. A person might help her for nothing, because it was the right and compassionate thing to do. Let us say, then, that Elon Musk suddenly appears, and offers a million bucks for somebody to do the deed. Not many would turn down the opportunity in real life, one figures - and the deed remains worthy - but maybe it still says something about those that performed it out of a promise of reward, and not for its own sake... Given this, my current understanding is: let us say that God exists. If so, then He knows everything - including one's underlying motivations - anyway. And if so, what was the point of all this ornamentation? Humans are amazing, if one thinks about it; after conceiving of an Almighty, their very next move is to attempt to come up with all manner of ways to swindle Him! Considering this, it seems reasonable not to wish for or believe in anybody else to suffer eternal torment, while accepting that one cannot control what others think of him. In following this, I sleep quite well at night, thank you. [*On the subject of curing cancer, this appears to have become a point of contention from the U.S. regarding China.]

Five undeniably great leaders headline the NYT! (Sources: nytimes.com, youtube.com) Part III should be a good place to return the ongoing National Resolutions series closer to home, while also catching up on some loose ends. Reflecting the concerns from Part II, China has just identified Team Blue Europe's real threat as themselves, and pressed them to bar entry to Taiwanese politicians, lest they fall foul of the (Team) "Red line" mentioned; that Venezuela raid seems to have hit a raw nerve with respect to the apparent failure of their radars, though they might take comfort in the latest news that the radars were not connected to the (Russian) air defence systems, probably thanks to U.S. intelligence. Otherwise, China has indeed been rather quiet on Venezuela after the initial (ineffectual) protests, and one supposes they are willing to wait Taiwan out, especially given their abysmal population replacement rate. On the local end, our Deputy Prime Minister has seen fit to announce that only three per cent of registered retail businesses here are owned by PRCs (with 89% by Singaporeans), to which sharp commentators noted that this statistic neglected that foreign Chinese retail entities would much more likely be large [advanced] chains (e.g. Haidilao, Scarlett and Mixue - that last already the world's largest food-service chain, having overtaken Starbucks), each of which would equal dozens of individual storefronts. Such strategic information-control maneuvers - as with the latest head-scratcher on TraceTogether not breaking public trust - could then have inspired the New York Times to place our Senior Minister on the same level as TRUMP and Putin* (while omitting Xi somehow), a honour surely matching Hegseth's elevation of LKY from last May. This appears to be due to strenuous nomination from our SM's nephew, who alleged a "pattern of using police investigations and criminal prosecutions to dispose of or exile his (political) opponents", as is currently happening with the (quite popular) Leader of the Opposition, aptly mirrored by TRUMP's investigation of Fed chair Powell.  More great leaders (Source: channelnewsasia.com) Our Prime Minister's New Year Message bluntly acknowledged the end of the previous global order while emphasizing economic Strategy and success (which has had our President also sound out on national debt at MIT) as a "means to an end" - the echoing of the U.S. National Security Strategy here might be mere happenstance. Anyhow, one understands if all this was put on the backburner, after GEOTUS TRUMP called him two days later to reaffirm the Strength of their bilateral partnership (as recently supported) - right before Maduro got snatched. It was all a close partner wishing to deepen cooperation (as with the Chinese, recall?) could do, then, to express "grave concern" over the unilateral military intervention, with our Senior Minister soon saying that it was "quite clearly a contravention of international law", concurrent with the new dean of the LKYSPP (after the previous one left soon after questioning America's place as Number One) raising the need for "international law and rules". On this, let us just assert for now that there is a reason why America (and to a lesser extent, Team Blue) has consistently used the phrasing of "rules-based [international] order" (RBO), instead of (U.N. Charter-based) "international law" - they are quite evidently not the same thing**. This had local discussants debate Singapore's true foreign policy principles online, and it was realized that the Ministry of Foreign Affairs' boilerplate press statement was in fact essentially the same as that put out for Russia's invasion of Ukraine in 2022 - which is congurent with claims of (relative) neutrality, I guess. Registered Team Blue flag-waver Bilahari Kausikan took the opportunity to repeat former Foreign Minister S. Rajaratnam's description of practical diplomacy as taking place in a "jungle world" - now containing a Great American Empire...  Didn't know it was that happening on USS Iwo Jima [N.B. The static image in the news sure didn't reflect the fun!] [N.N.B. The immaculate product placement for the Nike sweatsuit has reportedly overshadowed the viral Adidas Chinese jacket, in yet another show of American dominance.] [*Who has evidently revived the Cossacks as hinted, this time with satellite internet attached. Some may laugh, but show me an alternative single-seater army vehicle that is fuelled by grass, tackles off-road terrain, and self-replicates over time.] [**Put simply, America makes (up) the rules.]

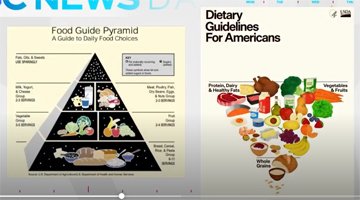

Fine, looks slightly unappetizing... [N.B. Looks like we're falling behind China here too.] (Source: r/SingaporeRaw) Switching over to less-controversial subjects for awhile, this discussion was originally intended to have been tacked on to the previous post's mention of Chinese restaurants, but that was before it absolutely blew up in the local news. Moreover, given that the school involved was my alma mater (which had it also pop up in several WhatsApp chat groups), and that the caterer involved is also supplying the canteen at my current workplace (small world, huh), an in-depth investigation seemed apropos. The saga started out as a typical Reddit complaint thread on January 3rd, which had some pretty sorry-looking bento boxes from Hwa Chong Institution (HCI) presented for public judgment. To provide some context, local school canteens (from primary/grade school through university) have generally featured multiple independent stalls, each of which would specialize in a particular (class of) dish(es), not unlike the ubiquitous hawker/food centres and coffeeshops (on which more later) dotting the island. However, given a supposed difficulty in securing stall operators (probably due to cost-of-living issues), a number of schools have shifted to a centralized kitchen model, where the food is prepared en masse offsite, and delivered. This included a price ceiling of at most S$3.60 for at least one of the full meals on offer for high schools, and as could be seen, the results were less than ideal; comparisons would be drawn with the fare at army cookhouses, about which it was noted that one actually gets served on proper plates - or enjoy superior combat rations - in the military, and that the school bentos were more akin to prison fare. From my admittedly outdated National Service experience, the above assessment appears to be true.  The man, the legend! (Source: mothership.sg) Of course, this did not prevent many fellow servicemen from opting for (paid) canteen food instead - while giving poor ratings for the cookhouse food, possibly against the mess officer's wishes. On this, I have to admit being something of a scab, in usually giving the highest rating due to my honestly-underdeveloped tastebuds, and because there seemed no point in getting the auntie-and-uncle servers into trouble over something they had very little control over. HCI did invite parents to sample the bentos - as per National Service practice - but it may come as no surprise that the fare served up during such sessions, may bear little resemblance to the usual. As some commentators soon explained, this seems mostly a matter of money, as so often happens; SATS - who cater for our (rightly) world-famous Changi Airport and airline - are definitely capable of serving up higher-quality meals, so it is probably not quite a cultural failing (with Japan and Korea mentioned). However, one believes airline business class (and above) meals to have a budget somewhat above the roughly S$7 allocated for army cookhouse (and some say economy class) meals, which is itself about twice the amount allowed for school offerings. From this perspective, the kids might consider themselves lucky not to have to settle for cold sandwiches for the price... Crappy food aside, the reason why the drama exploded was due to the attempted cover-up; apparently, the school administration had initially defended themselves by claiming that the original photos did not reflect actual food standards, only for the media to interview nine students, who confirmed that the food sucked. This led to a teacher allegedly circulating a warning for students "not to participate in the canteen food controversy" lest they be given demerit points for their social credit score, which was obviously also going to be leaked. This was also later denied wholesale, in true military style. Given that HCI does have a certain level of influence, this eventually had a former President come out to defend the quality of the food - which hasn't quite quelled discontent at the heavy-handed clampdown of dissent (what would LKY have done)?  Another RFK Jr. MAHA contribution (Source: nbcnews.com) All this coincidentally comes alongside the discontinuation of the budget meal initiative (launched in March 2023) at local coffeeshops, which mandated the compulsory provision of cheap meal options (defined as costing S$3.50 or below), while apparently not subsidizing the stallholders for their sacrifice. Perhaps unsurprisingly, none of the forty budget meals sampled by CNA managed to meet the local Health Promotion Board's nutritional recommendations - that may or may not get a look-over, following the latest updated Science (i.e. more protein and "real food", which is kinda hard to argue against, cost aside) from the U.S. Department of Health and Human Services... |

||||||||||||||||||||||||||||||||

Copyright © 2006-2026 GLYS. All Rights Reserved. |

||||||||||||||||||||||||||||||||