|

| |

|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ entry views: 2378 today's page views: 15 (3 mobile) all-time page views: 3386056 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1226 page created Fri Jun 20, 2025 00:27:32 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

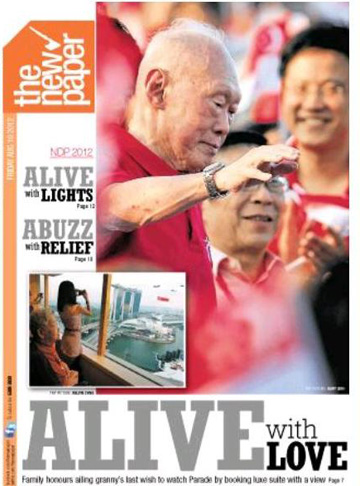

An engineering block went up in flames yesterday, though my lab was located far enough away that I failed to notice it. No fatalities, which should make it acceptable to quip that renewable energy has hit yet another stumbling block. And as Mr. Ham might say, they're research labs! If they aren't exploding, people aren't trying hard enough! It Never Fails There are moments when I suspect that I have been too harsh on the local news, but they swiftly dissipate when I open the newest daily edition, which tends to contain enough critical thinking puzzles that it is only natural to wonder if it is trying fervently to guide us down some Duneian Golden Path. Examples: (A8) Newspapers, magazines can now add online readers to circulation figures Again, I have to wonder why. Perhaps they might do better if people could not, like, guess all the opinions and views within without buying a copy? Just a thought. The New Paper's already pulled out the stops, going from TNP Dollars to Bingo with actual cash prizes, so they could be running dry... (C8) Many low-wage workers prefer cash plus CPF mix This is so-called Premium Content, but the main point is that a study found that only 14% of such low-wage workers always prefer to get paid in cash. In particular, "...the pollsters asked respondents to choose between a cash payout of $1200 and a combination of cash and CPF where the combined sum may be above or below $1200". First off, why should anyone ever prefer a combined sum less than a cash payout, since even if one wants to enjoy the CPF's low-but-probably-risk-free interest rate, one could just take the cash and plough it back in, to the best of my knowledge? Okay, maybe these workers won't be the most financially literate and might appreciate the convenience, but it still feels like another "more-CPF-good" subliminal message. (A44) (Forum) Leaders' red-and-white ensemble sends the right message Well, let it not be said that the local press is completely out of it. Days after a hopefully-unintentional pun (which might alternatively be delicious dissent on the part of the shackled state media employees?) on probably the most famous Nazi propaganda film (once again, they do have precedent), they have come up with more hidden gems for the sharp-eyed:  Left: NDP 2011, Right: NDP 2012 Note impeccable protocol behind Mr. Low's near-white shade of blue (Original source: ST Forum) Which brings us immediately to...  Stolen a march for once! (Source: newasiarepublic.com) But the unanimous winner of Headline Of The Day must be:  Alive! Alive! (Source: The New Paper) Perhaps they might someday find the wherewithal to quote Twain. Not Forgetting  Black tape - solves all problems (Source: ST Report on N-Day Message) More Concrete Box Mathematics With National Day still in the taillights, it seems a proper time to once again wrap up some of the hottest issues on the table, which as a local politician has sagely noted, are tightly interconnected. "...housing, it is immigration, and it is the cost of living. They are one because they are all part of the same." These have all been discussed briefly before in previous years, but little has changed (as expected). Case in point, a 2009 letter in Today urged the government to convert new citizens for the right reasons, instead of simply pushing them into it, concluding that "Inevitably, the message has created a mindset in some PRs that Singapore needs them to survive. But Singapore cannot be held to ransom by PRs who 'threaten' to leave." This seems, indeed, true. Now, thinking about it logically, why would a Permanent Resident be that eager to become a citizen? From various sources, by and large the differences are minimal (e.g. slightly lower educational fees, slightly higher medical subsidies, etc). The major differences that stand out are:

But the consideration that particularly stands out is that Singapore is not an especially attractive place to retire (perhaps quality, if not cost, of healthcare aside). A perfectly logical plan for a PR would be to arrive, make their packet, then up and leave with their CPF monies for their home country when old. In a way, this is desirable in that it would alleviate the demographic problem of having too many elderly residents, and too few workers. However, the problem is that this still imposes the cost of depressed wages on blue-collar workers and lower-level PMET citizens (who are actually intending to retire here), leading to a widening income gap, properly described as socially unconscionable. Or: this is a great place to be if you're at the very top, or aiming to be there; not so much otherwise. Put another way, my personal opinion is that permanent residency should be seen as an uncomfortable interregnum between foreigner status and full citizenship, a form of "internship" that most holders would aim to be done with as quickly as possible. This certainly does not seem to be the case here, despite some sullen shuffling of feet. But this is not the feature topic of the day. For that, I have to credit Yawning Bread's April 2011 post, though the basic concern is extremely simple, looking back. The original post has attracted heated disputes, some of them born of misunderstandings, so I shall attempt to illustrate the highlighted discrepancy as starkly as possible:  The purported contradiction:

The first scenario, of perpetual appreciation, is represented by the red line in the above graph (assumption of 2% annual real growth, ignoring cyclical fluctuations to show trend). The second scenario, where the value is zero at the end of the lease, is in blue, with the intermediate values interpolated. The green area, the disagreement between the two mental models, is seen to be relatively small (and easily-ignored; 99 years remaining, 79 years remaining, what's the difference?) at the beginning, but grows steadily as the years go by and the lease is run down, until they are completely incompatible. Certainly, there exist possible objections to this not-so-rosy picture, firstly that rental rates will always provide a certain level of price support; for example, what is a 5-room flat with 70 years left on its lease worth? If one expects to be able to rent it out at S$2000 a month (adjusted for inflation, already an understatement given today's prices) for the remainder of its lease, it would be worth nearly S$1.7 million! Ah-ha! I can almost hear the property agents exclaming - see, we're right! Don't listen to those saying that the market is overheated, there's no time to waste! Just sign on the dotted line here! Loans are so cheap that worst come to worst, you can always pay off the instalments with the rent. Right? But not so fast. That would hold only with a number of ifs, the largest of which would be actually being able to rent the flat out, which may not be applicable if the owner owns just that one property, I daresay like most households. If not, rental rates would not be relevant to him. Here, it bears repeating that property demand is ultimately derived from the demand for people - however wealthy, a man can only sleep in one bed at a time, after all - which may be one of the root causes behind our population inflation. Supply is of course the other factor, belatedly being rectified (when the government controls just about all the aspects, it should take the bulk of the blame, fair is fair), but my own take is that when 50-year loans are being offered, the market is horribly overpriced. But what do I know? There are many forums where one might attempt to gain an idea as to whether the local property market is headed for another bust, but the opinions tend to be heavily coloured by whether the commenter has recently dived in, which should be taken into consideration when analysing their arguments. One angle that does come about often enough to be especially convincing is that the current boom is partially fuelled by extremely low interest rates, and not fundamentals alone. And that is not even with the slowly-ticking time bomb of the lease being considered. Sure, so many are in the same boat that the government of the day can't say, lease's over, party's over, bye bye, right? Surely they will assign a new flat or compensate at near-market rates? Unfortunately, we don't quite know - the hammer won't fall for a few decades, after all - but my bet's on at best a sharing of the pain. What's really needed here is communication on the long-term plan, but the problem is that this is still far enough in the future that whatever the current authorities say will have to be weighted against their ability to fulfil it. Well, it may be a bit like sailing in the dark, but myself I will be expecting - and waiting for - a rather sharp correction, and soon. Ella vs. Ella (Learn Spanish) Next: Mobile Ready

Trackback by simplest home remedies

|

||||||||||

Copyright © 2006-2025 GLYS. All Rights Reserved. |

||||||||||