|

| |

|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ entry views: 2321 today's page views: 261 (32 mobile) all-time page views: 3385927 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1226 page created Thu Jun 19, 2025 21:32:22 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

Mr. Ham: ...and that concludes this quarter's meeting of H.L. Ham stakeholders. And yes, human, I haven't forgotten the big chat on the Sino-Sin condition that you've been awaiting. Sadly, Signor Prosciutto is otherwise engaged, but he has highly recommended one of the foremost experts in hamster circles. Let me just get him in here. *bustles out of door* Me: Mr. Robo, why are you looking so unhappy? The firm's coasting along fine, and if I'm not mistaken, you two have just sewn up a joint project with Kleinworth & Coutts. Mr. Robo: I... this may sound bad, but I think I'm jealous of Mr. Ham. He would up making the better decisions, despite me working far harder on market analysis, and he it all seems so... effortless for him. Maybe he's just born for this. Me: Hmm. On that, first off, envy isn't bad, if used to fuel positive development, and not to tear down others' work. And on the "natural" part, that may be true, but the thing is that Mr. Ham was always Mr. Ham - it has absolutely nothing to do with his recent successes. It's so easy to be true to yourself, when you're on a roll, but when the night comes and the chips are down, that's when that particular facet of character comes in. He may not be an angel by a long shot, but compromising what few principles he has is not something he can be accused of. And, you know, each individual has his limits - a con artist might not steal, a thief might not kill, an assassin might not lie; how fascinating the world is, when considered this way! We are, after all, all visitors at this intersection of infinity, and there is nothing more improbable than us conversing, in this out of all possible universes. One cannot help but laugh in joy at this realisation, even if such moments pass too quickly. There are still material things to yearn for, after all - that exalted state of mind is not for the likes of us yet.  既然二流, 就二流去尽吧 (Source: dm5.com) I understand the desire to be right, believe me - no, make that the desire to be accurate. "Right" has too much moral baggage attached to it. Unfortunately, this does not make for very amiable chats over the dinner table, but I'd take accurate over popular anytime. I guess there's a lifetime to refine this. Mr. Robo: *pacing around* Yes, that's... *door swings open violently, knocking Mr. Robo over* 神密者: 嗨, 老外, 你好! 今天就让我们来谈论关于中新经济与政治相关的话题吧! 我: 贵位是... 神密者: 卑职乃西北大政治科学系欽文仁孝英武勤奋弘功博览风趣幽默倩子仓鼠教授也! 平身,免礼了. 我: 呃, 您懂得说英语吗? 仓教授: 妈的, 又是个香蕉人. *咳一咳* Dr. Chang: Is this better? Me: Yep, thanks. Dr. Chang: No problem. *adjusts glasses* So, agenda for the day is a discussion on a country locked in decades of centralised one-party rule with strict media gagging, maintained under the auspices of Confucian harmony to head off Western democracy, long taken over by naked capitalism despite professing benign socialism, mired in the throes of long-term real estate imbalances exacerbated by population control policies, the incumbent party of which is now anxiously examining any and all possible methods of maintaining growth, in order to preserve their mandate and prevent pesky ideological re-examinations? Me: Actually, it's supposed to be on both China and Singapore... ah, I see. Dr. Chang: Indeed. Me: Well, about that last bit, it's interesting how Piketty has eaten into the public consciousness, as seen by the number of people browsing through the introduction, and how the Prime Minister and his unrepentant hearty nemesis are both citing him; not surprisingly, they're taking opposite sides of the fence, with the likely-soon-to-be-bankrupt blogger pushing the prescription of progressive taxes and minimum wages, categorically rejected by our incumbent leader - though I do doubt that a global tax rate can be implemented, given how U.N. resolutions on, say, children's rights are still in limbo. Case in point, The State's Times has recently run blanket coverage on how both income and spending are up, which was of course duly picked apart by keyboard warriors who decried the usual laxness in distinguishing "Singaporean" and "Singapore resident", the usage of obsolete goods as an indicator, and the focus on "average" instead of "median", all the more as the fact that lower-income households had to spend more than they earned was relegated to a footnote. Dr. Chang: *nods* I'll get to that, but one step at a time. 天下土地 - The Good Earth, Pearl S. Buck Dr. Chang: Despite China and Singapore being nominally under very different political systems, they have a lot more in common than outsiders - even those who recognize that Singapore is not part of China - might recognize. How much of this is down to shared ancestry, I do not want to speculate, but key among the similarities is a shared lust - the lust for land. More precisely, this is expressed as a lust for property, given that the vast bulk of land in both countries is merely leased. In China's case, this is despite the sheer size of the country - who would have supposed that a tiny apartment in major cities could cost over twenty times average household disposable income? It is little wonder, then, that some observers have been forecasting the mother of all property crashes in China's future, dwarfing even America and Japan's colossal misadventures. One could prattle for days on this alone, so I'll just summarize the main points for and against a potential meltdown: *whips out slides* Against:

For:

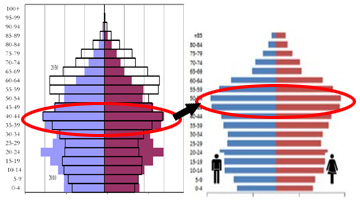

Me: Well, that "for" section's a lot shorter than I thought. Dr. Chang: Ah, that's because it's much more fun to expound on; but before we continue, I'd like to try a little roleplaying. It's not exactly original, but I think it neatly encapsulates a lot of what's going on in the Middle Kingdom. Mr. Robo - you're Mr. Robo, right? - imagine you're my junior partner in a Chinese construction company, and nobody's buying the houses we're building, and we'll work it out through Socratic discourse. Practical Economics Explained  Let's Get Started! (Source: ftdata.co.uk) Mr. Robo: Er, well, we'd probably have to get buyers, right? Put out advertisements, that sort of thing? Dr. Chang: *dismissively* Oh no, it doesn't matter at all, we just continue building as per normal. Mr. Robo: *confused* But why construct, if no-one is buying? Dr. Chang: The houses aren't built for general sale. In any case, most of the peasants can't afford them. Mr. Robo: Huh? Then how will we get funds to cover our costs, if we don't sell? Dr. Chang: We simply get a loan from the banks. Mr. Robo: But we'd have to pay it back, with interest... Dr. Chang: Let's say I borrow 500 million yuan from the banks, and use only 200 million for development. Then, the remaining 300 million is ours to keep, whether the houses are sold or not. After the houses are built, we simply slap a billion yuan price tag on the lot, and gift some of the choicest ones to select public servants. These favoured officials will then do all they can to prevent prices from dropping, to preserve their own fortune; in effect, they will be working for us! Mr. Robo: Ah, but won't the banks ask for their money back? Dr. Chang: Stupid boy, our property portfolio is now valued at much more than the loaned amount, remember? We simply pledge some of them as collateral, and take out more loans! Rinse and repeat! Mr. Robo: *getting nervous* Erm, I don't know... something doesn't quite add up... uh... what happens if the banks eventually run out of money? Dr. Chang: Oh, the government will print more. Mr. Robo: And what if they don't? Dr. Chang: If that happens, we just declare bankruptcy, get on the next flight out to the Caymans, and leave the houses for the government to deal with. All my money is already in foreign banks, anyhow. Remember - houses are not built for living in! At this, Mr. Robo was enlightened. The Way It Is Me: When you put it this way, it sure sounds like property is being held as a sort of "preferred commodity"... Dr. Chang: Yes, I was getting at that. A bit of background here - Chinese cities exist in several tiers, which one might consider as analogous to tranches in securities; Shanghai, Beijing and Tianjin are commonly regarded as "top tier", for example. Despite downturns, they have been holding up fairly well - if not in sales volume - and it is more the not-much-lower prices in second and third-tier cities that are considered most at risk. There is, of course, the reasoning that the empty units will easily be filled, as China's rural-to-urban migration continues. Indeed, this is a real possibility... but only when prices tank to the point that Ah Niu from Shanxiaxiaochun can actually afford to buy an apartment. Now, if official stats are to be believed, Chinese wages have been rising handily. From 2010 to 2014, average annual rural wages have risen from 5900 yuan to 8900 yuan (S$1220 to S$1850), with urban wages from 19100 yuan to 27000 yuan (S$4000 to S$5600). Trouble is, mortgages of twenty to forty times annual income are common. One thing about the one-child policy is that it allows parents' savings to be tapped heavily for such purposes, but frankly this state of affairs must be untenable for many honest everydaymen. Mr. Robo: Actually, it all sounds silly, doesn't it? The homes are there, the people are there, why not just let the people move into the homes? Dr. Chang: Ah, there's another instructive story in this. Have you heard of the tale of the kind peasant boy who saved a fairy, got a wish, and requested for the harvest in the region to be twenty times that of the normal amount? Mr. Robo: Sounds like a very nice boy. Dr. Chang: Well, when he excitedly told his father about it, his father dropped to the ground, muttering 'We're finished.'. The boy was shocked, and his dad had to explain it to him. 'My son, you have a good heart, but this is what will happen - the people in the cities can only consume so much rice, after all, and the merchants, knowing that there is such a gross oversupply, will be happy to wait until the most desperate of us offer to sell at a knockdown price. Further, most of us are in debt for seed grain and farming implements; many will have to sell themselves, not being able to get anything for their crops.' Mr. Robo: Oh. Dr. Chang: Moral here is that, it pays to know basic economics, which is what commentators have been pointing out - you can insist that your apartments are worth 400000 yuan each, and value them in your books accordingly, but if newcomers can really only afford to pay 100000 yuan, economics dictates that prices will eventually have to come down to 100000 yuan, one way or another, whether anybody likes it or not. Perhaps counter-intuitively, it is probably harder to check this realignment with residential property, as compared to more obviously speculative commodities - no-one has to own precious metals, but everyone needs a place to sleep! Worse, while gold doesn't need any special care, buildings do, and to be honest China's not exactly famous for structural longevity. Still, they're doing pretty well in niche mining sectors, unlike here. Mr. Robo: Why am I thinking of Yapese stone money again? Me: So, Dr. Chang, how do you think it will play out? Big Brother, Little Brother - reddit/r/PoliticalDiscussion Dr. Chang: Here, I'd just like to clarify that I recognize that I'm sounding bearish about the Middle Kingdom. Of course, I'm not unique in this - there are plenty of doom prophets, like Gordon Chang - no relation of mine, mind. Certainly, this may be at least partly down to a bias from Western news sources, as naysayers are sometimes accused of by the pro-China set. Me: Just to add on here, it's interesting how national stands are made according to prevailing conditions. On the defeated referendum on independence for Scotland a couple of weeks back, Spain was strongly against it to the extent that they were prepared to block admission to the EU if it went through, due to their own Catalan separatist movement, while Russia was hoping for a yes vote to legitimize Crimea's split from Ukraine. I gather official mainland Chinese media won't be giving too much air time to current pro-democracy protests in Hong Kong, either. Dr. Chang: Yeah, politicians, eh? But let's cut to the chase. *presses remote*  Population Demographics (Left: China 2010, Right: Singapore 2011) (Sources: globaleconomicanalysis.blogspot.sg & population.sg) These demographic charts have been scaled to match each other on the vertical age axis, and it is almost uncanny how similar they look, with the exception of Singapore being almost exactly ten years ahead in the ageing process; Singapore's "bulge bracket" is in the 45-54 age group, which will begin retiring en masse in ten years, beginning about 2025, assuming the current retirement age of 65. However, before you get too concerned, note that these are citizen-only numbers - it looks a fair bit rosier for Singapore when everyone else is included:  Singapore, Everybody (Source: indexmundi.com) Note that this looks superior to even Africa's demographics, with the huge working-force support in the 20-35 age range. This is, of course, down to the augmentation of foreign labour. Me: Mighty impressive, seen like this. Dr. Chang: Now, the main diagnosis. How will the real estate situation in each country play out? China first - a very rough eyeballed estimate is that the number of homebuying adults will fall by a quarter of so, over the next couple of decades, without even taking into account probable emigration of the wealthy set. The question then is: will there be an oversupply of housing, all the more as kids stand to inherit their parents' and grandparents' homes per the 4-2-1 structure, and if so, how will real prices stand up to the market? As just pointed out with Mr. Robo, for all the insistence from Singaporean developers, if strangely not local ones, it is unclear as to how urban prices in the ballpark of twenty times annual wages can be held in the long run, despite the obvious incentive to prop them up to claim booming provincial and national GDP growth, a fact that the authorities seem to have acknowledged. Adding to this, it has almost been funny to witness how China's GDP figures have been worked - after some anxiety several months back about how they would fare against the official target of 7.5%, they officially achieved a figure of... exactly 7.5% - not that anyone wasn't expecting that. Or, in other words, 君要臣报七点五成, 臣不得不报七点五成. Skipping on to Singapore, property prices have never been far from the public consciousness either, with first an MP, and then a concerned member of the public sounding out their worries about oversupply. The latter summed it up in a sentence: "Singapore, being a small open economy, cannot afford a plunge in real estate prices." (but big big rise, no problem!) Despite this, as you have mentioned previously, Singapore is in a fairly good position as regards to property prices - being small, you could, if really required, simply let in a couple hundred thousand expats ahead of schedule. Of course, this is an option not quite open to China - there probably aren't a spare hundred million workers just floating about. It may be said that tiny has its advantages too - get a big multinational or two to be based here, and you're set for years. Convergence Political opening is preferable to nationalism, but the [incumbent] party probably is not too keen on this idea as it is a threat to their power and could threaten the political-economic institutions that have made many of the party's family members very wealthy. Political opening could threaten both the party's political power and its material wealth. This could lead to instability which could further hurt the... economy. " - reddit/r/Economics [Question: Again, China or Singapore?] Dr. Chang: And now, a video. 27 September, 2014  (Source: theguardian.com) 0045 hours, Civic Square, Hong Kong, China. About a hundred student protestors had broken into the square, having scaled the surrounding fence. Police begin to disperse them, carrying away those who did not leave voluntarily. Over seventy were taken into custody, including leader Joshua Wong.  (Source: straitstimes.com) 1700 hours, Hong Lim Park, Singapore. About a hundred CPF protestors had broken into the YMCA event area, marching in front of performing special needs students while yelling slogans. No official reaction was elicited, according to leader Han Hui Hui. Aftermath: Joshua Wong internationally hailed, Hong Kong protestors praised for orderly and peaceful behaviour (well, until materially provoked, and not by mainlanders) Han Hui Hui largely disapproved of even by CPF issue supporters, and further drew over 5000 signatures on a petition to revoke her citizenship (not that it'll happen, but...) Alright, human, you can take your palm off your face now. Me: Now, I've always admired those with the guts to stand out on political matters in this environment, but somehow our most ardent activists appear to have a tendency to swallow the simplest of baits. I mean, it might be true that the YMCA's choice of venue was strange, but this silliness won't help them and associated opposition causes from shaking off their "looney fringe" designation anytime soon. It's a real waste of those of their points that are credible, really. Dr. Chang: Heh. Actually, what I found most striking is that Hong Kongers - whether justifiably or not - are actually engaged in a popular demonstration over principles, and against their other countrymen at that; you Singaporeans may really be nice to a fault, come to think of it. Me: Well, sometimes I do wonder - what if our land area suddenly doubled overnight? Would the extra space alleviate the stress? And is our current situation actually, all considered, not too bad? Actually, from recent interactions, I do have the feeling that quite a lot of people here, especially those with kids, just don't want trouble - as long as I draw a decent salary each month and my child gets into a good school, why bother too much about the long-term, bigger picture? It's so much easier to agree and follow... Then I think, people are just people, sometimes good, sometimes less so - maybe I shouldn't give a shit, and focus on looking out for number one, any way I can.  (Source: mangahere.co) Dr. Chang: Not a bad idea, I'd say. 好吧, 我也该先行一步了. 下次再见! 纷纷扰扰/千百年以後/一切又从头 "A smart city needs a dose of chaos" Next: Civvies Redux

Trackback by how does a reverse mortgage work

Trackback by Sexual Intercourse Enjoy And Bahamian Women.3.Mov

Trackback by Resorts in central america and caribbean

Trackback by Free Bitcoins Sites List

Trackback by best dating sites

Trackback by how to lose weight with diabetes

|

||||||||||||||||||||

Copyright © 2006-2025 GLYS. All Rights Reserved. |

||||||||||||||||||||