|

| |

|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ entry views: 782 today's page views: 9 (2 mobile) all-time page views: 3386832 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1226 page created Sat Jun 21, 2025 00:28:31 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

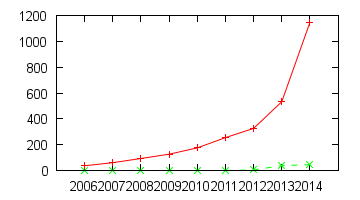

- Marvel does sneaky social commentary  One... meelion pageviews! (Source: ytimg.com) And, updating last year's average daily pageview chart, with the green curve being mobile-platform views:  I even saved the gnuplot file I even saved the gnuplot file[Errata: Corrected chart on 10 Dec, data parsing error. Whoops.] With those preliminaries done with, the gossip for the week. On computer science, the powers that be are pushing programming to (a handful of) primary and secondary schools, under the vision of Making Singapore a Smart Nation (really). Catchy slogans aside, I'd gather that less toeing of the party line would contribute a lot more towards that goal, but that wouldn't get many brownie points. Meanwhile, torrents are finally being put towards their intended use, with a service meant for sharing research data making its appearance. The eight terabytes it has currently indexed isn't that much yet, but these things take time. And over in Korea, there're customized sticks for taking selfies. Which are getting banned. For Bluetooth radiation. A little overprotective there? Zooming out, NASA's targeting Mars, some Beijing researchers managed to state the obvious about demand-free construction, and the world's gonna get more people than anticipated, courtesy Africa. Well, China may at least have the answer to that last one, quality control depending. Locally, the long-ongoing mushrooming of moneylenders/pawn shops has made its way to The State's Times forum, together with a concerned doctor writing in to protest against the high interest rates charged, which can go up to 20% a month, before extra fees. On this, recall the curb to 4% proposed last month, which was described by horrified lenders as not being commercially viable. Now, while I try to applaud each gesture that the incumbents make towards the little guy, rare as they are before election season, and have no particular love for moneylenders, the relevant minister could perhaps have quickly recognized why the latter may actually have a point, from the figures given. Assuming that the Moneylenders Association's estimate of a 20% default rate is true, then for every S$10000 they lend out, they would expect to lose S$2000 of that principal to defaulters. Then, at 4% monthly interest, the remaining S$8000 would take half a year simply to break even! Of course, there are a number of variables involved, such as how economical it is to recover monies from defaulters (I suspect not very), how quickly those defaults tend to happen (the later the better for the lenders), and how long the average loan is for (arguably the longer the better, since one reliable customer repaying for six months beats a mixed bag of six month-long borrowers), etc. Still, I do suspect that the lenders may have a case, given that their customer profile would be composed of those who fail the vetting of commercial banks, who tend to charge about 2%, as the learned minister alluded to. Problem is, this being a commercial business, one can't simply legislate unprofitable rates - squeeze too much, and underground loansharks would only be too happy to step into the breach. In economic theory, this can be modelled in terms of expected return with a risk premium, though of course it breaks down at some point - one could lend at a 1000% interest rate to someone desperate enough, but this wouldn't mean jack if the borrower simply can't pay it back (e.g. Greece) Moral: being poor reinforces the state of poverty. It sucks. While this was going on, another association tried their luck leaning on the government, as real estate bigwigs pleaded for supportive measures, in the wake of a disastrous... four percent decline after surpassing all-time highs. On this, another forum contributer (rightly) questioned about their commitment to "stability" and avoiding "unintended outcomes" when home prices exploded a few years back. Then again, the too big to fail shtick worked elsewhere, so... Bonus: The Who Would Win of the year. Next: Maintenance Mode

|

|||||||

Copyright © 2006-2025 GLYS. All Rights Reserved. |

|||||||