|

| |

|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ entry views: 144 today's page views: 478 (17 mobile) all-time page views: 3386519 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1226 page created Fri Jun 20, 2025 10:52:11 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

Remedial Fun Seen in Maju Camp:

Who says the army doesn't have a sense of humour (sometimes)? To top it off, the programme for the latest session included captain's ball... between two teams of approximately fifty each, with two balls at once, in the multistorey carpark. Somehow, none of the lights got hit, and only slightly less amazing, grown men - mostly strangers - quickly got into the spirit, even if there wasn't all too much contact. Save around the captains, where defenders mostly ignored the rule of keeping at arm's length after awhile, but no-one much cared. Interestingly, with two balls, they usually wound up at opposite ends, together with the teams who automatically split into roughly-even offensive and defensive units (and a very sparse midfield). Nice thing about these types of games is that it's hard to take it too seriously, since no one person can have all that much impact. Of course, those who are slightly more into it will tend to park themselves much closer to the captains, but overall there's a huge amount of fortune involved. Okay, it's not that hard to score from any reasonable distance with a measured throwing arm... but where's the joy sans chaos? You get to meet people too when buddying-up for exercises (even if most of them would rather not be there - let's be honest lah), such as an SIM Business and Finance student, and even an NUS Economics graduate (now turned entrepreneur) from my batch. While I'm definitely not the most social guy, I don't mind the odd interaction. There will usually be a couple of real D.I.Y.-ers each session, though - and how can I forget the fellow who began quite vocally collecting the running tags during the cooldown exercises? No *beeps* given! [N.B. Idea of the month: Pizza by the slice] One Gig MyRepublic did it again with their offer of 1Gbps fibre broadband for S$50 (immediately seized upon by The State's Times, again with less than solid justification), which I upgraded to without hesitation. Oh, not for the surfing, but mostly due to MyRepublic's Teleport service offering video streaming from overseas... such as premier league football from New Zealand for S$20/mth (HD). "No incentive to bid" for sought-after content in future, SingTel? Better not bid then, if you think jacking package prices up to S$60/mth through sneaky bundling of channels is what consumers want. It's not that most users will perceive that much of a difference, what with speeds in practice being dependant on so many other factors, but one has to give it to MR for shaking up the place a bit with the Big Two stuck on 500Mbps for S$70, or 1Gbps for S$400 (!). At least they haven't been eyeing additional non-net neutrality payments... for now. After the scare it gave me, the latest update of avast at least made up for it with its integration with Chrome and provision of seamless ad-blocking. More specifically, I don't actually mind most online advertisements... just the ones with auto-start audio that has users scrambling to find the right tab to switch it off (and which Chrome has solved, to a degree). And those non-skippable thirty-second blurbs on Youtube videos. In fact, I make it a point to avoid products that bank on such intrusive advertising, and I suspect I'm not alone in this.  Norton *does* put up a good argument, though... (Source: Hardwarezone Forums) While we're on this, do Asian guys get the benefit of the doubt on technical subjects? I'd say possibly. However, refusing to accept (or having parents who do the refusing part) that one can't do something probably plays a bigger part, regardless of the sensationalist taglines being slapped on the concept. Not that it matters, given the reach of the NSA, who have now been revealed to have bugged upwards of a hundred thousand computers, chances are that we can just rely on helpful secret service agents next time. RF bug detectors, anyone? Taking A Hike - gov.sg, 16 May 2012 "Since 2005, wages have risen by about 30 per cent. Over the same period, public transport fares have increased by 2.7 per cent cumulatively." - Minister for Transport, 12 Nov 2013 (yes, repeat) [Really, how they calculate one?] That's transport fares, up 3.2% (with a repeat next year), to "help the poor", but frankly given how past such attempts tend to pan out, the needy would be better off left alone. Going through the points:

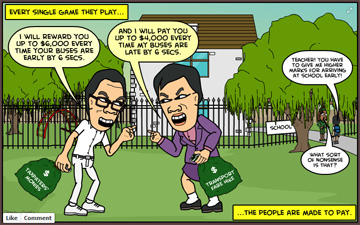

Now, other prices are increasing across the board, so maybe a hike isn't that out of order. The general complaint however is that reliability and comfort appear to be decreasing in tandem. Oh, there have been cute ideas like palming a few thousand bucks to-and-fro depending on when the buses arrive, but I daresay none of the involved parties will really care about those nickels and dimes.  Masak-masak lah, dey (Source: Demon-cratic Singapore) Again, the point is that whatever action that these public transport providers take or do not take, does not appear to materially affect their profitability. Things will simply happen such that they rake in a hundred million or so - who cares if they're making a healthy net profit, if one division can be described as "financially ailing"? For that matter, who today remembers the 1987 pledge by a then-minister that "the private company... set up to operate the MRT will not be allowed to profit at the expense of the public"? When the government has to put up a no-strings-attached S$1.1 billion, perhaps it is best to just drop the pretense that the transport providers are independent, competitive private firms. It's Coming, Bub Further afield, the most provocative article on Singapore for the week was Jesse Colombo's claim that our economy may be heading for an Iceland-style meltdown. Expectedly, the MAS denied everything, buttressed by staunch ally The State's Times, which drew a follow-up by the original author. Thing is, what Colombo said was not quite new. Look at the points that he raised:

Note that none of these positions, by themselves, are that controversial; what the relevant authorities are against, it seems, is the conclusion that follows when they are strung together. It is worth noting the The State's Times forum writer, in defending the local economy, has as a key reason "the population is projected to grow till 2030" - which was covered in the Forbes piece as a negative. All right then. Keeping in mind that the MAS denial is largely information-free - which central bank would freely admit that it is in trouble until a blowup is imminent, after all, as Colombo also notes - readers should form their own opinions from the facts (notably, Iceland kept its triple-A rating until five months before their collapse, thanks to agency wisdom) In any case, is anybody seriously doubting that there will be Big Trouble in Little China when rates rise and property prices dip? Econs Reading/Viewing List Fight of the Century: Keynes vs. Hayek! [Lyrics]

Next: The Big Three Zero

|

||||||||

Copyright © 2006-2025 GLYS. All Rights Reserved. |

||||||||