|

| |

|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ entry views: 4490 today's page views: 29 (2 mobile) all-time page views: 3394546 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1227 page created Sun Jul 6, 2025 01:35:06 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

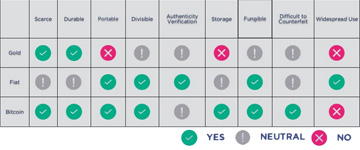

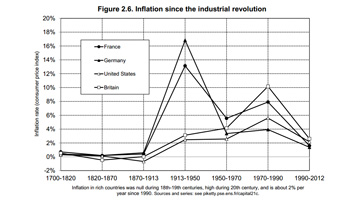

With a new year upon us, I received an invitation letter from H.L. Ham to their 2015 strategy session. I figured that I had to refill their food bowl, so why not? Mr. Robo: Human! You're here!  We're going to start out easy today. (Image sources: flickr.com & dailymail.co.uk) Me: What in the world happened to you?! Mr. Robo: About that, remember that live ammo that "was probably safe" because it was dropped a few times without incident? Well, Mister Smartypants here persuaded me to keep a few crates in my cubicle. *glares at Mr. Ham* Mr. Ham: *defensively* Hey, don't look at me like that. I've got to entertain guests in my corner office. Furthermore, I paid for the hambulance and hospital bills in full, as usual. Me: If you're not feeling well, we could do this another day... Mr. Robo: No, no, I'm fine. After having put so much effort into the firm's annual report, I do want to show it. Me: Oh, okay, then. Seeing as this month's gonna be hectic for me too, I might as well get some overdue discussions out of the way too, in case the next few weeks are off. Mr. Ham: *claps hands* So, what are we waiting for? The next New Year? Full Disclosure Mr. Robo: I'll cut the bullshit then and kick off with a slide, carrying on from our latest full review at end March 2014:  Ref: [1] [2] [3] (Source: bitcoinwisdom.com, Bitfinex prices) *checks figures* with the ongoing dip below US$300, H.L. Ham is only up about 40% on our Bitcoin dealings for the last three quarters, from our three major trades and in-between utilization of assets. On hindsight, our latest return to the market might have come slightly too early. H.L. Ham's year-on official call from April 2014 on was a daily median low of at least US$350 and high of at least US$700, both of which turned out to be slightly optimistic as can be seen from the chart above, and as the human noted then. Mr. Ham: *waving cigar about* Then again, the human made some rather high-end year-end predictions during the June boom, so don't read too much into that. Mr. Robo: Ay, it wasn't too bad a range that we set out - shift it down about US$30, i.e. US$320-670, and we'd have had it more or less spot-on. I'd say that the all-inclusive model we designed then, incorporating everything from historical tendencies to the mining economy to market psychology, has held up fairly decently. That said, it's true that I'd have hoped for the price right now to be a teeny bit higher. It's been something of a steady slide from July to October, arrested with the monumental Slaying of the Bearwhale event that saw a massive thirty thousand coin dump taking price down to US$275 in an instant, which we've thankfully avoided the worst of. In a way, the fall in price could be seen as strange, given that there has been no lack of adoption - Paypal, TIME and then Microsoft have embraced Bitcoin in turn, which would have been unimaginable a while back. Unfortunately, the really big events that we had been awaiting did not happen - the "BitLicense", a regulatory framework that New York is developing and others are eagerly waiting to ride on, has been in the works for over a year, but may finally be coming out. The Winklevoss twins' COIN ETF has also been stuck in limbo for about as long, delaying the on-ramp for more conventional investors. So, the bottom line is that Bitcoin has been named the worst-performing currency of 2014 - though getting referred to as a bona-fide currency could itself be considered a step up. What Is It Again? Me: Going back to the basics for a bit, in our last musings on the true nature of Bitcoin, I held that it would - eventually - be considered a commodity store of value. It has not done so very well in the past year, but I haven't changed my mind yet. Just an overview, from the Winklevii's not-very-hot presentation at Money 2020:  (Source: winklevosscapital.com) It's not totally authoritative, mind you - one could argue that Bitcoins are less than durable if one loses his private key, for instance - but it isn't a bad quick-and-dirty overview. I will first discuss what Bitcoin's edge is, next its weaknesses, and then what goes into its nominal value. So, the edge first. In one word, transparency. In another, neutrality. In a third, accessibility. By transparency and neutrality, I refer to the protocol and production schedule. The entire edifice has been built on A) there only ever being a maximum of 21 million Bitcoins, and B) the network adjusting to produce X Bitcoins every ten minutes or so. Lose either of these, and all bets are off. By accessibility, I refer to one being able to verify and transact in the underlying commodity easily. In contrast to, for example, gold, there is little excuse to handle representative certificates because the actual object is bulky. This is an understated advantage, given how tempting it is to over-issue certificates, which is after all how our entire fiat system came about. Compared with the headache in auditing precious metals - does that bar have a tungsten core? - a Bitcoin-based enterprise can conclusively prove to all and sundry that they control X amount of coins, without special effort. Now, the outstanding challenges. The price is, of course, a concern, but as we have long noted, that US$1000+ peak could not be more of a bubble if you had dipped it in soapy water and blown it through a ring; discounting it, there remains a very healthy 200% increase over slightly more than a year, and plenty more if you peek further back. In terms of the price, problem one has to be the appearance of outlets that profit from a fall in the price. Shorting at 2.5x leverage has been possible at Bitfinex throughout, but a few months ago, some Chinese exchanges upped the ante. Okcoin released 20x futures, and 796.com took it to 50x. What does this mean? Well, with 50x leverage, the idea is that any earnings are multiplied fifty-fold, but a 2% change in the wrong direction would wipe one out completely. In practice, leverage this high tends to mean tricky settlements, since the actual order book is likely not that "neat", which has led to socialized losses and accusations of early liquidations. To this, I can only be reminded of the bucket shops of old. Merchant adoption has, while important, also added to selling pressure, and the downtrend had to an extent fed on its own momentum - falling prices mean profitable shorting and less incentive to buy in yet, which forces marginal miners to liquidate more of their coins to pay their bills, which further drives the price down, or so the story goes. However, more than either of these, what I feel is really keeping Bitcoin down is that it remains hard - and dare I say, not a little intimidating to use. Standalone hardware wallets are still expensive, and there's a fairly steep learning curve and a lack of safety nets - what if I lose my phone and mobile wallet? What if I type a character of the unintelligible address wrongly? What do you mean those coins that I sent to that typo-ed address are irredeemably lost? And so it comes down to this - what the average consumer fears is not so much complicated technology (money transfer by SMS has been common in Kenya for years, after all), but the possibility of not having somebody to hold responsible; and when you're talking about potentially thousands of dollars or more, who can blame them? The Concept Of Value Certainly, there is a non-zero chance that plunging prices could presage a wholesale collapse, but for someone who sketched out a US$200-400 range the December before last, I'm not overly concerned at that scenario yet. If you're into technical tea-leaf reading, some forecasters have built up a fairly accurate record, but do keep in mind that past performance is no guarantee of future results, as always. One area where there has been unadulterated growth in the cryptocommodity sphere is in academic research papers, which has exploded in the past year. As might be expected, these works range from computer science to finance and economics, and in the latter, the standard objection repeatedly comes up - Bitcoin is eventually deflationary. You can't base a modern economy around that! Gold is a barbaric relic, but ignore the fact that its value has held up far better than paper! This is probably a good time to work Piketty's Capital in: one of the observations that he is fond of repeating is the implicit understanding of a 5% real rate of return in 18th and 19th century literature (in particular, Austen and Balzac) - once informed of the value of a character's holdings, the reader is assumed to know his income too. For example, Mr. Darcy's £250000 estate translates to an annual take of about £12500, a princely sum in those largely inflation-free days.  (Source: piketty.pse.ens.fr) We all know that Piketty's main thesis is that we are moving back towards the prevalence of income from capital (i.e. investments, as opposed to labour, i.e. wages), and even foregoing his equations, it is not hard to see why. Imagine that a wealthy man in those days spends a constant 1.5% of the 5% return on his family's upkeep, and reinvests the rest (possibly in government bonds, which very conveniently return around 5%). Then, his fortune would double every twenty years, without any additional skill or effort! Obviously, this has its limits, since it would imply that he would go from owning, say, two houses in 1700 to a thousand in 1900, and there are indeed many pitfalls in the way, not the least of which is the division of fortunes among offspring and simple living beyond means (with the "three generations" observation surprisingly constant across cultures), but also the fickle hand of natural disaster, war and politics. But back to Bitcoin - where then would its value come from? Recall that we have described the value of gold and other luxury commodities as a bit of a "reliable insanity". It might be time to shed a bit more light on that madness. The mainstream investing opinion remains that (crypto-)commodities are fads with no solid basis, and one should keep to buying stocks in mostly blue-chip companies that produce goods for which there is real demand. Under this worldview, there is no room, or need for, commodity stores of value. All one needs is to rely on those nice central bankers, who will cleverly adjust the fiat money supply as needed (and without any bias, no sirree!). What could possibly go wrong? Well, if history tells us anything, quite alot. Maybe not today, or even tomorrow, but in five years? Ten? Fifty? In the end, fiat means that it can be created at will, despite best intentions, as so many continue to come to realise. Surely, it is not unreasonable to park some amount of one's wealth (i.e. value) in an asset class maintained by a gatekeeper more disciplined than nominated humans? Definitely, we wouldn't need such hedges in a perfect world, but then we'd be zipping about in solar-powered jetpacks too, and I don't see either happening anytime soon. So let us say that there is demand for a reliable, neutral store of value. So enter gold, which ticks most of the boxes. Then why does silver have any non-industrial value? It could be argued that even if there was a hedging demand for X units of value, it could all be assigned to a single commodity, all things being equal. Of course, things are far from equal; one could imagine two very similar neighbouring countries, who differ only in that one has only gold mines, and the other, only silver mines. Which metal then should be used as a store? Clearly, it is likely that this function would be split between the metals, which is indeed what tends to happen. Continuing this thought experiment, let us say that gold and silver have been used as near-universal stores of value for millenia (hence, a 6000 year-old "bubble"). Imagine now that a guy is rooting about in his backyard, and discovers that he's sitting on a mine that contains a large quantity of a new metal. Excitedly, he calls for backup, and a team of engineers and scientists soon reports that it is a whole new element with physical and chemical properties roughly the average of gold and silver, and which the guy unimaginatively christens "silld". Moreover, the capacity of the mine corresponds almost exactly to known accessible worldwide reserves of gold. What then is the price of silld? The Case Of Silld One could reason thus: silld is a better conductor of electricity than gold, does not tarnish either, and is no less scarce - surely, its value must be similar to that of gold? If so, the man (or his nation, depending on land right laws) is sitting on US$8 trillion (not overly outrageous, given that Saudi Aramco estimates it has US$30 trillion worth of oil and gas reserves) If the mineowners curtailed production severely, one does indeed expect silld to be far more expensive than gold (like aluminium was). However, say that they decide instead to mirror global gold production of some 2800 tons annually. At US$1200 an ounce, this would fetch US$120 billion a year. New question: if silld production is fixed for some reason at 2800 tons/year (with negligible excavation costs), what would be its price in the open market? I'd suspect that it would be very significantly lower than US$1200/ounce, the prevailing price for gold. But does this make sense? Essentially, silld's an improved Gold 2.0! Ah, but there's one difference - there are currently about 170000 tons of gold, spread out among very many holders, who largely accept it as being worth around US$1200/ounce (otherwise, they would have sold it). Further, one figures that they value it as such, in large part because they exchanged actual value for it. We can imagine a rich Indian farmer who sold some lands for a kilobar, that his son can someday buy a house, or a refugee who liquidated his assets for some coins he (rightly) trusts will retain value in a wholly strange land. For silld, there are no such invested parties as yet. One could of course pay US$1200/ounce for it - but will he be able to get that much value back out of it when he wants to? Perhaps... but if he wants a hedge, why not just purchase the far more established gold? This is of course not an absolute argument. Stranger things have happened than a cartel forming to fix the resale retail price (as with diamonds), or the country owning the mine to peg their currency to their new resource. However, if one had to bet, I'd wager that adoption would be gradual, not without hiccups, and fairly erratic - but with a good chance of coexisting beside gold etc after some decades/centuries. By Any Other Name My intelligent readers will, no doubt, have by this point have recognized that "silld" is a model for a cryptocommodity. Taking this analogy further, let us suppose now that silld has the magic property that it can be transmitted over cables, like data, and also that while nobody can counterfeit silld, anybody can conjure up his or her own similar variant metal, but which is easily distinguishable from silld (and each other). Notably, the metaphor extends even to the mining operation, which has continually been getting harder - and more costly. Each of these metals has its own annual yield, mining rate, etc, but it should be evident that their eventual success is likely to be strongly correlated with its spread - the number of individuals who have an interest in it. Mr. Robo: Wait up, human. Then why did equal-distribution coins like Auroracoin fail so miserably? Did they not achieve near-perfect spread in their communities to begin with? Me: There is an old story about a wealthy businessman, who feared that his pampered son would grow indolent. Therefore, he sent his son to apprentice with his friend for a year. His friend however treated the boy as a honoured guest, and indulged him while not giving him much to do at all. At the end of the year, the friend paid the boy with a gold coin, which he then proudly showed to his father. Astoundingly, the businessman took it and threw it into the river. Mr. Robo: Didn't the boy get angry? Me: Well, as the story goes, no. He was more bemused than anything, which told his father that he had made the wrong choice. The next year, the father sent his son far away to toil under a hard taskmaster, whom he did not personally know. At the end of that difficult year, the son got the same coin. This time, when the father made as if to throw it, his son snatched it back immediately, and the father was pleased.  And I raise you a leg. (Source: mangafox.me) Mr. Robo: So what you are saying, is that those pre-mined equal-distribution cryptocoins failed, mostly because their owners did not value them? Me: More or less, yes. They had not projected value onto the coins, out of their own free will. I believe that the origin of value basically reduces to this, trite as it may sound. Critics may look at somebody with 100 Bitcoins and complain that there is absolutely zero basis for them being worth US$30000, because those coins were mined in half an hour on a personal computer back in early 2010, with next to no effort. Indeed, on this, they could well be right. However, it is also very possible that these 100 Bitcoins took a slightly different path. Say:

In this case, one can hardly accuse most of the buyers of freeloading - a few took losses, but each of them put in a certain amount of value, some probably in the expectation of gaining value - not that there's anything wrong with that. So, instead of railing against undeserving get-rich-quick schemers, one could perhaps consider the unavoidable process by which value is recognized and accumulated; I daresay this "anchoring" stabilizes prices somewhat, as holders dislike selling at a price/value lower than they put into it. The Year Ahead Me: And so... hey you, wake up! *raps table* Mr. Ham: Huh? Ah, is it time for the price predictions again? *whips out pencil* I'm all ears! Me: Just a bit more. Conclusion then is that to thrive in the medium-to-long term, Bitcoin and other wannabe cryptos have to spread. While its nature makes it impossible to determine exactly how many users there are, most estimates I've seen top out at a few million, with maybe a hundred thousand or so active each day. By way of comparism, Snapchat has over 100 million, and Tinder has 10 million daily users. Oh, and both are valued at more than the Bitcoin network. Mr. Ham: Yeah, Bitcoin should, like, throw in profile photos. Me: Thing is, I can't decide whether Bitcoin's current inflation rate is too high or too low; some have blamed the 3600 coins generated each day for taking the price down, but on the other hand, two-thirds of the coin supply is already out in the open. That is, any significant redistribution in relative terms has to come from current holders, and I foresee only big price movements - in either direction - helping that along. Mr. Ham: *hopefully* And they are... Me: *sighs* Fine. Mr. Robo, let him have it. Mr. Robo: In light of the maturing Bitcoin marketplace, and mindful of manipulative operatives, the firm of H.L. Ham predicts a conservative year-on daily median range of US$200-600 for 2015, as the sector continues to consolidate. Key points to look out for would be the reaction if the US$266 level of the bubble before the last were to be reached, as well as of course the BitLicense and COIN ETF. Me: Considered calling it quits? Mr. Ham: Nah, not really. Being in Bitcoins has opened up some... unconventional opportunities. Unfortunately, they're classified. I'm sure you understand, human. And hey, when China's blowing up stuff to hit GDP targets and stodgy Britain's joined Italy in incorporating oohlala to boost their own figures, it's almost as if everyone's afraid that their fudged numbers wind up on the low end. It can't hurt to be hedged, given all this... Next: Slow Week Out

|

|||||||

Copyright © 2006-2025 GLYS. All Rights Reserved. |

|||||||