|

| |

|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ entry views: 284 today's page views: 657 (22 mobile) all-time page views: 3386698 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1226 page created Fri Jun 20, 2025 16:34:07 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

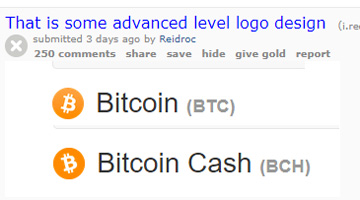

- win liao lor Me: ...and they looked at me funny, when I revealed that I had discussed market strategy with you hamsters. And it's not like they ever sincerely tried, you know. Like, I don't land in Rome and expect to speak fluent Italian off the bat, and then diss the language when it doesn't work that way; I mean, when I started out with hamsterese, it took some time before I got past "thanks for the sunflower seed, sucka" and "back off, or I bite", but nothing that more immersion couldn't fix. Mr. Robo: *shrugs* Humans have always been like that, when interacting with non-human species. But it can't be helped, I suppose; some of us are just too tasty, and it would seem kind of bad manners to sauté one's dinner companion, after making ardent political conversation... wait, it might actually be easier. Me: Yeah, people are often kinda bad losers on such topics, but it's easier to handle as one gets older and slightly wiser. Getting busier is another thing, I can't even find the time to blog as often as I would like to. But back to business. Mr. Robo, the Bitcoin summary. Mr. Robo: The entire thing? Me: Nah, save some for the annual general meeting letter to the shareholders. Mr. Robo: Fine, let's see... to begin with, BTC-E, that slightly-shady exchange that somehow managed to survive with little incident all these years, has finally bitten the dust a week or so back - and, get this straight, it appears that they were responsible for laundering the proceeds from the Mt. Gox hack, including by sending some stolen Bitcoins back to Mt. Gox. As it turns out, Uncle Sam might have arrested the wrong guy (not even all that rare), with the actual funds pending disbursement to customers... but we'll see about that. Alongside this distraction, segwit deployment via BIP91 reduced-threshold MASF has triggered through MEME MAGIC, with segwit itself scheduled to lock in any day soon, allowing actual usage by the end of the month. Attention had thus turned to the ill-conceived 2x hardfork, which has already been beset by bugs after being rushed contrary to proper software practices. Despite that, Bitcoin would nevertheless undergo a hardfork, with a breakaway faction launching Bitcoin ABC/Cash, retaining the non-segwit codebase with increased blocksize.  You can just feel the effort and originality behind Bitcoin Cash (Source: reddit.com) Me: Now, just to reiterate: anybody can fork Bitcoin, and at any time. Indeed, countless lesser-known cryptocurrencies have started life as a Bitcoin fork or clone. A number of them, such as CLAM, Stellar Lumen and Byteball, have further tied token distribution to the state of the Bitcoin blockchain, in effect attempting to boost their own popularity by "airdropping" ownership to Bitcoin holders. Others, such as BitcoinDark and BitcoinPlus, have gone as far as to hijack the brand directly... but, you haven't heard of them before this? Me neither. Bitcoin Cash would however represent probably the strongest direct challenge to the Bitcoin name that the crypto has ever encountered, claiming as it did both the full history, and the brand. However, to put this in perspective, this is a little like investing in a printing press, and issuing a "SU Dollar" with matching denomination and serial number, to each person who shows you a particular US dollar bill for the first time. Obviously, anyone can do that with some upfront investment - and likely even legally, providing that there is no danger of the SU Dollar being mistaken for the original article. The question then is: how much should SU Dollars be worth? Of course, the analogy from physical banknotes to cryptos isn't perfect. Issuance is near-effortless digitally - forking a codebase is essentially just copying-and-pasting files - but supporting the system is another thing. To begin with, there's the hashrate required for proof-of-work, which BCH is frantically ramping down, and then there's retailer and user acceptance, which might be much, much harder to get. That said, some exchanges are supporting the BCH token, if slightly grudgingly, due to it having non-negligible value for now. Mr. Robo: H.L. Ham has dumped BCH at above 3000 Yuan pp. at ViaBTC as instructed, human. Me: That did turn out a reasonably good rate, given what we could discern from the poor liquidity. There were some outliers before the first batches came in, but BCH appears to have settled at about 1400 Yuan equivalent currently. I don't rule out a future pump, but that would just be gambling. Mr. Robo: And, in any case, BTC's burst US$3300 this weekend, representing an MCAP of over US$50 billion, so it's almost like the sensible people in the room are just glad to be rid of the most militant big-blockers.  Comrades, I think they're onto us. (Original source: r/bitcoin) Me: Can't argue against free money. And, Mr. Robo, you should seriously be knocking Mr. Ham up for a raise. You've been working at H.L. Ham for, what, four years now, and it sounds like you're not even getting a cost-of-living adjustment. Remember, employees who stay at a company for more than two years earn 50% less on average, so if he cites loyalty, throw this figure right back at his face. Mr. Robo: Eh, I don't know... Me: Be brave, hamster. Tell me how it turns out. Got other stuff to settle. [To be continued...] Next: Happy National Day!

|

|||||||

Copyright © 2006-2025 GLYS. All Rights Reserved. |

|||||||