|

| |

|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ entry views: 218 today's page views: 297 (29 mobile) all-time page views: 3248445 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1215 page created Mon Apr 21, 2025 15:26:19 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

Of a man who only did hodl Never was sodl His digital godl He did this until he was odl - from r/bitcoin Ditto. Mr. Ham: *adjusts monocle* Gee whiz, just look at how this darned Bitcoin market's acting up again! This right ol' kerfuffle must be down to my blasted research associate intern. Oh well, time to kick him square in the nuts for this. *Mr. Ham strides to Mr. Robo's desk, and does the deed* Mr. Ham: ...what the... ow! My toes! Mr. Robo: Aha, I knew that was coming after the last time, and thus I took the precaution of stuffing a thick metal plate down my pants... arrrrghhhhh! *Mr. Robo doubles over in delayed agony* Me: You're a quick study, Mr. Robo, but just note that that doesn't disperse the force properly - you should really invest in a good armoured jockstrap. *looks around and sighs* Let me get the ice, before we begin this extraordinary general meeting of the firm of H.L. Ham, proper. Nay - the trading wisdom of r/bitcoinmarkets  We disapprove. Harrumpph. Brought to you by the SEC. (Original source: cuteoverload.com) *One human, and two sullen hamsters, sit around a table* Me: Cutting to the chase, I'm sure both of you are aware that the SEC has denied the Winklevii's request to list a Bitcoin ETF, which has been near four years in the making, and despite glowing statements of support. In particular, the disapproval hinged on two points:

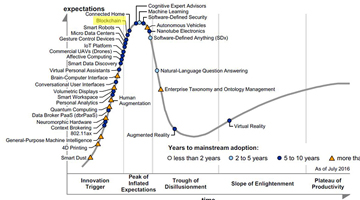

Mr. Ham: *puffs on cigar* As much as it pains me to admit it, their reasoning is mostly sound - why, take your fill of that absolute wankery, on the last day of the decision deadline: knowing that many punters were banking on price movement as a secondary signal, it got pumped from a base of about US$1200 to a new all-time high of US$1350 in a few minutes, before a massive crash to US$1060, wiping high leverage positions in both directions. And, of course, when the official rejection was announced, it went as low as US$960... before recovering to close to US$1200, as if nothing had happened. Me: The immediate takeaway from this, then, seems to be that the Bitcoin economy is rather more robust than expected, and that the ETF is a nice-to-have, but not essential, factor in Bitcoin's continued growth. As Needham's January analysis suggested, it was a low-probability moonshot - since there were appreciable risks on the part of the SEC - with a concomitant huge upshot if approved... which is however, as we now know, not to be. Before continuing, a few more comments on the ETF decision buildup. Firstly, there were some convincing arguments that it was headed towards approval. For one, it is well-known that the SEC tends to allow petitioners the courtesy of gracefully withdrawing, instead of the finality of an official rejection. Thus, hopes rose as no such withdrawal happened, in the final days. Moreover, the price rising and settling at unprecedented levels of near-US$1300 was taken as a sign of possible early buy-in, meetings with big players continued to be held, and the Winklevii kept up with making minor updates - which, many felt, made no sense if the ETF was dead in the water. Some have questioned why the Winklevii had insisted on the verdict instead of simply withdrawing, if as one supposes, they had been given a heads-up; well, one can imagine that they might have appreciated the reasons in black-and-white, given how they've been screwed over in the past. It would have been hilarious in a way if they got beaten to the punch again by the SolidX offering, though given the stated requirements, there's no chance of that happening... or is there?  What do you mean, 'Facebook and Bitcoin are actually very similar'? (Source: pinterest.com) Mr. Ham: To me, the bigger issue is that, from the required criteria, it was fairly obvious that the proposal had no hope of passing, and the SEC could have rejected it promptly at any time, rather than letting it drag to the bitter end. That said, it may not be forever insurmountable, if we take the gold market as an example: while there are countless pseudo-anonymous private transactions taking place each day, gold ETFs have nevertheless been given the green light, because a bunch of shady bankers get to fix its price twice every day... now, wait just a minute here... Me: It could be a nice coincidence, then, that the SEC's professed need for surveillance has come in the same week as Wikileaks' latest revelation that the CIA has conceivably been hacking everyone, including through innocous automatic software updates (but, yeah, it was totes expected). Ah, and on the increasingly-popular GOD-EMPEROR TRUMP saying that he was wiretapped by the Obama administration? Well, other than circumstantial evidence, it is now apparent that the CIA has maintained a black ops group specialising in mimicking foreign agents; Obama's former Director of National Intelligence James Clapper has, of course, categorically denied any wiretapping, but just a heads up: this is the same guy who lied under oath to Congress on the Snowden saga. Mr. Ham: While we're on this, have you heard this old Soviet spy joke? Me: Tea? Why not vodka? And, by the way, GOD-EMPEROR TRUMP has managed to get mentioned more than Putin in the Russian media, bless him! But, let's continue on our economic analysis of Bitcoin. The big picture, again, remains mostly unaffected. From prior discussion with Mr. Robo, his original year-on projection of US$900-US$1800 stands, since the likely ETF rejection was baked in. Had it been approved, we would have had to project a break of US$2000 by 2018, but then, altering such predictions after the fact is kinda unsporting. While supporters have been lampooned for declaring that the ETF rejection is actually a good thing for Bitcoin, this may well contain more than a kernel of truth, if one considers an ETF as a near-guaranteed price booster (more time to accumulate on the cheap!). Though the decision may have shaved off some speculation potential, it has also reinforced Bitcoin's fundamentally-unregulatable property, which was its main selling point in any case. Amusingly, the People's Bank of China is mulling measures such as blacklisting Bitcoin addresses, which is obviously utterly pointless, given that fresh new addresses can be created at will by anyone.  Trend: Cryptocurrencies → Blockchain, moved backwards (Source: medium.com) Mr. Ham: Eh, given China's longstanding approach to economics, one can't expect much better:

Me: And liberal news outlets are now praising dictatorships, go figure. The way it's going, TRUMP will have them lauding North Korea, still top of my list of places not to visit - observe the poor Malaysians now stuck inside. Ah, almost forgot, was going to nominate Amos Yee for the MIT Media Lab Disobedience Award. I'd gather he certainly qualifies on the "disobedience" part, and really, I see this as an ironclad no-lose, win-win act. But back to Bitcoin economics. Personally, I see us entering a very interesting period, with larger players - up to and including state actors - jostling for position. Note that one thing Bitcoin won't do, is to redistribute wealth appreciably; Mr. Robo has a nice model for that. However, there remain enough inefficiencies to make it worth the while of even big fish, as the dilemma looms ever closer: don't buy, and risk missing out on a stake in a global commodity network. Buy, and have a hand in signing away one's monetary sovereignty - probably much easier for smaller, poorer, more unstable nations. It can be quite delicious to watch. Mr. Robo: While the Chinese markets were revealed to be rather less substantial than they previously seemed, after the introduction of trading fees, they do still hold two aces - futures trading and the accompanying leverage, and mining share. The struggle between Bitcoin Core's segwit and Bitcoin Unlimited has proven fiercer than anticipated, despite Unlimited's weak development team and inbuilt design flaws, and it is looking increasingly unlikely for there to be an amicable compromise to the scaling issue anytime soon. Core has gone as far as to propose a user-activated soft fork (UASF), which has invited retaliation from large Chinese mining pools. Me: I'll be honest, this is by far my greatest worry for Bitcoin in the near-to-mid-term, but then, given how Ethereum's been doing after their own forced hard-fork, even the worst might ultimately turn out not to have a lasting effect.  Believers, it will not divide us! (Source: r/the_donald) [N.B. Background: 4chan gloriously trolls Shia Labeouf, kekeke] [Also: the rise of the valiant ALT-KNIGHT, slayer of ANTIFA] Next: Trade Special

|

|||||||

Copyright © 2006-2025 GLYS. All Rights Reserved. |

|||||||