|

| |

|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ entry views: 287 today's page views: 362 (14 mobile) all-time page views: 3386403 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1226 page created Fri Jun 20, 2025 08:21:48 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

Mr. Robo: Human! Human! Am I glad you're here! Why, after the Bitcoin price blasted past US$5000 on Thursday, Mr. Ham has locked himself in his office, and he ain't coming out! Not only that, there have been some very odd sounds emitted from within, usually coinciding with the sudden price jumps... Me: Nah, leave him be, somehow I think he's okay. On to proper business. But before that, just a small observation. With the current crypto boom, you can't help but hear of more private investors leaping in, particularly into alt-coins, with a get-rich-quick mentality. It may be timely to reiterate Mr. Ham's observation - wise, for once - from over three years ago here: in general, I intensely dislike giving investment advice, since it's far easier to get blamed when things go pear-shaped, than remembered if they go right. Consider one of Livermore's timeless quotes: "If I buy stocks on Smith's tip I must sell those same stocks on Smith's tip. I am depending on him. Suppose Smith is away on a holiday when the selling time comes around? A man must believe in himself and his judgment if he expects to make a living at this game. That is why I don't believe in tips." Mr. Robo: With that said, the firm of H.L. Ham hasn't done too badly by following other Livermore rules - in particular, not to try and catch the exact tops and bottoms in a secular crypto bull market, and that sometimes - often - the right thing is just to sit tight and hodl.  But also, if you're confident, not to be discouraged by those with differing worldviews, e.g. the fine folk over at r/personalfinance (Source: r/bitcoin) Me: With that off my chest, a further comment. From both real-life communications and forum surfing, it appears that many newer would-be investors are getting interested in more-minor alt-coins (i.e. excepting Bitcoin, usually also Ethereum and Litecoin, and maybe a few others) and ICOs, with the following common reasonings:

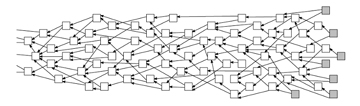

As for the second point, it is almost certainly true, in that some alt-coin will near-surely produce returns that blow the major cryptos out of the water over the next years. The question, as with penny stocks, is identifying the correct one. For once, China was probably right to put a lid on ICOs, given the proliferation of dot-com era-like vapourware offerings and outright scams starting to take root in the space. Case in point: a biotech firm with nothing previously to do with crypto renamed itself "Riot Blockchain", and its stock price promptly doubled. Cutting to the chase, I must admit that I have not been able to model alt-coin prices to my satisfaction, unlike that done for Bitcoin over the past few years. Now, I could proffer the relatively tiny market caps - making manipulation even easier - as an excuse, but it's mostly that I have not managed to form a good enough idea of the fundamentals and factors involved. For example, had I known, we could have increased profits several more times over by simply shifting it all from BTC to ETH last year, rather than just maintaining a modest hedge. Let's just say that I haven't been losing much sleep over such what-if scenarios, however. But anyway, there has been some particular interest in the IOTA crypto, so... Mr. Robo, you've prepared the notes?  (Source: wikimedia.org) (Source: wikimedia.org)Mr. Robo: Yes, human. There's the main website and subreddit, of course, but its bitcointalk.org thread is also worth going through if you're serious - note that a lot of alt-coins are first unveiled to the in-crowd at that crypto watering hole. I'll even put its original Tangle whitepaper out here, but since I guess most of the audience would be interested in a less-technical summary, here goes. Recall that most crypto(coin)s - probably the vast weighted majority, by market value - currently follow the Bitcoin blockchain paradigm. You have users submitting transactions, usually with a small associated fee, and miners including these transactions into blocks, partly incentivized by those fees. These miners constantly compete to include their active block into the blockchain, by performing computationally-costly calculations as proof-of-work (POW). By successfully solving the active "puzzle", their block is inserted into the chain, the transactions become official, and the lucky miner is rewarded some time later with both the transaction fees, and usually a block reward. Certainly, this is not perfect, with one of the major gripes - which has led to the ongoing strife over scaling and segwit - being limited transaction rates and backlogs. For example, Bitcoin currently has a 1MB block size limit, with hash difficulty retargetings aimed at maintaining an average block time of ten minutes. Some simple math then puts this at up to 2000 transactions every ten minutes, or maybe three per second. Definitely not enough to serve a global population as-is, which has brought fierce debate as to the right solution. While Bitcoin-type blockchains are largely quibbling over block size and second-layer tradeoffs, however, IOTA has cleverly made to sidestep the scaling problem with a whole new underlying data structure: the Tangle, which is basically a direct acyclic graph (DAG). Basically, so the proposal goes, rather than rely on blocks and miners, return power to individual users (nodes) for the Internet of Things - each node must participate in transaction validation to get its own transaction considered, and because this involves validating two existing transactions, validation supply rate is always twice that of demand, unlike the fixed validation supply rate of blockchains.  The Tangle: newest transactions (tips) in grey (Source: forum.iota.org) Ergo, the Tangle is infinitely scalable - the more transactions, the more confirmations! Not only that, there are no longer any transaction fees, since participating nodes "pay it backward" for their transaction, by validating previous transactions. Or, at least, that's the idea if all goes well - refer to the whitepaper for the detailed proofs. Before continuing, it may be helpful to try and understand the Tangle with reference to blockchains, on one of their prime motivations: the illegality of double-spending in a distributed environment, i.e. invalidating of an earlier transaction, with associated monetary losses. It can be recognized that the Tangle is not really that different from blockchains in this sense. Where blockchains rely on POW to ensure that it is prohibitively difficult to rewrite previous blocks (with increasing difficulty the more blocks have passed), the Tangle indeed relies on a similar mechanism. The basic idea is, while you can't be sure that your transaction is "locked in" right after you add it to the Tangle, you can become surer as newer transactions validate your transaction... and yet newer transactions validate those transactions. In this sense, users can decide on their own margin of safety, as with blockchains. A common rule-of-thumb was to wait for six confirmation blocks after one's transaction, for high-value Bitcoin transactions. This however becomes slightly more iffy with the Tangle, since there are no canonical blocks - one can only estimate some "weight" for a transaction, depending on how many new transactions directly or indirectly validate it. However, we now note that this itself is only really reliable, if the node has a good-enough idea of the state of the Tangle. If it is aware of too small a subset of the Tangle, it may only later realise that what it thought to be a "safe" transaction, had in fact been invalidated by a "heavier" parallel Tangle - sort of analogous to a blockchain miner reserving private blocks in a classic 51% (or 33%) attack.  And boy, can they attack when they want to (Source: ibtimes.com) While the whitepaper does analyse a parasite chain attack, the explanation of how it handles the touted billions of transactions, across a similar number of devices in the machine economy, is rather less examined. Offhand, the Tangle doesn't magically escape some fundamental physical limitations. If there are more transactions, they still have to be distributed, else the underlying data structure might well shard involuntarily. Moreover, they still have to be stored, and while IOTA appears to have hit upon automated snapshots as a solution - which sounds to me like a de-facto "block" - it seems that a minimal Tangle of just the nodes nearest to the tips can still be fairly large indeed, which might be a problem for embedded devices... Perhaps more worryingly, it seems that IOTA is currently quietly utilizing a master "coordinator" node to operate, which means that it is effectively centralised, after all! The author of that exposé further posits that this is because one of the purported strengths of IOTA can also be a weakness - while having users be miners does encourage decentralisation in a manner, it also means that IOTA's effective hashpower can be very unreliable, since there is no reward for consistent hashing throughput. As such, a 33% attack does not need to defeat a baseline set by dedicated miners, but only needs to defeat what is likely a much easier transient target. Interestingly, the response to this critique by the IOTA devs appears rather defensive and slightly hostile (as often is the case in the crypto space, where riches are involved; this extends to some professors from reputable universities, who shall not be named here), and it'll be interesting to observe when the "coordinator" node is obsoleted, if ever. Actually, I wouldn't be overly surprised if IOTA eventually turns to second-layer solutions too; as it is, some of the tech should be included in Bitcoin's Rootstock implementation, which may lend some credence to the Bitcoin maximalist "Bitcoin can just incorporate any new innovation as a secondary layer/sidechain" view. And finally, the part you've been waiting for - so, is IOTA a good investment? Short answer: I don't know. Longer answer: although there appears to be some technical concerns about IOTA in practical deployment, we have frankly not been able to price these considerations to our satisfaction. One might suppose, for example, that a crypto with no promised issuance schedule or cap cannot be valued, but ETH somehow exploded in price anyhow. Speaking in crude terms of signal and noise, the general hype ("noise") over alt-coins has H.L. Ham severely doubting its ability to read their true value ("signal"). It can be noted that for IOTA, as with ETH, those involved in the initial technical ICO - buying the initial distribution with Bitcoin - definitely made out like bandits. Of course, this has probably become too widely known, and the market premium has perhaps swung the other way... Do I spy shades of Tarja? [Russian/Mandarin lyric glosses for Katyusha; Russian choir version] Next: Light Pickings

|

|||||||

Copyright © 2006-2025 GLYS. All Rights Reserved. |

|||||||