|

| |

|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ entry views: 570 today's page views: 426 (19 mobile) all-time page views: 3732470 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1256 page created Fri Mar 6, 2026 10:24:59 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

Mr. Robo: ...well, that was a long intermission. How was Hong Kong and Hawaii? Me: Good, but, one matter at a time. Let's finish up the Bitcoin analysis, before doing the travel recap. Beginning with a question that has been raised by a number of my friends and acquaintances: as anyone who has browsed CoinMarketCap must have noticed, why are the price movements for all cryptocurrencies so correlated? More specifically, consider this observation: the price of Bitcoin rises (or falls, which seems to be the more common movement these days) 3%. The general tendency, then, would be for the prices of alt-coins to also rise (or fall) about 3%, thereby largely preserving exchange parity when denominated in Bitcoins. However, one would expect that if the change in price had been driven by some Bitcoin-only news (e.g. another Bitcoin ETF delay), then the price of alt-coins should remain largely unrelated, in fiat currency terms. Why this discrepancy? The answer then would firstly be that Bitcoin remains the main trading pair for alt-coins, especially the smaller ones that exist only on smaller crypto-only exchanges (that avoid having to contend with pesky banking regulations). As such, the natural inertia indeed tends towards preserving the exchange rate on the Bitcoin trade pairing, in the same manner that a drought in California would increase the price of locally-grown artisanal almond juice in US dollars due to reduced supply, but have next to no effect on said almond juice price in, say, Indian Rupees. At this point, it may be appropriate to confront an interesting thought experiment proposed by a couple of Federal Reserve economists, arguing that the proliferation of alt-coins is dragging down the Bitcoin price:

While the economists do submit that the analogy isn't perfect because crypto exchange rates aren't fixed, one could note that the analogy is much poorer than it could have been. By conflating Bitcoin with a Hamilton tenner, and Altcoin(s) with a Lincoln fiver, they are insinuating that various crypto systems are entirely interoperable, and thus any Altcoin could sink Bitcoin by issuing coins willy-nilly. The far more natural analogy, one would feel, would be to conflate Bitcoin with a US dollar bill, and Altcoin(s) as foreign dollar bills. The question could then be posed as to what would happen if the supply of foreign (say, Venezuelan) bills were increased dramatically; a short visit to a Caracas dining establishment should provide the economists better intuition about whether hyperinflation in a two-bit currency materially depresses a reserve currency (it doesn't) Mr. Robo: ...to be honest, the standard of reporting on crypto mostly leaves much to be desired. Market Segments & Use Cases - Darius510, r/cryptocurrency "The first mover status of Bitcoin is an objective truth in an ocean of subjective tribalism. It is the only characteristic of any coin that can never be imitated, iterated upon, cloned, forked, or be challenged in a debate of merit. Without Bitcoin, cryptocurrency has no scarcity." - polomikehalppp, r/bitcoin (consider also: Lindy effect in crypto) Me: That said, in their defence, alts do probably affect Bitcoin prices, although the exact relationship is tricky. For example, Monero and the like might attract a privacy-obsessed crowd, that might not otherwise have been interested in Bitcoin, thus expanding the crypto market as a whole. The question, then, would be: how many different (types of) cryptocoins does the world really need? From existing evidence, the answer seems to be: quite a lot fewer than already exist. As repeatedly emphasized, cryptos are fundamentally monetary (or protocol) plays, and not technology plays; as such, rampant innovation-for-its-own-sake was never the point - nobody buys into a national currency because they introduced new high-tech shiny plastic banknotes, and in fact reinvention has led to the decline of more than a few high-profile platforms (Digg, maybe Facebook). It has been noted that indexing in crypto has historically been a losing proposition due to the high number of rubbish hype alts and ICOs that oft die completely, which has brought with it the advice to stay within one's circle of competence - which we have striven to. Of course, in a true bull run, it probably won't matter much, from the price correlations. In the wake of this latest popped bubble, a back-to-basics reassessment might be in order: what use-cases are there for crypto, and what is the demand for each of those? Off-hand, we might recognize:

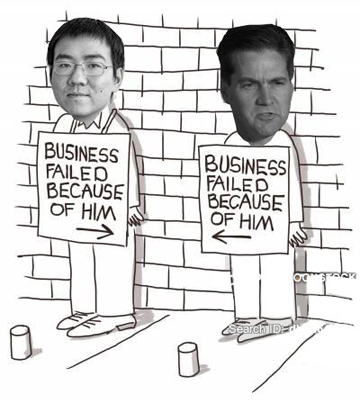

Beginning with random services, we might note that many of those seem mostly... unnecessary (e.g. Dentacoin, oBike's oCoins, Sakae's Bitecoin, imgCoin for image hosting and Kim Jong Coin, greatest of them all), with many of these fanning interest by touting partnerships with big-shot companies - oft short on details. But seriously, why does every firm or industry need its own token? Like, a dozen Weedcoins?! It's like having your friendly neighbourhood pot dealer insisting on non-transferable vouchers, rather than good ol' greenbacks. Bankster initiatives like R3 aren't doing too well either, even considering it got picked over Ripple for SWIFT, as the extant financial system is arguably fundamentally trust-backed-by-legal-might based - contrasting heavily with blockchain's most novel property of decentralised trustlessness. Interoperability protocols appear to necessarily be a secondary, derived demand, which brings us to Ethereum-style platforms. Personally, I adore the vision, but Oracle problem of interfacing with the real world for error-prone smart contracts aside, it remains that distributed apps have been exceedingly slow - likely unavoidably slower than simple value transfer, for the same security - and something of a solution in search of a problem. This is not to say that Ethereum, EOS, NEO etc are doomed, ETH for one remains very thoughtfully designed and actively developed. It remains, however, that platform-centric tokens appear somewhat easier to replace - in other words, have a weaker "economic moat". Which takes us to the original commodity money and payments motivation, as exemplified by Bitcoin. We have argued for the attractiveness of its store-of-value function, and we might also note that the "naivety" of Bitcoin's design - as compared to Ethereum's latest iterations, for example, and oft derided as out-of-date by the r/Cryptocurrency set - is actually an asset. As with all good cryptography (and unlike IOTA), Bitcoin is relatively straightforward to analyze, and its limitations and failure conditions are well-known, rather than obscured. These security basics, by the way, have been rather harder to come by with most altcoins. In practice, we have seen EOS block producers forming cartels out of the gates, resulting in double-spends being rubber-stamped. Bitcoin Gold and Ethereum Classic got 51% attacked, as most cryptos not called Bitcoin are frankly quite vulnerable to. Bitcoin ABC is relying on the hack of enforcing immutability after ten confirmations - which brings its own set of issues, while the experience of Nano and IOTA thus far suggests that theoretical blazin' speed by itself really isn't the point, not with decentralization at stake. Pumpy Dumpty Broke The Wall Best crypto trading video of 2018 [Bogdanoff explained] Mr. Robo: So, in short, continue loading up on Bitcoin. Me: Well, and maybe Ethereum. See, the trouble with investment advice is, you gotta recommend what you're holding; because if you promote something else, the obvious question would be, if it's so good, why aren't you into it? Can't be having that, can we? Just to make it clear - when my pals buy alts, I'm hoping they succeed, but the fact is that objectively speaking, I can't be confident of that. Goodness, I've tried to read the alt markets, but the sheer amount of dodginess going on, such as with market cap gaming - even acknowledging that Bitcoin's hardly that pure either - is astounding. There's the pump-and-dump groups, of course, where the ringleaders arrange to pump the price of some benighted altcoin up, only to then dump their bags on late-arriving chumps. The trouble with getting on this action - ethics aside - is that one can hardly be sure of not being on the "chump" side, especially without insider information. But seriously, this is just classic penny stock shenanigans, transplanted. Fortunately, this is not too hard to detect by machine learning, it appears. This might however pale in comparison to the long con of scam projects (many originating from you-guess-where), in which the coin, exchange, ICO or dApp creators put up just the right front, throw out the hottest buzzwords and organize rigged contests, to lure unsuspecting investors. And, the best thing is, if executed correctly, the big exit's probably even legal. Then again, one supposes the incentives are often out of whack. Consider some hotshot ICO hawker - guy makes some outlandish promises and poses with Jack Ma, and gets tens of millions thrown at him with next to no conditions, all upfront; cutting and running, claiming most of the profit with none of the scheduled work, sure sounds tempting... Long story short - if you're going to play the altcoin markets, at least spread your investments out. Perhaps the proportion of altcoins that die can be slightly exaggerated, but not by much. Are Bitforks Any Better? - Vitalik lays on the burn Alright, no alts. But what about those Bitcoin forks then? Surely they, as the direct descendant of the chain, might pose a threat to replace it, and thus be a value buy? Yeah, no. Recall our piece on the dear Dr. Craig S. Wright, and his quite senseless hocus-pocus, two and a half years back. He certainly hasn't been idle about spamming nonsense, and his alliance with Bitmain's Wu Jihan predictably eventually went up in flames, with Dr. Wright insisting on his own Bitcoin Satoshi Vision (BSV) fork - which is just as well, given that they've all but exhausted materials-based suffixes with Bitcoin Polyester. This led to the November hash wars on the already near-unused Bitcoin Cash chain - so people aren't hung up on block size, after all - which saw both Jihan's Bitmain and Wright's Ayre burn millions on renting hashpower, only for the combined price of the resulting chains to be lower than what Bitcoin Cash had started with. BSV remains, as Vitalik so poetically put it, a pure dumpster fire, leaving Dr. Wright a pile of unsellable tokens after conceding defeat. It's hardly better for Jihan, however, as he by all accounts swopped just about all their real BTC for BCash, somehow managing to turn a near-IPO money-minting miner manufacturing business, into a firm that's shedding staff and overseas offices, while pushing questionable cloud mining and A.I. out of nowhere, in an effort to stave off bankruptcy. Quite a remarkable development, given that all Bitmain had to do was to sell their machines honestly, possibly after "burning them in" with a bit of mining on the side. But ego always gets in the way, one supposes. And, get this, after resisting segwit for so long, Jihan wound up proposing the segwit-enabled Lightning Network as a BCash scaling solution. Maybe next time...  Rule One: Never fight a hash war in Asia (Source: r/bitcoin) Scaling By Lightning Returning to the scaling issue that precipitated the Bitcoin forks in the first place; it's not gotten much press, unlike more flashy alts, but the Lightning Network's quietly up to roughly five thousand-plus nodes, twenty thousand channels, and 500 BTC over the past year - even after a partly-adversarial experiment. As explained last February, it's a true network, rather than a collection of separate peer-to-peer channels; in theory, once it gets big enough, Bitcoin microtransactions - the ubiquitous coffee payment problem - will be nigh-instantaneous and nearly-free. Assuming most future users being happy to rely on a Lightning Network or similar second-layer solution, almost all transactions can be offloaded from the base Bitcoin layer. This tradeoff - using a secondary layer, rather than continually expanding the capacity of the base layer, as the Bitforks do - has always been the more sensible solution to us, all the more given the security limitations of Bitfork zero-confirmations. Definitely, Lightning has its own limitations - channels closing all at once, intuitively - but clever fixes are constantly coming into play. For example, regarding the cost of using two transactions on the base network to open a channel, researchers have proposed Channel Factories to batch channel creation. Certainly, it's important to question the Lightning Network setup, with concerns that it cannot be properly decentralized - due to the formation of large hubs - pretty common. On the surface, this seems to be happening with payment providers such as Square getting into the act. However, personally, this seems like an issue that LN will naturally outgrow, with the target endpoint being normal users eventually transferring crypto over LN seamlessly, oblivious to the internal workings. Obligatory Crystal Ball Gazing Mr. Ham: Privacy patches like Mimblewimble are also coming - interesting times ahead, to say the least! Me: To be honest, I'm a teeny bit concerned that improving privacy too much might scare regulators off at this point. Then again, I don't see them holding the tide for long, given how the blockchain concept's getting normalized. Thirty years ago, you'd be something of a weirdo - or a boffin, at best - to be tinkering with mobile phones or related computing devices. Today, every kid is face deep in their smartphones and tablets. Warranted or not, optimism's not yet in short supply, despite the market taking an absolute beating in the past few months. The Satis Group's reasoned out about US$100k in 2023, Draper's sticking with US$250k in 2022, rather earlier than the pattern recognitioners over at r/bitcoinmarkets. Myself, I'm holding firm on US$40k after the next halving about 2021, and just for fun, a range of US$3k to US$8k this year. ...and really, where's our CEO? Let's check on Mr. Ham's office, Mr. Robo. ...  This is not what it looks like. Next: Medical Notes

|

||||||||

Copyright © 2006-2026 GLYS. All Rights Reserved. |

||||||||