|

| |

|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ entry views: 403 today's page views: 391 (14 mobile) all-time page views: 3386432 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1226 page created Fri Jun 20, 2025 08:59:02 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

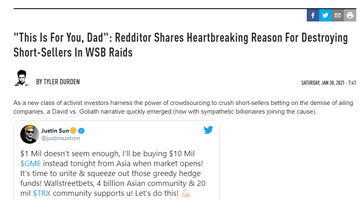

"Ah, yes." his town-dwelling cousin says. "All you need to do is to download this here Robinhood app on your phone, and buy all the GameStop shares you can get yer mitts on." "Right," says Cletus. "I want to make sure my fifty bucks is safe. Like, what happens if someone robs the bank and takes everything, before the transfer goes through?" "Oh, don't worry about that!" says the cousin. "The main branch in the city would cover you!" "Okay," says Cletus. "But suppose the whole bank went bust? I know these things happen." "Well," says the cousin. "People have a right to be worried, of course. So that you can feel completely secure, the bank's insurer still guarantees your savings." "But suppose the insurer ran out of money?" asks Cletus. "It's nearly happened before. What would happen then?" "This is very hypothetical," says his cousin. "But if it ever happened, we have an arrangement with the Federal Reserve. They would still make sure you weren't out of pocket." "But what if the Fed went bust?" asks Cletus stubbornly. His cousin sighs. "Look," he says. "Wouldn't that be well worth your fifty dollars?" - joke shamelessly adapted from Cold War I It's certainly been an entertaining week in stocks, and that's amidst a crazy clown market that has seen BlockBuster video - down to a single store in Oregon, and bankrupt for a decade - surge twenty-fold in two days, making Dogecoin's 56% in a day seem tame in contrast (still, much wow). I have absolutely no compunctions about sitting this one out on the couch, because I believe that one should have at least a faint inkling about what's going on, when investing; either cross the road now or wait for the next break in traffic, but don't get caught up in the FOMO and blindly follow others on a dash. Anyway, just in case any past readers were skeptical about the hundred-baggers mentioned previously, GameStop (GME) has become one in a single year - from a low of US$2.80 in the wake of the big crash last March, it's just hit some US$350, making some wise and early punters extremely wealthy indeed. One can hardly escape the flurry of articles being pumped out on GME in recent days, or the many requests for a brief synopsis (along with how to get into the game too), so I'll try to oblige with my own telling: GameShort GameStop, together with BlockBuster, should be familiar to those in their thirties and up - once, they had thousands of outlets carpeting the U.S. and elsewhere, but the rise of streaming video and broadband capacity had smashed their core business of selling and renting physical media containing movies and games. Thus, it was probably only to be expected that their stock prices had been lingering very far off their respective peaks, at least until very recently. Part of their depressed stock prices could be attributed to various hedge funds, who sought to pad their bottom lines by shorting GameStop. Those who still recall their Financial Economics 101 might skip this, but for the rest, shorting - or short selling - involves selling some stock (or commodity) at a certain price, with the expectation of this trade being profitable due to the stock being projected to fall in price in the future. All well and good and not seemingly unreasonable so far, until we come to the second part: since the short-seller generally doesn't own the targeted stock in the first place, what's usually done is to borrow the stock from a current owner, and sell it. Then, if all goes right, the short-seller will purchase the same amount of stock back in the future - but at a lower price - to return to the original owner, and pocket the difference between their selling price and the buyback price (minus interest/fees to the owner) as their profit. Short-sellers tend not to be very popular with other market participants at large, for several reasons. Firstly, they are betting against the direction that the (vast) majority of participants would want the market to go. Your everyday pensioner and index-funder benefits when stock prices go up, and there are many, many more of them than shorters. Secondly, there is just something distasteful about wishing - or forcing - failure upon a firm, with the attendant consequences for its employees, especially when one suspects that it could have been avoided. Thirdly, short-sellers tend towards being greasy corporate vultures, the 1% of the 1%, and they have never exactly been loved by the wider population - though one suspects that they're coping fine with their hookers and blow. There are legitimate reasons for shorting, that said. The textbook explanation is that shorting admits proper price discovery, and in particular allows for deserved price corrections to take place when a company is fraudulently valued above its fair price, with Enron and more recently Noble Group and Luckin Coffee oft cited in this respect. The morality of shorting was probably not the most instrumental factor in the GameStop saga, though; it was the method and extent to which the hedge funds went about it. Negative & Naked must buy it back or go to pris'n." - Daniel Drew Hedge funds, recall, are named as such because they supposedly hedge - or try to place limits on - the potential risks that can be suffered by their portfolio. Say that a hurricane has just been projected to hit the coast; a hedge fund might seek to minimize volatility by shifting assets out of sectors likely to be impacted in relatively unpredictable ways, perhaps housing, and into more stable areas. In this case, selling the unpredictable sectors short - to an extent - might well be a reasonable method of balancing risks, which is after all what their extremely well-remunerated actuaries and quants are supposed to do. Of course, there's little preventing big funds from greedily trying to profit directly on tanking firms out of avarice, which seems to be more of the case with GameStop. GameStop had been regarded as such an obvious basket case, that it has been reported that their short interest had been as high as 140% of the float (i.e. available shares), possibly due to shares being recycled for shorting reasons multiple times. On top of that, there were rumours that the hedge funds were additionally (illegally) engaged in naked shorting - where they sold the shares without even having borrowed them (of course, naked shorting can work if one can crash the market quickly, then get out of the position before anybody notices) So far so good, but in their eagerness to squeeze money out of the short trade, some of these hedge funds had apparently neglected the fundamental caveats about shorting - as Drew and others have warned from centuries back, shorting implies that the underlying stocks have to be bought back and returned to the lenders sometime; this deadline is either fixed where futures contracts are involved, or implicitly imposed by the carrying interest charged for continuing to borrow the requisite shares. However, for shorting to really hurt, it tends to require someone to take up the other side of the trade - in other words, to force the share price up, likely against institutional pressure. Question was: who's dumb enough to try it? Enter r/wallstreetbets - the best of Internet folklore wisdom  The guy looks familiar... (Source: r/wallstreetbets) Subreddits are oft not what they might seem, what with heavy-handed moderation and bans having imparted an ideological slant to many of Reddit's default subs, and one generally has to do some poking around to find where the real action's at. For instance, a newcomer interested in stock market punting might figure that he should peruse r/investing, r/economics or even r/stockmarket, and that these official-sounding subreddits reflect the aggregate opinions of the wider community. However, as of this moment, these subs have anywhere from about 1,000 (for r/economics) to 7,000 (r/investing) readers online. r/wallstreetbets, in contrast, has almost 250,000 users active. The WallStreetBets subreddit, then, hearkens back to what was probably the Golden Age of Reddit - when anon autists could congregate and converse freely on whatever inane topic they so wished, and perhaps take over the front page and meme a Manhattan real estate shitlord into becoming the President of the United States (and as it happens, one of the better ones, but that's another story). r/wallstreetbets has frequently been accused of being culturally akin to 4chan, and in this their detractors are right. However, it should be recognized that when these self-described autistic trolls claim that they're retarded enough to move the market... they might not be wrong. For all the superficially-infantile memery and emoji-spamming going on in r/wallstreetbets, though, there was perhaps quite a bit more method behind the seeming madness*, than the well-heeled actual Wall Street set might wish to admit. The GameStop squeeze had actually been formulated by a r/wallstreetbets user - who fittingly goes by the username DeepF**kingValue - over a year back, when he noted that a bunch of hedge funds had probably badly overextended themselves on shorting GameStop, and that the stock had been vastly oversold. While perhaps not a totally unique insight - Michael Burry might for one have built up his position before later shoutouts - r/wallstreetbets provided these particular autists a platform, and the plebs a functional plan. [*N.B. The method may extend to the deliberate use of fast-changing memes and references on the subreddit, the invented language of which has been posited to make influence ops and spamming much more challenging; creating catchy memes takes wit and knowledge of the sort that's possibly relevant to success in the rough-and-tumble of the stock markets, after all, and do you really want to trust the projections of a guy who can't shitpost his way out of a wet paper bag?] Capital Insurrection!  Storming the gates! (Source: google.com) That apart, comparatively nothing much happened, up until a few weeks ago. Yes, GME had risen from about four bucks to eighteen, but that wasn't overly outlandish in an easy-money environment that had seen many other tech stocks boom by about that much or more. The fun would pick up as the price breached US$30 on the 13th of the month, then US$60 by the 22nd, near US$150 by the 26th, and about three-fiddy the next day. While the r/wallstreetbets mob had not managed to hit US$420 for YOLO potential (as done for Tesla), this remained a quite dizzying 100x rise in less than a year - which translated into correspondingly pants-wetting losses, for the shorters. Here, it might be remembered that there was no reason for the hedge funds to find themselves in this precarious position. They had plenty of time to take mitigating action, after all, such as taking out hedging options on their short positions - and they had months to do it while GME was still below twenty bucks. However, it appears that the Armani-suited, MBA-credentialed types in the hedge funds figured that they were not about to concede to a sorry collection of unemployed Redditors slumming it in their parents' basement. As so often happens in real-life finance, they were wrong. The critical mass of idiocy would only build going into the end of January, with r/wallstreetbets going from less than two million to over seven million subscribers over the past month, and I'd pay to watch the hedgies' faces as their billions wilted under this sheer retard strength. It made no sense, but it was never meant to do so, and the world would be captivated as the shorters - who had so often crushed opponents through overwhelming application of capital - appeared hoist by their own petards. Realizations of Riggedness The Establishment wouldn't take long to strike back, however, and from how broad the countermeasures were, it wasn't hard to suspect that some cabal was coordinating it all from the top. First off, the WallStreetBets community got unceremoniously kicked off Discord and Facebook (under the basically unavoidable guise of sporadic "hate speech", since it's only too trivial to plant some), and (temporarily) shut down on Reddit, as Big Tech shed what remained of its friendly facade - and which has driven many towards Alt-tech, but more on those consequences next time. As if on cue, the mainstream FAKE NEWS would attempt to link r/wallstreetbets with the alt-right and Trumpism - which, however, might misunderstand the very real popular appeal of flipping the bird to the elites. On the financial front, small-time traders hoping to get in on the raid would find themselves suddenly blocked from buying GME and related stocks, while being allowed to sell, which happened to be just what the hedge funds would want, to be able to pick up shares to cover their short positions (note the opposite happening in China a few years back, which makes one wonder what could have happened had their army of investors been engaged). The reputation of the Robinhood online trading platform would crumble in the aftermath, as (possibly-illegally) preventing purchases from retail customers aside, their massive conflict of interest with their hedge fund financiers would also become known, before rumours that they were selling customers' stock without permission. While that last might be technically kosher due to customers' account being margin-based by default, it was definitely not a good look under the circumstances, which has led to calls for Robinhood to rebrand themselves as SheriffOfNottingham for truth in advertising. It was certainly starting to look like Big Guys versus Little Guys on every front, as Google and Apple would intervene to salvage Robinhood's (sorely deserved) one-star rating on their app stores by deleting over a hundred thousand negative reviews, which is perhaps the rawest indication of how Big Tech can curate and manipulate opinions yet. If a guy downloads a trading app and reasonably expects to be able to buy and sell stock with it, and discovers that he is in fact not able to buy stock not due to official regulations but the broker's own policies - resulting in him being cut off from potential gains - why shouldn't he be able to savage the app in his review? While there was some rare full compass unity coming from unlikely bedfellows - when was the last time you saw AOC, Rashida Tlaib, Ted Cruz, TRUMP Jr. and Ben Shapiro all on the same page? - it appears business as usual among the politicians who actually exercise power. Continued probable (legal) insider trading by the Speaker of the House aside, the new White House administration's response after carefully monitoring the situation would apparently be to declare that they had installed the first female Treasury secretary when directly questioned about the GameStop situation, which might be a clue as to their leanings. Said very female Treasury secretary having received near a million bucks in speaking fees from Citadel - who happens to buy Robinhood's stock flow, likely for front-running purposes, and who are major investors in the Melvin Capital hedge fund at the centre of the GameStop saga - was not expounded on. As it stands, it's looking like the SEC will be applying pressure to shut down online congregations of small investors - such as r/wallstreetbets - to prevent future repeats, supposedly for their own protection, with stock exchanges reserving the right to halt trading due to unusual social media chatter; however, as more than a few commentators have noted, it seems like such dealings were all a-ok when the big boys were the perpetuators, but now that retail has managed to exploit a wholly-preventable mistake from the big guys, it's suddenly unacceptable? It's Personal Now  It's not about the money anymore (Source: zerohedge.com) Now, let's not expect too much - while Robinhood has had a class action lawsuit filed against them for their part in blocking purchases, I fully expect them to get off on technicalities, having weighed the risks beforehand. To be frank, not all that much is known for certain about their liquidity position, or about whether Melvin Capital has already covered their short positions, what with there being an incentive for them to dissimulate about it on the mainstream FAKE NEWS. So the thinking goes, if the peasants are persuaded that the hedge funds have capitulated, they'll turn on themselves and start rushing to sell - and that's when the actually-still-exposed funds can quietly wade in and make good on their commitments on the cheap, you clever sneaky buggers you. Trouble is, there's a zeltgeist forming around the madlads and commoners wanting their pound - of British sterling equivalent if possible, but of the hedge funds' flesh above all. Consider that r/wallstreetbets has canonically been known as a place where completely silly yet huge losses have been celebrated, and one might recognize why the hedge funds might not be let off this easily. Plans of action continue to be drafted on the subreddits on how to blow up the markets, with posts celebrating the funds losing a billion dollars for every eleven bucks the GameStop share price goes up (accuracy unverified), and newly-rich autists are placing "$GME GO BRRR" messages on prime Times Square billboards. References to "diamond hands", "APES TOGETHER STRONK" and "HODLING" (from crypto culture) abound, and with some rogue star power in the likes of Mark Cuban and Elon Musk etc. (who have also been targeted by shorters in the past), this insurrection may well have some legs. But let's not get too retarded - it's true that while GameStop was probably undervalued at US$3.50, it's not worth anywhere near US$350 by any stretch of the imagination either - you can have me on the record about this - and there will be a reckoning. While the ideal endgame from the r/wallstreetbets perspective is for the hedge funds to eat crow, what seems rather more likely is that much of the buying action has been taken up by rival hedge funds, and not small investors. There will be little guys who bought at the top and lose big, including locally, even if the power of the online mob (not always productive, mind) may be here to stay. Personally, even this will pale in comparison to the big pop and fizzle when it comes, so watch out for the very interesting times ahead! Next: More On Excess Mortality

|

|||||||

Copyright © 2006-2025 GLYS. All Rights Reserved. |

|||||||