|

| |

|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ entry views: 4407 today's page views: 7 (0 mobile) all-time page views: 3386049 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1226 page created Fri Jun 20, 2025 00:17:47 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

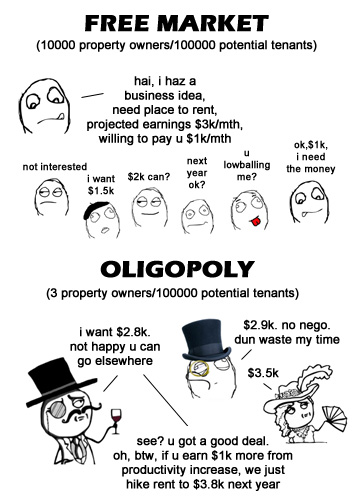

Secure in the knowledge that the hamsters were meaningfully occupied with their new venture, I dropped by their home for a look-see, to find Mr. Ham immersed in conversation. Mr. Ham: ...look, sir, who are you going to believe, a fat hamster in a suit - whom you've never met - or your wife? There, that wasn't that hard, was it? So how much do I put you down for? Five thousand? Please, that paltry sum does not befit your stature... yes, I specialize in liquidating college funds, no, there's no risk, and your kids are probably smart enough to get scholarships on their own merit, anyway. What, your wife's after you with a rolling pin? Sir, that's a lame sixties sitcom cliché... wow, that sounded like it hurt. My heartiest commiserations. Wait, don't pass out yet, be a man, dangit, at least give me your bank account number... six-oh-eight, come on, you can do it! Eight, seven, come again, I didn't catch that, hello... hello? Well! Good day, sir! *slams phone down* Me: Another botched sale, I take it. Mr. Ham: *draws several puffs on cigar* Tarnation! I had no idea marketing had gotten this hard! I must be well out of practice, I was a born natural back in the day. Me: Just curious, you had some... large associates with you, and met up in person, then? Mr. Ham: I don't see why that should make a difference. Me: Second question, why has Mr. Robo been standing behind you and yelling out random numbers all this while? Mr. Robo: *in a hoarse voice* Four-fifty, nine! Four four nine and three eighths! Six of four-five-one... Mr. Ham: Oh, background ambience. It helps to look and sound the part, when sealing deals. Me: Erm, even if so, wouldn't it be more efficient to make a voice recording, and then play it back on loop? Mr. Robo: Give me half at four-four... that's... *pant* that's what I told him! Mr. Ham: Sir! At H.L. Ham, we prize authenticity! Me: ...Fine. And one last thing. You don't end conversations on smartphones by hanging up. Mr. Ham: So sue me, I'm not a techie. In any case, it's not mine. It's Mr. Robo's. Well, on to serious business. You have arrived at just the right time to pick up the latest Bitcoin market tip from H.L. Ham; unlike other firms, who push out dense and near-unreadable heaps of paper that go on to end with some worthless recommendation such as "it will hit one million, but on the other hand, it could go to zero.", H.L. Ham sticks its neck out with a number up-front, no bullshit. For the year of 2014, H.L. Ham's official call is: daily median low of no less than US$350 - that's three-fiddy - taking into account we had about US$420 a few days back, 20% money-back guarantee on our consultancy fees if that floor is broken. High of at least US$700, another 10% back if it doesn't make it that high before the thirty-first of December, but no refunds if that level is exceeded heavily, of course. Me: That feels... optimistic. Mr. Ham: *stubs cigar out* It is a principled projection, obtained from H.L. Ham's executive director of financial operations Mr. Robo, a lot of forced speed-reading, and a pointy stick. Hey, Mr. Robo, how about you explain your reasoning? You can stop with the shouting of numbers. Mr. Robo: Five zero-one, hut hut hut!... ah, good. Um, about that, I ran a few tests, but at the end it's mostly a gut feel from estimating the price support from equipment sunk costs and dedicated buy-and-HODL-ers, and the likely maximum enthusiasm that can reasonably be expected. *Mr. Ham points to his gut proudly* Mr. Robo: I concede. Mr. Ham: Let's say that dealing with clients as a Gang Leader gives you an... insight into reality. Hard not too, after hearing ridiculous promises all day long. If I were you, I'd place buy orders about uniformly in the range between US$350 and US$450, and shift the lower orders up if the current prices hold for a few weeks. To be honest, I don't see US$1000 again this year, but I wouldn't be sad if I got that wrong. One more bonus bit of advice - don't go out of your way to introduce friends and acquaintances to such ventures. It's simply not worth it. Sure, you may get some cred if you're right, but far, far more stick if you get it wrong - and maybe even when you're right, if they get caught up in the fever and start plowing in at the top, and then it becomes your fault for pulling them in in the first place. Nope. Bad idea. Rule number one, if they have to ask, they shouldn't get involved. Me: Agreed. In economics, it is well-established that losses hurt more than gains for most. Those who mostly don't give a shit, then, have an unfair advantage, which is of course assuming they have the basics right. I have found it calming to accept that if I die, I die. There is nothing more to be said. As opposed to the famous football anthem Mr. Ham: Yes, that helps too. Makes me want to enter advice-dispensing mode too. Alright here goes - what do you think is the most important attribute for those in our main line, i.e. personal advisor-consultant, to be successful? Mr. Robo: Huh? Isn't it giving accurate predictions and recommendations, by definition? Mr. Ham: *slyly* Nuh-uh. Oh, that helps, I will give you that - but it's far from the most important factor. *takes a long, deep draw* You see, most of the time, when somebody hires a consultant, he already has an idea of what he wishes to hear, whether he admits it to himself or not. The main trick, then, consists in identifying what he wants to hear, deep down, and devoting the bulk of your report to reinforcing that. For example, if you gather that he's bullish on the market, you match him with a similarly-optimistic analyst, and sell him stock. If he's a bear, assign him a sulky fellow and ply him with short options. Either way, it was their idea all along, and you get repeat business. Now, say that we follow Mr. Robo's straight-arrow style, and give them our real best-faith judgment, even if it goes against their own opinion. If our advice turns out to be correct, then we just proved our client wrong, which goes against the basics - and I tell you, a lot of them don't like that, even as they take the money. And if we're wrong? That's even worse, we robbed them out of their winning hand! It's a no-win. Me: Doesn't H.L. Ham only have two employees, as of now? Mr. Ham: I'm bull. Mr. Robo's bear. Me: And haven't you just made a year-on prediction... Mr. Ham: *waves a dismissive paw* Oh, that's long term in this market. Plenty can happen in the meantime. Ah, the phone still works! Another potential patron! Hello? Yes, CEO of H.L. Ham speaking... you want to know about Robocoin ATMs? You've come to just the right place, we have their inventor, Mr. Robo, as an executive director! Mr. Robo: What the... I never... Mr. Ham: You want to order some of them? No problem. How many? Two? Sir, just for you, today only, volume discount, a quarter off if you take a dozen. Not quite in your budget? Alright, six will do. Sure, great. You want some modifications? Absolutely. We'll throw in an added encryption layer for free! Update intervals of ten minutes too long? I'm sure Mr. Robo can get it down to two minutes. Easy. *Blood drains from Mr. Robo's face* ...That's it, then. Nice doing business with you. *Ends call* Done! Ok, Mr. Robo, go order six of those whatchamacallit ATMs from their website, make those little tweaks that the customer wants, and have them on my desk by tomorrow. Mr. Robo: Do... do you even know how the blockchain works?! Mr. Ham: Mr. Robo, I may not know much computer science, but you sure as hell don't understand sales. *puffs on cigar contentedly* [N.B. Actually, he just needed to invent seven-dimensional paper] [N.N.B. They're right on the cute critters, though] Mr. Robo: Please stop him before he gets us all arrested! Mr. Ham: *grinning* Hey, you two! Good news! The guy just now, he wants to set up an interview with the creator of Robotcoin! You know, same as Bitcoin, but they can walk about and do your dishes too? Mr. Robo, I'm looking at you. Doesn't sound too difficult at all. Stop that sobbing in the corner, you have two weeks to do it. The Market Is Free! Me: To be honest, I don't think even Mr. Robo will be able to pull this one off. Mr. Ham: Well, you never know. I'm prepared to raise him to senior executive director if he manages it. And anyway, the important thing was to close the deal pronto. Specifications and costs can be... negotiated. Me: Let's just say that I don't see myself ever being a good consultant, then - how some of these things can be said without blushing, I do not understand. Mr. Ham: Fine, continue being a scrub. Me: Anyway, the Committee of Inquiry for the Little India Riot seems to be leaning towards pinning the whole affair on alcohol, as expected, with one of the rationalizations being that "beer bottles were used as projectiles" - but if so, should they not implicate parking lots and cleanliness too, given that pavement slabs and rubbish bins were also used? Mr. Ham: Whoa, you want Master Political Analyst Herr Ahm for that. I'm now the proprietor of a boutique investment firm, and I don't want no trouble. ... Haha, like, who gives a crap about that? Got you, didn't I? Life is too short to clam up due to some misplaced sense of duty, or unworthy sense of fear. Remember what I just said about getting the opinion that you want? That's happened again. That, and setting up a fall guy. What's new? Me: And of not hearing what you don't want to. But then, the outcome's almost certain, given how the status quo has to be maintained - ban alcohol, ban gatherings, dole out reprimands, and it's back to business as usual. That said, there's been a slight shift in the local media towards identifying spiralling rents as one of the major problems facing businesses here, instead of trying to put everything down to labour costs - i.e. why aren't you happy about letting in an extra fifty thousand semi-skilled workers every year? Are you xenophobic, comrade? - so one can hope. On this, we could mention the incumbents' latest foodie effort, a subject that has seldom gone well for them. This time, a DPM alerted his Facebook followers to S$1.80 chicken rice, and it was telling that the first comment was one of doubt (referencing December's unlikely nasi padang pricing). By now justly skeptical, netizens looked more closely, and reported that it was a promotional price. In an added touch of irony, the S$2.50 nasi padang shop has since closed, perhaps yet another casualty of the rental scourge. By the way, the local Ramly burger's gone from S$3 to S$3.50 too. The local institutional response to the property situation is perhaps best summed up by a forum letter, which notes that even a one to one-and-a-half percent fall in prices has been described as "unnerving" and "not sustainable" by developers and agents, who were apparently all a-ok on sustainability when prices rose by 50% across-board in the past six years. Mr. Ham: Actually, it's not the price that they're up in arms about, as much as the transaction volume. Or, just perhaps, there are too many agents around from the last bubble? Me: It is my belief that in a healthy economy, real estate should play at most a secondary role - one oft-heard remark about the true state of Singapore's innovativeness, or lack thereof, is reflected by looking at what really pays here. Now, one point of view is that these rental rates depend purely on supply and demand, and it is best not to interfere with the free market system. We could however begin by questioning the premise - how free is the market, exactly? One could first and foremost suspect that commercial and industrial property owners, as a group, can be more aptly described as an oligopoly, while tenants are comparatively "free market"... as in free to take prices. For once, both economic theory and practice produce the same outcome - profit-seeking oligopolists exert market power, and their tenants pay more than in a truly free market. This might be a little new for non-econs majors, so let me sketch it out for you:  It is often left unsaid, but nevertheless true, that Our Most Successful Investment Firm has a huge stake in local real estate yields, certainly a low-risk punt given the setup. Basically, the fewer viable options there are, the more aggressively tenants can be squeezed. Of course, the less said about residential property being a "free market", the better. And The Runaround At this juncture, I would like to discuss Ngerng's latest attack, entitled "Truth Exposed: The Dirty CPF-HDB Scheme To Trick Singaporeans", which seems to be gathering a lot more attention than the norm. One little quirk of his site is that it seems to consistently attact a majority of dissenting opinions, which is fairly rare with pro-and-anti-incumbent supporters generally segregating themselves quite neatly into their respective cyber-haunts. The frequent accusation of his site being anti-establishment is strange, though, given how many sources are dedicated to singing the incumbents' praises. There have been plenty of dismissals, critiques and rebuttals for this article, and I will attempt to consider the main points as objectively as I can.

Next: Wrestling With Doubts

|

|||||||||||||||||||

Copyright © 2006-2025 GLYS. All Rights Reserved. |

|||||||||||||||||||