|

| |

|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ entry views: 544 today's page views: 288 (28 mobile) all-time page views: 3740535 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1256 page created Tue Mar 10, 2026 09:11:44 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

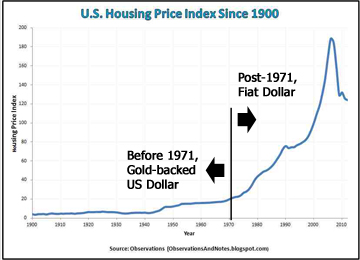

It was unfair, I felt, for Alexandria Ocasio-Cortez's opponents to hold her college dance moves against her (they were pretty decent, I thought). The same goes for her provisional adoption of audience-specific speech features - politicos gotta do what politicos do. It is, however, fair to knock her asinine policy suggestions, such as the Green New Deal that fittingly obtained a grand total of exactly zero votes in the U.S. Senate; astoudingly, the elimination of farting cows wasn't even the greater part of the lunacy on display in that proposal. That distinction must belong to the proposed funding mechanism: Modern Monetary Theory (MMT). So, what is MMT? Its essential idea is that since the government can create new fiat money at will, government expenditure does not - and should not - depend on taxation. In other words, if the government wants to pay for some assumed-socially-beneficial project (e.g. solar power plants, tertiary education, universal healthcare, bovine buttplugs), they can just print the cash and pay for it. Note that the above assertion that governments can, indeed, print as much fiat money as they want is not at all controversial. The problem, as any competent economics undergraduate - or any right-thinking citizen - would immediately identify is: sure, maybe there's no strict need to tax to spend, but this is just additional money chasing an unchanged amount of goods and services. As such, wouldn't price levels simply increase (i.e. the inflation rate rise) as a consequence? To this, the MMT advocates have a ready answer - to combat any inflation, simply raise taxes. Wait, what? Let's try to interpret this charitably - MMT agrees with conventional basic economics that creating money tends to create inflation; the difference is that instead of trying to predict the effect and budget for it beforehand by pre-emptive taxation, MMT proposes that any inflation can be dealt with after it arrives. Interestingly, this by itself isn't that crazy either - inflation in America has for instance been lower than expected in recent years, despite all the quantitative easing, probably due to the consolidation of wealth by the already-rich. MMT Compared Stripped to the bone, one realises that the major thrust of MMT is simply towards transferring control of production and ownership to the state. Consider the following scenario: the state wishes to build a school. Under a sound money regime, the state would have to tax the people (i.e. convince them to give up their gold, silver, etc) to pay for the land and construction costs. Under the current fiat money regime, the state likewise has to either tax (admittedly in fiat dollars, which can indeed theoretically be created at will) or issue bonds (i.e. borrow from the future). Under an MMT regime, the state simply prints the required monies and observes what happens. A couple of important clarifications here. Firstly, we do not deny that the provision of education is generally a worthy deed. Secondly, it is acknowledged that in all three regimes (sound money, fiat money, MMT), "the state" ultimately does not produce anything by itself ex nihilo; the state merely redirects the resources and effort of its citizens. The key distinction rests in the upfront transparency of the appropriation. Under sound money, the people know exactly what is being taken (e.g. one gold coin per family); as such, there can be - and in fact were - nasty pushbacks against authorities, up to and including revolutions, if such taxes were felt to be onerous. Within existing fiat money systems, despite it being true that governments can create money at will (i.e. directly monetize debt), there has been a studied reluctance - at least in thus-far-surviving economic regimes - to rely on this power. Instead, they tend to follow two defining principles. Firstly, control over fiat money supply is devolved to an independent entity, generally a central bank (e.g. the Federal Reserve), that is supposed to be able to tighten the pursestrings over the exhortations of the spenders (i.e. the rest of the government). Secondly, there is a commitment towards recognizing the very real costs of such spendings, through borrowing (by open market operations) instead of simply printing money, the contemporary version of having a bondsman whisper in the ear of the all-conquering bankers in their triumph - you haven't earned this yet. Admittedly, from the national debt figures, this discipline has hardly been absolute - but it was something. Under MMT, however, any remaining pretensions towards respecting the costs of spending are further abandoned. Superficially, MMT is free - no upfront taxes, no need even to borrow; it is not difficult to see how such a system could be popular, at least initially. Of course, the costs don't actually disappear - they are just obscured in inflation. More critically, presentations of MMT by Ocasio-Cortez and her ilk appear to discount oversight over money creation. Arguments tend to be along the lines of "climate change is an existential problem, we will therefore pay anything it takes". This is a dumb idea. It happens to not even be a new idea. A Tale As Old As Time - identity_zero, Hacker News Back last August, we have explained the cyclical nature of monetary systems in history, from representative to fiat and back again. The story seldom differs much - a state first conducts its business with some sound money or its representation, before realizing that chartalism (and the ensuing additional power & control) would be so much more convenient by fiat (removing as it does the distasteful need for murdering one's creditors, as King Philip of France did with the Knights Templar). There were always the concomitant excuses, some of them even good. The flaws then arose from the administrators, and while not strictly unavoidable, tended to pop up sooner or later; once it is established that money is basically make-believe, it seems, people are uniformly driven to regard "then just make more of it" as a legitimate solution to challenges. This process can happen either overtly through unabashed industrial-scale printing, as has happened recently in Zimbabwe and Venezuela, or more insidiously with pseudo-intellectual backing, as we have seen with MMT. Re-releases follow the same script either way: the state claims more and more control over production through issuance of fiat money, before discovering that both resource allocation and corralling of inflation are a lot trickier than they thought. Realising this, former users of the fiat currency get out as quickly as they can, the currency collapses under mismanagement, and citizens turn to sounder money for their needs, until next time... The debate over MMT, one realises, is inextricably tied to that of the government's intended role - the more a state is expected to intervene directly in production decisions (as in a command economy) as opposed to private citizens, the more it will be aligned towards MMT. If MMT is implemented in the manner that Ocasio-Cortez and Sanders are supporting, the separation between the monetary (the Fed) and fiscal (the executive/legislative branches) levers of government would likely no longer be respected. The usual outcome, regardless of the nobility of the original intent, is seldom pretty for most, as Commiessar Ham and Secretary Robo have realized. In Search Of A Neutral Monetary Standard - PakG1, Hacker News, on the perceived safety of "real-estate-money" in China, where some 80% of private wealth is held (hmm, does this remind us of somewhere closer to home..?) We might, then, recognize the matter of money as a perpetual struggle between self-determination by individuals and smaller communities, and hegemonic states. With state-issued fiat money, individuals are at the mercy of the state, in that they have to trust the state not to dilute their wealth through the ever-convenient creation of new fiat. An obvious recourse, certainly, would be for citizens to transfer their wealth out of the fiat money, and into harder assets (e.g. foreign real estate), as much as possible. As covered in January and before, this behaviour can be interpreted as individuals choosing to store value in a non-fiat money; instinctively, people understand that unlike fiat money that can be created at a whim for whatever excuse, property and precious metals and the like cannot be manipulated thus. It has also been noted that the "inflation tax on wealth", has as such tended to fall more on the poor than the rich, since the rich would tend to hold a far smaller proportion of their wealth in freely-creatable fiat money (clever them) An interesting hypothesis would then be whether the end of a sound, representative reserve money (Nixon's termination of the gold convertibility of the US dollar in 1971) has been a major factor in the broad-based rise of property prices and housing costs since then. Greatly simplified, there is some subconscious (and well-founded) baseline level of demand for a sound monetary base, one that is independent of state machinations. Gold has famously filled much of this role for millenia, but has (once again) been ousted by the reigning hegemon [Nixon 1971]. Since then, all substantial paper currencies have been essentially pure fiat (make-believe) However, given that the baseline demand for sound, independent monetary backing has not actually changed, it was just a question of where that displaced demand would manifest. While it could not easily return to gold and other precious metals, due to concerted international efforts to break that relationship, it remained far too strong to simply disappear; therefore, the demand merely diffused into various hard assets, but most significantly the real estate sector, with houses and apartments serving as a "proxy sound money"; which explains why their being uninhabited is of no concern to many owners, since that is no longer their main function.  Flight to Alternative Monies (save end-WW2 bump) (Original source: observationsandnotes.blogspot.com) This de-facto elevation of real estate as an alternative money (and not merely pensions, as suggested back in 2016) has been tacitly encouraged by many governments, given its ubiquity as a resource (a country is defined by its land boundaries, after all). This conception of "real estate as sound money" has in many places been ingrained to the extent that there is a popular expectation that the state will stabilize its value - which, you see, is what one might expect of a money, and not of a general investment (see: Hyflux) To be explicit, this attitude has taken root locally (with 99-year public housing now breaching S$1.2 million) and in China (with Shenzhen to adopt Singapore's housing [i.e. alt-monetary] policy instead of Hong Kong's... which, to be frank, is an easy upgrade), and has been - dare we say - irresponsibly fanned with semi-official promises that "property prices will only go up". This is clearly hardly tenable, especially for limited-time leases, and has belatedly been recognized by measures such as limiting CPF loan quanta for aging flats. In response, the government's just expanded the The appeal of cryptoeconomics - note Bitcoin's price bursting back above US$7000 after a half-year slump - should then be apparent to more open-minded and historically-inclined students of the dismal science: crypto serves as a flagless and neutral sound money, that has been explicitly designed to excel on many of its classical properties. As discussed back in 2018, this presents an inextricable dilemma for central banksters: if they ban crypto-money, they'll get locked out of the new sector entirely; if they allow crypto-money, their control of the economy via fiat measures (e.g. negative interest rates, which the IMF seems to be resorting to) naturally weakens. Given that the idea of cryptos can't be un-invented, our expectation is that states will eventually seek resumed control through ownership of the asset, as China and Russia are returning to with gold. This is evidenced by the increasing legitimization of crypto by the financial establishment, with Fidelity - a Top 5 global asset manager - next to offer crypto trading. An interesting property of crypto is that financial shenanigans, such as rehypothecation with "paper gold", should be in theory harder to get away with, given the innate transparency of blockchains; myself, I'm just eager to see how various governments deal with the new sound money. Unus Sed Leo The Lioness laughed at her and said: "One, but that one is a lion!" - Aesop's Fables, The Sow and the Lioness [N.B. Also employed by Taleb to explain (stubborn) minority rule] And like clockwork, Bitfinex's back at it again. Having lost 120000 Bitcoins back in 2016, the naughty ruffians behind the exchange have managed to get US$850 million tied up in a rogue payment processor this time, and stand accused of transferring funds from the Tether stablecoin backing to cover those missing funds. Say what you will about Bitfinex's past deficiencies in computer security and character judgment, you can't accuse them of being short on chutzpah, and their latest maneuver has seen them simply up and raise a billion bucks - mostly predicated on the next few years' of profits - just like that. Cheeky fellas - but I like them. Trade War, As Expected The most surprising thing about the expanding U.S.-China trade war, it seems to me, is how few surprises there actually were. The key parameters were all out in the open since at least early 2016, when we called an eventual American trade war victory, having observed that even if they don't win much in the short term, China's economy will be by far the harder hit. Remember, if GEOTUS has a signature platform, this is it. In-depth analysis will be deferred, as the tariff slap-fight plays out in this game of chicken. The Bowl That Was Promised Yeah, so maybe the final season of Game of Thrones absolutely mangled the plot, but hey, at least we got the Gregor vs. Sandor fanservice bout. And just to add on to last week's Kengan Asura recommendation (how did the resemblance between Hatsumi Sen and Hokuto no Ken's Juza get left out?), it turns out that there may be unofficial Fight Clubs going on in our secondary schools, from a recently-viral video. Thin guy had reasonably good technique, I thought, although red guy could have done much better had he tightened his punches, or used his weight to take it to the ground; he seemed slightly reluctant, to be fair. Glad to see them hug it out at the end, unlike with that higher-level duel a few years back, when only one fellow had a parang. Extremely unsporting, if I may say so, despite the passable footwork and overall much grander atmosphere. Next: Buddy Flick

|

|||||||

Copyright © 2006-2026 GLYS. All Rights Reserved. |

|||||||