|

| |

|

| |

|

|

|

|

TCHS 4O 2000 [4o's nonsense] alvinny [2] - csq - edchong jenming - joseph - law meepok - mingqi - pea pengkian [2] - qwergopot - woof xinghao - zhengyu HCJC 01S60 [understated sixzero] andy - edwin - jack jiaqi - peter - rex serena SAF 21SA khenghui - jiaming - jinrui [2] ritchie - vicknesh - zhenhao Others Lwei [2] - shaowei - website links - Alien Loves Predator BloggerSG Cute Overload! Cyanide and Happiness Daily Bunny Hamleto Hattrick Magic: The Gathering The Onion The Order of the Stick Perry Bible Fellowship PvP Online Soccernet Sluggy Freelance The Students' Sketchpad Talk Rock Talking Cock.com Tom the Dancing Bug Wikipedia Wulffmorgenthaler |

|

bert's blog v1.21 Powered by glolg Programmed with Perl 5.6.1 on Apache/1.3.27 (Red Hat Linux) best viewed at 1024 x 768 resolution on Internet Explorer 6.0+ or Mozilla Firefox 1.5+ entry views: 254 today's page views: 543 (17 mobile) all-time page views: 3386584 most viewed entry: 18739 views most commented entry: 14 comments number of entries: 1226 page created Fri Jun 20, 2025 12:50:23 |

|

- tagcloud - academics [70] art [8] changelog [49] current events [36] cute stuff [12] gaming [11] music [8] outings [16] philosophy [10] poetry [4] programming [15] rants [5] reviews [8] sport [37] travel [19] work [3] miscellaneous [75] |

|

- category tags - academics art changelog current events cute stuff gaming miscellaneous music outings philosophy poetry programming rants reviews sport travel work tags in total: 386 |

| ||

|

Me: Ho hum, another media exposé on our local universities' obsession with KPIs and rankings causing academics to quit, promptly sent down the memory hole; same for the HWZ forum gossip. This sort of censorship's getting more and more insidious everywhere, what with CBS News "fact-checking" the current POTUS's national address, only to delete confirmation of his apparently most outrageous assertion on migrant women victims, when it turned out to be a gross understatement if anything. How does one trust the media in this climate? Ah, you're early, Mr. Robo. Mr. Robo: *sitting down* Not too much good news on the investment front for the firm of H.L. Ham in 2018, I'm afraid. Hedged a lot less that we should have. Me: Oh, that's not a huge problem - I'd say our major thesis remains intact, but we'll get to that in the meeting proper. But just curious, Mr. Robo - what do you think the point of gathering wealth is? Or, what's in it for you? Mr. Robo: Ah well, my stake in the firm's not that big to begin with, but there's the challenge, I suppose. And, as you once mentioned, the relative transparency and independence - make your call, and next to nobody can just pull rank to tank your decision. As for the money itself, well, I've taken to thinking of it as some form of potential energy, after trying to make my way through Mirowski's More Heat than Light; modern economics has drawn heavy inspiration from physics, and if you carry the analogy deeper, the application of cash is no more than that of a force: neutral in itself. Me: Yep, there's the Tale of Thales again - there is some satisfaction, even for those who consider themselves philosophers first and foremost, to demonstrate their ability in more... worldly affairs. Ability that, ideally, derives from some more-involved theory. As for the eventual dispersal of the loot, I'd say Maimonides might make a good guide:

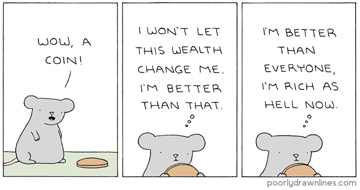

Mr. Robo: So the less recognition obtained, and the more pro-active and purer the intent, the better, it seems. A fairly common concept across religions, I think, though to be frank I wouldn't have thought that you amenable to the source... Me: *wags finger* Nuh-uh, hamster. I'm against the illogical bits, like the pick-us-only-or-fry mentality - but today's not the time for that discussion. Anyhow, an implicit addendum to Maimonides would be that a grudging gift remains superior to piety without giving - i.e. thoughts and prayers - of course assuming that one has the means. I can get behind that. This is also entirely in keeping with your conception of wealth as a resource towards bringing about a desired change. Capitalism remains the worst method of allocating resources, it seems, other than everything else that has been tried, at least at scales larger than a tight-knit clan group. On objective inspection, much of the world's ills can be - indeed, are possibly most appropriately - mitigated by judicious use of moolah. And if so, if one believes oneself to be a decent farmer and steward, so to speak, does it make sense to give away all one's seedcorn?  That was quick (Source: r/comics) Mr. Ham: *waddling in* You got that, human. Can't give what you don't have, my pa always said, whatever the commies try to argue. A plump portfolio's the difference between making a difference and sitting with your bits in your paws, he said! Me: Ah, the prodigal CEO returns. So, as I was discussing with Mr. Robo, why exactly do you wanna be rich? Mr. Ham: Three chicks at once. Me: ...okay, cancel the scheduled shareholder address. We might have some editing to do. Nothing New Under The Moon Me: Well, I'm sure neither of you need a play-by-play of the painful details. Long story short, we were inaccurate. It was, again, a bubble. On this, we were wiser and more circumspect in 2014. However, a pronouncement that "we think it unlikely that Bitcoin's price will fall to one-fifth its current value, which is harder to vouch for for most alts" has just about come to pass, considering Bitcoin's price of some US$16500 - if highly unstable - then, compared to about US$3700 today. This drop has, as expected, brought eager naysayers out of the woodwork, with prominent critic Nouriel Roubini observing that cryptos are rather less decentralized than advertised. Others have resummoned old critiques about a lack of value tethering - see our previous rebuttal - and resemblances to tulips, beanie babies, Pokémon collectible cards and the South Sea Bubble. Some have at least, while celebrating the collapse in price, acknowledged that the price remains, like, forty times that of five years ago despite the crash - or an annual 100+%, compounded. Surely then, if this is accounted a failure, where might we encounter a whole lot more of it? Not even Google or Berkshire Hathaway have anything on this rate of growth. It can be hard to maintain proper perspective, considering the current price remains 4x that of two years ago, right on trend. An interesting consideration here is that, the older the hand, the more fortified they tended to be about these developments. We drew upon the experience of 2012 back in 2013/2014 ourselves, and the biggest surprise might be how closely 2017/2018 repeated that period, and the classic bubble chart to boot:  Complete with prescribed bull trap both times, after the implacable run through 2017 (Source: cryptocurrencyfacts.com) Mr. Ham: Spooky, maaan. Me: The psychology does seem empirically solid, and while I didn't discount a drop, I must confess I didn't see it repeating an 80+% retrace. But to reiterate, the main takeaway should be that virtually none of the critiques about Bitcoin are new. Almost all of them had been accounted for on the BitcoinTalk forums before 2012, back when discussants were nearly without exception thoughtful technical enthusiasts - who tend towards Bitcoin maximalism, and for good reason - instead of the loudmouthed get-rich-quick shills that populate r/cryptocurrency and the like nowadays - many of whom have gotten badly burnt. As for the participants, the discussion content from when prices were soaring/diving about 2014, can hardly be distinguished from the corresponding threads four years on. Mr. Robo: The question is then, is there anything significantly changed about the crypto scene, from 2014 to 2018, or will it be roughly the same pattern all over again? Me: Right on. A fresh critique is then that, instead of being five years old then, Bitcoin had become nine years old, and thus expected to be more mature. Well, to this, one might suggest that a some 20x jump in maximum price might qualify, the 341st declaration of Bitcoin's demise notwithstanding. Keeping in mind the old hat about past performance and future results, the recent price action has supported theoretical projections about Bitcoin price growing by bubbles - with more to come. No, as we hinted in our last AGM and before, it all reduces to a single question: is crypto the future of money, as the Internet was the future of information? If no, then the critics will be right, and they can smugly regale captive audiences about how it was all obviously smoke and mirrors; if yes, however, then one might consider the various dot-com busts - and wonder at what, say, the next twenty years might bring...  Listen here, son. It might hurt, but you HODL THE LINE, you hear me? 'Cause you neva know when the BIG BULL appears. (Source: r/bitcoin) [To be continued...] Next: Crypto In 2019

|

||||||||

Copyright © 2006-2025 GLYS. All Rights Reserved. |

||||||||